Apple Inc. has acquired Mobeewave Inc., a startup with technology that could transform iPhones into mobile payment terminals, according to Bloomberg. Apple paid about $100 million for the startup.

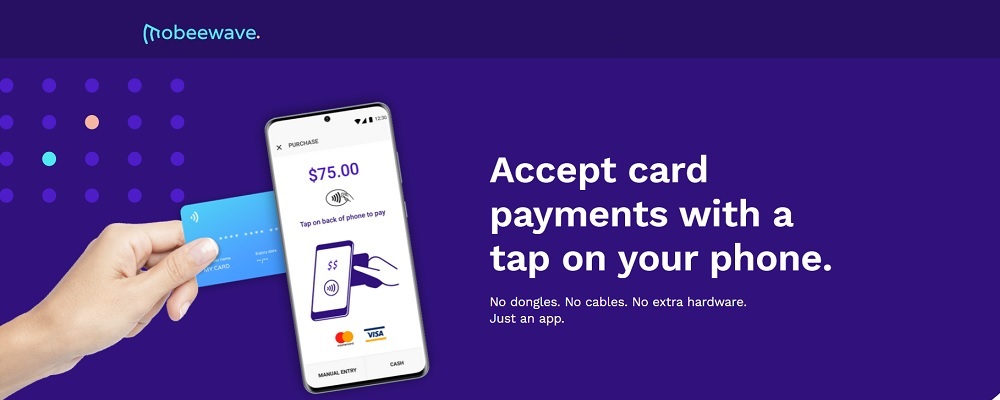

Mobeewave’s technology lets shoppers tap their credit card or smartphone on another phone to process a payment. The system works with an app and doesn’t require hardware beyond a Near Field Communications, or NFC, chip, which iPhones have included since 2014.

“Apple buys smaller technology companies from time to time and we generally do not discuss our purpose or plans,” an Apple spokesman said.

Apple typically buys startups to turn their technology into features of its products. Apple added Apple Pay to the iPhone in 2014, allowing users to pay for physical goods with a tap in retail stores. Last year, it launched its own credit card, the Apple Card. Integrating Mobeewave could let anyone with an iPhone accept payments without additional hardware.

This would put Apple into more direct competition with Square Inc., a leading provider of payment hardware and software for smartphones and tablets.

On its website, Mobeewave shows a demonstration of a user typing in a transaction amount and then a customer tapping their credit card on the phone to process the payment on the device.

Samsung Electronics Co. partnered with Mobeewave last year to allow its phones to use the technology. Samsung’s venture arm is also an investor in the startup, which has raised more than $20 million, according to PitchBook.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: