Apple’s mobile wallet is gobbling up a growing chunk of card payments around the world. As the service grows, it’s becoming a greater challenge to rivals like PayPal and attracting the attention of competition watchdogs.

Apple Pay accounts for about 5% of global card transactions and is on pace to handle 1-in-10 such payments by 2025, according to recent trend data compiled by Bernstein, a research firm. “There are indeed plenty of reasons to worry that Apple may attempt to disrupt the payments ecosystem,” Bernstein analysts, led by Harshita Rawat, wrote in a research note, published by qz.com.

As iPhone sales plateau, the Cupertino-based company is leaning into its services division, which includes Apple Pay. The unit generated $12.7 billion in revenue in the last three months of 2019, a 17% increase from a year earlier. The company’s payments ambitions have the benefit of a massive cash hoard, years of experience in card transactions, and a vast customer base consisting of hundreds of millions of iPhone users.

The digital payments race is an immense opportunity, representing about $1 trillion in revenue around world. Visa and MasterCard process more than $14 trillion of payments each year and are still growing as more transactions go online, flow through apps, and as consumers in many parts of the world use cash less often.

Apple Pay makes money by taking a sliver of each transaction that runs through the device. Users can store their credit and debit cards on the wallet and use it to make contactless payments—beefed up with biometric security—through their phone’s near-field communication (NFC) tech. In the US, contactless payments are forecast to increase to $1.5 trillion in 2024, up from $178 billion this year, according to Juniper Research.

There’s no shortage of slick, feature-rich payment apps out there, but Apple Pay has several advantages. The app is pre-installed on iPhones, and Apple has tight control over the device’s NFC technology that’s used for contactless payments. That’s why Apple Pay is the only iPhone mobile wallet that can make NFC transactions. (Alipay and WeChat Pay, the enormously popular Chinese payment apps, use QR-codes. The optical codes are read through a phone’s camera and aren’t controlled by Apple.)

Academics, lawyers, and executives see Apple’s control over the iPhone NFC chip as a way to block competition and make its own wallet more popular. Apple argues that its policies are for security against hackers and to make the user experience as smooth as possible.

Tech and card giants

Apple CEO Tim Cook is aiming to give the wallet an extra boost by linking it to cash backs through the company’s credit card. Apple Pay revenue and transactions more than doubled in its last fiscal quarter, Cook said recently in a conference call with analysts, and the wallet is becoming more widely available for train and bus commuting around the world, with rollouts in Chinese cities like Shenzhen and Guangzhou coming this spring.

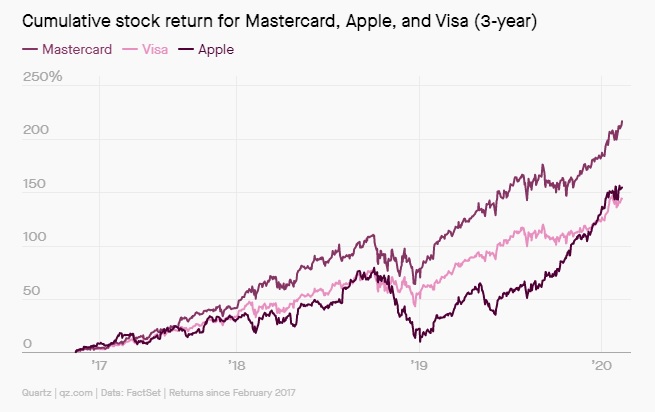

Apple Pay probably won’t pose a challenge to the card giants anytime soon. While the tech company could, in theory, create its own network that runs outside the card systems, Bernstein argues that Apple still needs the card networks, which are ubiquitous and trusted. Visa and MasterCard, meanwhile, are used to dealing with partners (traditionally large card-issuing banks) with the kind of scale that even Apple Pay could muster.

The same may not be true for other wallets. “Apple Pay is indeed one of the long-term competitive threats to PayPal,” Bernstein analysts wrote. For now, PayPal has a commanding lead in the world of online checkouts, and also benefits from network effects that have been building up since the turn of the century. But Apple and PayPal could end up competing for the same turf in the coming years.

In the meantime, European officials are eyeing Apple Pay more closely. German lawmakers recently passed a measure that would require tech companies to open up their interfaces for payment services, but domestic lenders, including Deutsche Bank, have reportedly decided not to take advantage of Apple’s NFC interface.

And the European Commission is probing Apple’s control over the iPhone’s NFC tech, marking the second time EU officials have scrutinized the mobile wallet’s impact on the market. The commission’s earlier, preliminary view was that there was sufficient competition, but that could change as Apple Pay uptake increases.

About the author

John Detrixhe covers the future of finance. He previously wrote about markets and trading for Bloomberg News in New York and London. His interests include global banking, fintech, and the digitization of money.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: