The announcement by the CEO, Tim Cook, came on an earnings call on Tuesday after the company’s third-quarter earnings beat predictions, sending shares up 3% in after-hours trading. The tech company reported a quarterly revenue of $53.8bn, higher than its previous estimate of $53.39bn.

Apple saw its sales of services and wearables rise as it continues to expand beyond the phones, computers and other hardware that made it famous, increasing funding to services such as Apple Pay, Apple Care and Apple Music.

Apple saw overall revenues fall in the previous two quarters as iPhone sales fell. In quarter three, sales of the iPhone made up less than half of Apple revenue for the first time since 2012, at $25.99bn compared with $29.47bn a year ago.

„The Apple Card will include a user interface that shows customers where each purchase was made and the amount of the transaction. It will break down purchases into categories including entertainment, food, and shopping, and include cash back incentives rather than a points system.”, according to the Guardian.

Wearables, including the Apple Watch and Airpods, grew nearly 64% to $5.5bn in the third quarter, surpassing the iPad in sales.

“This was our biggest June quarter ever, driven by all-time record revenue from services, accelerating growth from wearables, strong performance from iPad and Mac and significant improvement in iPhone trends,” said Cook.

Apple said it expected its fourth-quarter revenue to be between $61bn and $64bn.

More about Apple Card

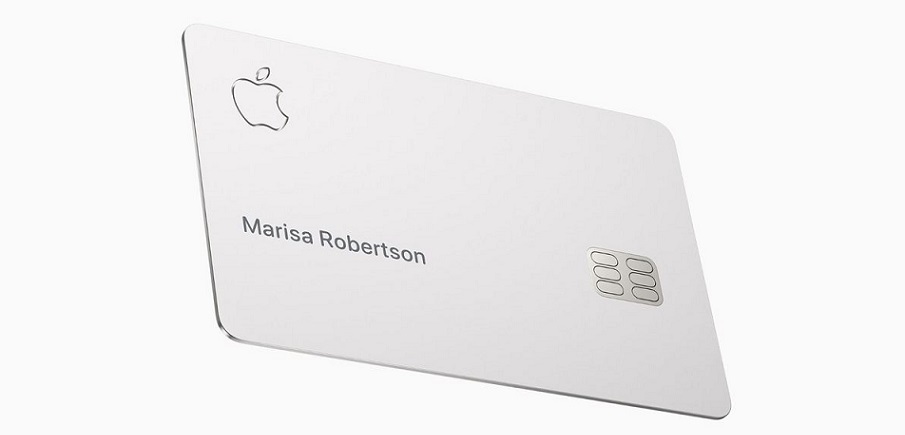

The launch of Apple Card was announced for the first time during a US Apple event in March 2019, when the company also revealed the credit card will be powered by Goldman Sachs.

Goldman Sachs manages the banking infrastructure while Apple controls the user experience. You’ll be able to sign up directly from the Wallet app on your iPhone. You can then use your Apple Card with Apple Pay, but you also receive a titanium card that works on the Mastercard network.

In addition to a list of your most recent transactions, you can see a breakdown of your purchases by category. There’s no monthly fee and no foreign transaction fee with the Apple Card. And you get 1% back when you pay with your card, 2% if you pay using Apple Pay and 3% if it’s an Apple purchase.

Cash back is credited directly on your Apple Cash card. You can pay for things using this balance through Apple Pay, make a payment on your Apple Card or transfer it to your bank account.

„When it comes to security, you won’t find any credit card number on the card. Instead, when you want to pay for something on a website that doesn’t support Apple Pay, you get a virtual card number in the Wallet app.”, according to techcrunch.com

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: