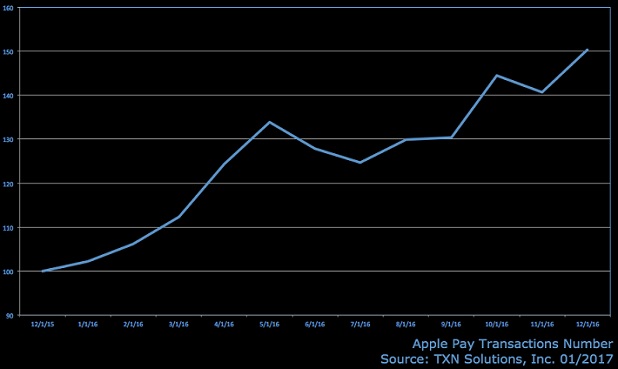

Apple Pay records 50% growth in 2016, as mobile apps and websites prove most popular

The number of monthly US Apple Pay credit card transactions conducted in-app, online and at the in-store point of sale grew by 50% between December 2015 and December 2016, research released by consumer spending analytics portal TXN reveals, with mobile apps and websites attracting the highest proportion of transactions.

Overall, Apple Pay usage has been growing steadily over the last year (2016). The number of monthly Apple Pay transactions grew by 50% between 12/2015 and 12/2016 .

“We looked at our panel of transactions from over 3m payment cards to learn more about the adoption of Apple Pay by consumers,” TXN says. “For some of the card issuing banks, we are able to distinguish payments made with Apple Pay from other payments.

“Apple Pay had strong growth in 2016, but still accounts for a fairly small percent of all credit card transactions, leaving lots of room for further growth. The businesses with fastest Apple Pay adoption are, unsurprisingly, apps and websites popular on Apple mobile devices.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: