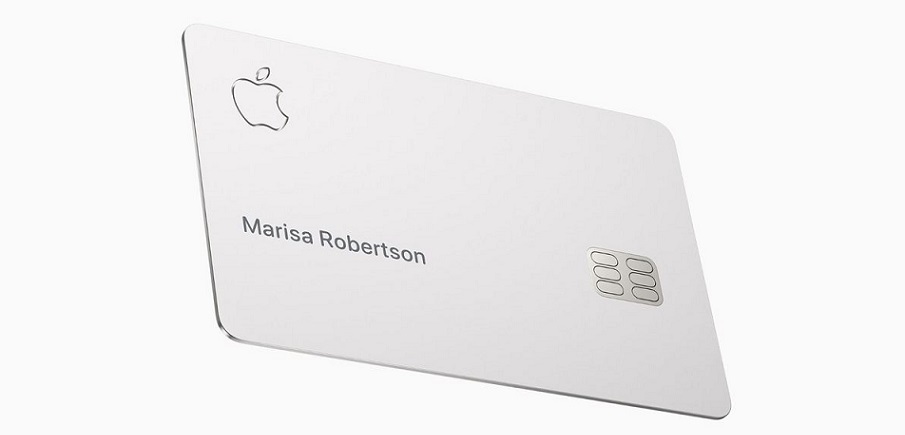

. With no card number, CVV security code, expiration date or signature on the card, Apple Card is more secure than any other physical credit card, Apple claims.

. Apple will not charge a late fee or apply a new high-interest penalty rate for a missed payment.

. Unlike other cash back rewards, Daily Cash is added to customers’ Apple Cash card each day and can be used right away for purchases using Apple Pay, to put toward their Apple Card balance or send to friends and family in Messages.

Apple Card, a new kind of credit card created by Apple and designed to help customers lead a healthier financial life, is available1 in the US starting today, according to the press release .

Customers can apply for Apple Card through the Wallet app on iPhone in minutes and start using it right away2 with Apple Pay in stores, in apps and on websites. Built on simplicity, transparency and privacy,

Apple Card has no fees,3 encourages customers to pay less interest, offers an easy-to-understand view of spending and provides a new level of privacy and security. This launch follows the Apple Card preview earlier this month, during which a limited number of customers were invited to apply early.

“We’re thrilled with the overwhelming interest in Apple Card and its positive reception,” said Jennifer Bailey, Apple’s vice president of Apple Pay. “Customers have told us they love Apple Card’s simplicity and how it gives them a better view of their spending.”

Apple Card’s compelling rewards program, Daily Cash, gives back a percentage of every purchase as cash on customers’ Apple Cash card each day. Customers will receive 2 percent Daily Cash every time they use Apple Card with Apple Pay, and 3 percent Daily Cash on all purchases made directly with Apple, including at Apple Stores, apple.com, the App Store, the iTunes Store and for Apple services.

Apple Card is extending 3 percent Daily Cash to more merchants and apps. Starting today, customers will receive 3 percent Daily Cash when they use Apple Card with Apple Pay for Uber and Uber Eats.4

Customers can request a ride through Uber in more than 700 cities across the globe and order a meal through Uber Eats in more than 500 cities around the world. Apple Card will continue to add more popular merchants and apps in the coming months.For purchases made with the titanium Apple Card, customers will get 1 percent Daily Cash.

Apple Card delivers new experiences only possible with the power of iPhone, including reaching support 24/7 by simply sending a text from Messages. To help customers better understand their spending, Apple Card uses machine learning and Apple Maps to clearly label transactions with merchant names and locations in Wallet,5 and provides weekly and monthly spending summaries.

There are absolutely no fees associated with Apple Card: no annual, late,6international or over-the-limit fees. To help customers make informed choices, Apple Card shows a range of payment options and calculates the interest cost on different payment amounts in real time.7

Apple Card also provides a new level of privacy and security. The unique security and privacy architecture created for Apple Card means Apple does not know where a customer shopped, what they bought or how much they paid.

„Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do things no other credit card can do. And it’s the first card that actually encourages you to pay less interest.”, the company said.

Apple is partnering with Goldman Sachs as its issuing bank. Goldman Sachs will never share or sell data to third parties for marketing and advertising. Apple is also partnering with Mastercard to provide the support of a global payments network.

1 For qualifying customers.

2 Subject to credit approval.

3 Variable APRs range from 12.99 percent to 23.99 percent based on creditworthiness. Rates as of August 2, 2019.

4 Apple Pay is coming soon to Uber services like Uber Cash, Scheduled Rides and JUMP. Merchant offers may change at any time.

5 Some transactions may not appear in Maps.

6 Apple will not charge a late fee or apply a new high-interest penalty rate for a missed payment. However, customers will continue to accrue interest on their balance at their regular interest rate.

7 Interest estimates are based on customer’s posted account balance at the time of the estimate and do not include pending transactions or any other purchases that may be made before the end of the billing period.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: