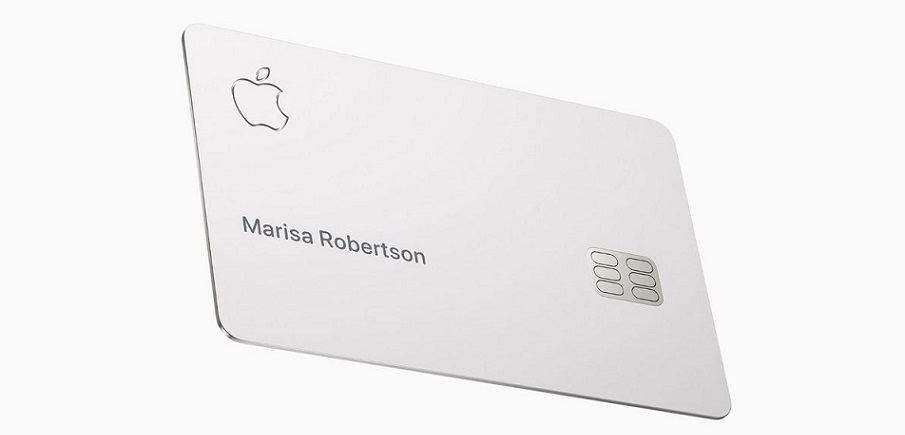

Goldman Sachs submitted a regulatory filing today for its “Platform Solutions” group of businesses that includes Apple Card. The collection of consumer offerings from Goldman is on track for a loss of $4 billion since 2020 with Apple Card making up more than $1 billion of that, according to Bloomberg.

In just the first nine months of 2022, the businesses including Apple Card saw a pretax loss of over $1.2 billion. Looking back to 2020 through the end of September 2022, those losses amounted to $3 billion. But when Q4 results of 2022 are included soon, the number is expected to be close to $4 billion.

The numbers released Friday offer clues into what Goldman has been spending to establish the high-profile Apple Card, created through a partnership with Apple Inc.

The division’s $1 billion pretax loss reported for 2021 was mostly tied to the Apple Card, people with knowledge of the numbers said. And about $2 billion in 2022 mainly stems from the Apple card and installment-lending platform GreenSky, the people said.

Previously, the only financials Goldman had disclosed in its consumer business showed $1.3 billion in losses since inception through mid-2019. That and the about $4 billion three-year loss don’t include the roughly $2.5 billion spent on acquiring installment-loans provider GreenSky as well as other bolt-on acquisitions to beef up the business.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: