The Apple Inc credit card being launched with Goldman Sachs Group Inc will not allow the purchase of cryptocurrencies with the card, according to a customer agreement posted to Goldman’s website on Friday, Reuters said.

The customer agreement said the card cannot be used to purchase cash advances or cash equivalents that include cryptocurrencies, casino gaming chips, race track wagers or lottery tickets. Apple and Goldman did not immediately respond to requests for comment.

Goldman Sachs Group Inc’s credit card is expected to appear in Apple Inc stores as soon as this week, introducing another major touchpoint with affluent, tech-savvy consumers the Wall Street bank hopes to lure.

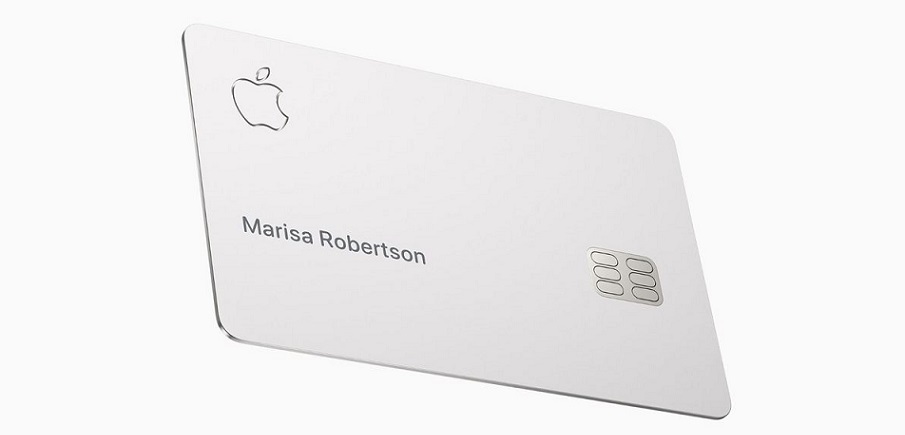

Called Apple Card, the card will use the MasterCard payment network. While consumers will receive a physical card, Apple and Goldman hope users will store payment information in the iPhone wallet app and make purchases without needing to carry the card.

The Apple alliance will push the brand much further into the mainstream than Goldman’s prior efforts, analysts said. Effectively, the Goldman Sachs-Apple card will become the vehicle for people who want to buy pricey smartphones, computers and other gadgets from one of the world’s most popular consumer brands.

“There is a great deal of buzz,” said Barclays analyst Jason Goldberg, comparing Goldman’s offering to JPMorgan Chase & Co’s popular Sapphire credit card. “We expect solid issuance right out of the box.”

There were 1.4 billion active Apple devices, 900 million of which were iPhones, as of January. The company has been emailing potential customers about the new credit card’s launch, with Apple Chief Executive Tim Cook saying last week that it would soon appear in stores.

On Friday, Goldman Sachs released terms and conditions, including details on interest rates and rewards.

Although there is excitement on Wall Street, analysts have expressed concern about Goldman’s plunge into retail.

For one, the bank has precious little experience dealing with Main Street borrowers.

Many economists and analysts believe the United States is overdue for a recession, which makes the timing of Goldman’s card roll-out less than ideal, according to Reuters.

Analysts are also worry that Goldman is spending a lot on something that is unlikely generate meaningful profits for some time. Over the past few years, Goldman has spent $1.3 billion, before taxes, on new business initiatives, Goldman Chief Financial Officer Stephen Scherr told analysts last month. The initiatives are the Apple card, Marcus’ digital offerings and a transaction banking product.

Analysts believe Goldman’s credit-card endeavor will be fruitful over the long-run, even if it takes awhile to get off the ground.

A few years from now, the card will only represent 1-2% of Goldman’s earnings, Wells Fargo & Co analyst Mike Mayo predicted. But, he said, the bank has the advantage of starting from scratch, unlike rivals that are dealing with costly branch networks and old technology.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: