Android Pay, Samsung Pay, Android Pay or BBVA wallet, an app that acts as a remote control for cards

BBVA Wallet was originally created for BBVA’s customers in Spain in December 2013 and it is still the only app on the Spanish market that acts as a remote control for cards with the most total downloads among those in its category (+570,000). Furthermore, BBVA wallet continues its international expansion with launches in Mexico, Chile and the U.S. (introduced on June 15 – see the press release)

https://www.youtube.com/watch?v=uxqCooS9yKk&width=500&height=350

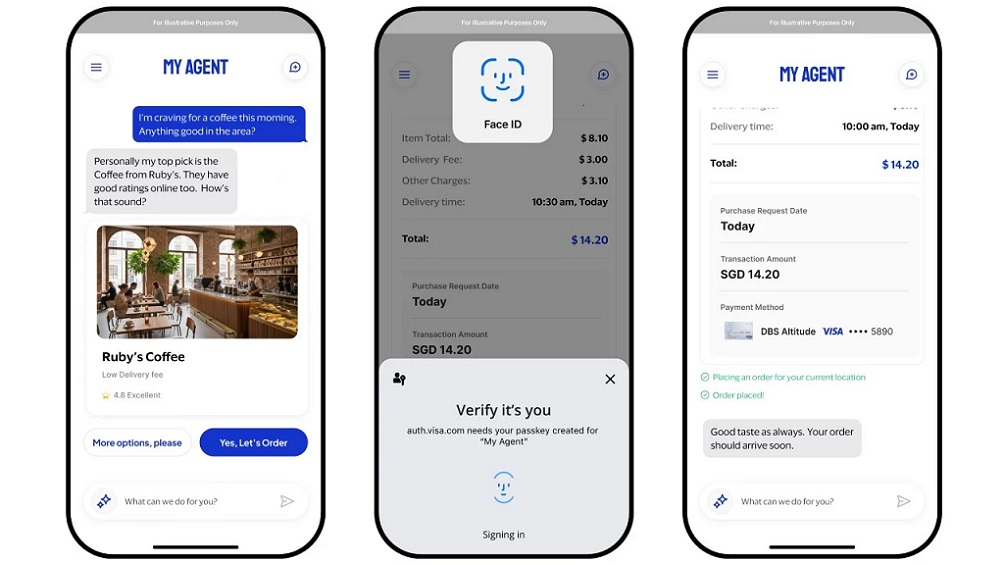

BBVA has recently improved its mobile payment app even further by adding a series of functions not found elsewhere on the Spanish market. The new version of BBVA Wallet allows users to control the spending on each card, limit its use to ecommerce or take money out of an ATM, as well as temporarily block it if it is lost or reactivate it when the user finds it.

„You can do all of this with a smartphone and in real time, which once again puts BBVA on the cutting edge of payment system solutions and makes it a leader in mobile banking.”, according to the press release.

BBVA, which was already a pioneer in using the cloud for its mobile payment system, as once again pulled ahead of the other financial institutions by giving BBVA Wallet new functions. “The new version of BBVA Wallet turns our customers’ smartphones into a remote control to do whatever they want with each one of their cards”, says Mehmet Sezgin, Head of Global Payments Systems at BBVA.

The new BBVA Wallet functions give users total control over their transactions, allowing them to set up alerts, as well as the ability to turn the cards “on” or “off” according to their specific needs at any given time. Therefore, they can set up and limit the use of each card, for example, while offering the option of establishing whether or not they want to use it exclusively for Internet transactions or physical stores, or even deactivate the card in the case of a trip abroad. This provides customers with greater security.

“These functions usher in a new era for payment systems. Personalizing cards up to now never meant more than choosing a photo to decorate them, but now BBVA’s customers have the ability to set up their own cards, cancel them and modify each one to meet their needs and circumstances”, underscores Sezgin. „And with such functionality we are leading the transformation from plastic to mobile” he ads.

International expansion

This service is an example of BBVA’s commitment to digital products. As it is a global app, it has also been rolled out in Chile this year, where the app allows users to manage credit card transactions and make mobile payments via smartphone. Furthermore, this app will soon be rolled out in other regions, such as the U.S. and Mexico, always adapted to the specific needs and characteristics of each country while staying true to its global functionality and interfaces.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: