Apple’s savings-account offering will allow Apple Card users to generate interest on their cash back, which arrives in 1%, 2% and 3% increments depending on whether the purchases were made via Apple Pay, on Apple products or with select merchants. Therefore, Apple Card users will be able to grow their rewards in Apple Wallet by automatically depositing their Daily Cash into a new high-yield Savings account from Goldman Sachs.

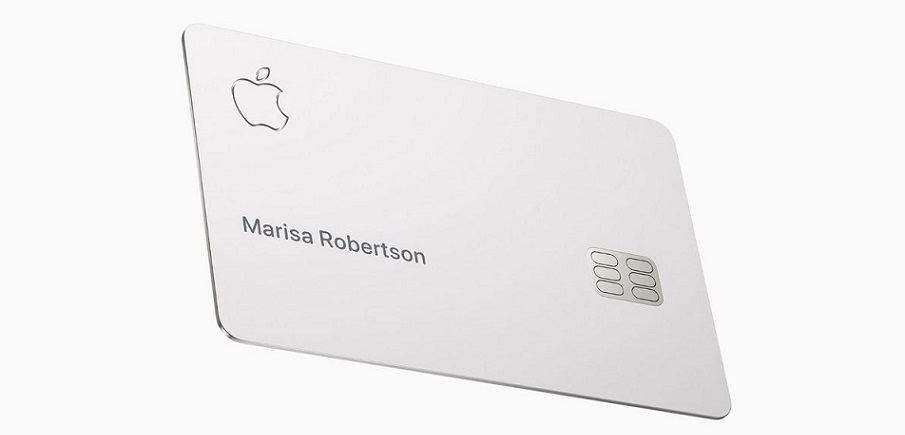

Apple today announced a new Savings account for Apple Card that will allow users to save their Daily Cash and grow their rewards in a high-yield Savings account from Goldman Sachs.1 In the coming months, Apple Card users will be able to open the new high-yield Savings account and have their Daily Cash automatically deposited into it — with no fees, no minimum deposits, and no minimum balance requirements.2 Soon, users can spend, send, and save Daily Cash directly from Wallet.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Savings delivers even more value to users’ favorite Apple Card benefit — Daily Cash — while offering another easy-to-use tool designed to help users lead healthier financial lives.”

Apple Card users will be able to easily set up and manage Savings directly in their Apple Card in Wallet. Once users set up their Savings account, all future Daily Cash received will be automatically deposited into it, or they can choose to continue to have it added to an Apple Cash card in Wallet. Users can change their Daily Cash destination at any time.

To expand Savings even further, users can also deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees. Once set up, Apple Card users can watch their rewards grow in Wallet through an easy-to-use Savings dashboard, which shows their account balance and interest accrued over time.

Apple Card users get 3 percent Daily Cash on Apple Card purchases made using Apple Pay with Apple and select merchants, including Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Mobile, ExxonMobil, and Ace Hardware, as well as 2 percent Daily Cash when they use Apple Pay at other merchants, and 1 percent on all other purchases. There is no limit to the amount of Daily Cash users can receive.

The new Savings account from Goldman Sachs expands upon the financial health benefits and valuable Daily Cash that Apple Card already offers. Built into Wallet on iPhone, Apple Card has transformed the credit card experience by simplifying the application process, eliminating all fees, encouraging users to pay less interest, offering the privacy and security users expect from Apple, and offering Daily Cash on every purchase.3

Goldman has been Apple’s partner on the credit card since its launch in 2019. However, the tech giant has since made moves to ensure independence in the financial services arena.

Apple was long-rumoured to be using Goldman Sachs for the loans for its upcoming BNPL play. However, Goldman is only facilitating the service as the technical issuer of the loans and the official BIN sponsor, with Apple making the loans directly through a new subsidiary, according to Finextra.

This week, Bloomberg reported that Goldman could be retreating from its recent push into retail banking. With the consumer business set to lose $1.2 billion this year, the bank may pull the plug on digital lender Marcus, says Bloomberg.

____________

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: