Apple Pay Was Useful, Apple ID Will Be Indispensable. Payments are only the table stakes in the wallet wars.

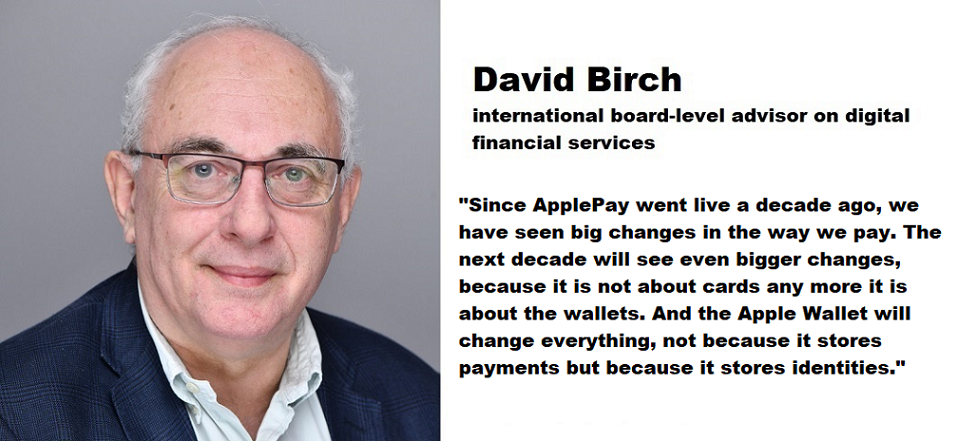

an article written by David Birch

Since ApplePay went live a decade ago, we have seen big changes in the way we pay. The next decade will see even bigger changes, because it is not about cards any more it is about the wallets. And the Apple Wallet will change everything, not because it stores payments but because it stores identities.

Mobile Payments Were Inevitable

When I first downloaded ApplePay and went off to try it out in London, paying by phone was already old hat. I had been paying using my phone for quite a while, using a sticker which had a Barclaycard token in it. I went around annoying everyone by telling them that stickers would be the future of payments because the banks and the telcos would never get their act together to make NFC payments work properly, despite the fact that it was obvious from earliest days that allowing consumers to pay with their phones would be absolutely huge.

I was not the only person to think this. Far from it. Writing back in 2008, Sophie Tacchi saw that while banks had been exploring “niche” payment services the introduction of contactless proximity communications would transform the mobile phone into a secure transactional device offering payment, coupons, ticketing and other services. She correctly predicted that European consumers would quickly adopt such services and that this would present a great opportunity for banks to develop new value-added services: an imperative because banks would face new competitors who would emerge and use those new technologies to provide payment and other transactional services to the “detriment” of retail banking payment services.

Writing at the time of the Apple Pay launch, Stephen Vass pointed out that while it had been recognised since the early 2000s that contactless (i.e., Near Field Communication, NFC) was the preferred choice of technology to get the mobile payment industry rolling, the wrangling between the bank and the mobile operators over who “essentially owned” the consumer resulted in nothing but delay. They all wanted to be in charge and they ended up with none of them in charge while Apple assembled a vision that was consumer focused.

(Digital wallets are not all about Apple, of course! There are more than 3.4 billion digital wallet users worldwide and tw0-thirds of US adults used a digital wallet in the last month.)

As I write, there is no cash in my wallet and there has not been any for some time. Everywhere I go I use my phone.

So why are people like me so bullish about wallets? If people can pay with their Apple Wallet right now but do not, what is going to change their behaviour over the next decade? Well, it’s because they won’t be using their wallets for payments.

No-one is going to use a wallet that you cannot pay with, even if you don’t want to pay with it right now. But it’s the other stuff, the identity stuff, that will make wallets indispensable in the mass market.

A recent poll in the UK found that half the people surveyed said they only carried a wallet to store non-payment cards such as driving licences and loyalty cards. In fact, a third of 18-24 year Brits say that the digital wallet on their phone is already their preferred way to pay and more than half would rather just carry their phone in place of a wallet or purse.

Identity Is The New… Everything

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, talked about what’s next for Apple Pay saying that they are going to go “beyond payments” to replace the physical wallet with a secure, private and convenient digital wallet to manage everything from event tickets and keys to government IDs and transit passes. There are nine US states already issuing mobile driving licences (mDLs) that can be stored in Apple and Android wallets and as Mark J.F. Schroeder, New York’s DMV Commissioner says, these digital credentials are “the future of identity verification”, vastly preferable to a physical document that gives away all of your personal information because they give the citizen control over what personal data is shared. And not only in the USA: the ISO mDL standard is also being used in, to give just two examples, Australia and in Europe for the new EU Age Verification app.

Car keys are another particularly interesting use case highlighted by Bailey who said they may one day be a key enabler of contactless car rentals. Keyless car unlocking is a mainstream use case where Apple already has patents. Indeed, Apple was a charter member of the Car Connectivity Consortium and is working with more than 30 car manufacturers worldwide to put digital car keys into the Apple Wallet.

I think this vision of the future will change the world more than Apple Pay did. The lack of digital identity infrastructure is a significant drag on the evolution of online services and someone has to do something about it. If that someone else is Apple, it could be huge. We are about to leave the era of Apple Pay and enter the era of Apple ID. I’m excited.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: