An increase in the current deposit coverage level of EUR 100,000 would have limited impact on financial stability and depositor protection, an EBA simulation shows

The analysis shows that currently under the EUR 100,000 coverage across the European Economic Area (EEA), 96% of depositors are fully covered, meaning that, in case of bank failure, they would be paid back the full amount of their respective deposit. The 4% of depositors that are not fully covered are mostly companies, and, despite being few in number, they hold more than half of deposits held in the EEA.

The European Banking Authority (EBA) published a Report on the deposit coverage level and coverage of public authorities’ deposits, in response to a call for advice by the European Commission. The quantitative analysis and simulation show that a potential change to the current coverage level of EUR 100,000 would have positive but limited impact on financial stability and depositor protection.

On the other hand, it would be costly and have a somewhat negative impact on moral hazard. The analysis also shows that the extension of coverage to public authorities’ deposits would have limited impact on the industry, mainly because there are relatively few public authorities in comparison to the overall number of depositors across the EU.

The EBA’s response provides a quantitative analysis of the current EU deposit coverage of EUR 100,000. The analysis shows that currently under the EUR 100,000 coverage across the European Economic Area (EEA), 96% of depositors are fully covered, meaning that, in case of bank failure, they would be paid back the full amount of their respective deposit. The 4% of depositors that are not fully covered are mostly companies, and, despite being few in number, they hold more than half of deposits held in the EEA.

The analysis also shows that, since the first assessment done by the European Commission in 2010, the proportion of fully covered depositors has not changed much, even though the amount of deposits has, overall, increased. This follows from the observation that the coverage level of EUR 100,000 continues to be well above the amount an average depositor holds, despite the inflation that occurred over the said period.

The analysis then simulates the impact of a potential increase of coverage level to EUR 150,000 and EUR 250,000. It also simulates a EUR 1,000,000 coverage only for companies. The Report shows that a potential increase of the coverage level would have no impact on the vast majority of depositors, as they are already fully covered anyway.

The EBA also assessed the impact of a potential extension of coverage to include public authorities’ deposits and concluded that its previous recommendation dating back to 2019 to extend such coverage still holds. The analysis shows that such an extension would have limited impact on the industry, mainly because there are relatively few public authorities in comparison to the overall number of depositors across the EU.

Findings at the level of Deposit Guaranteed Schemes (DGSs)

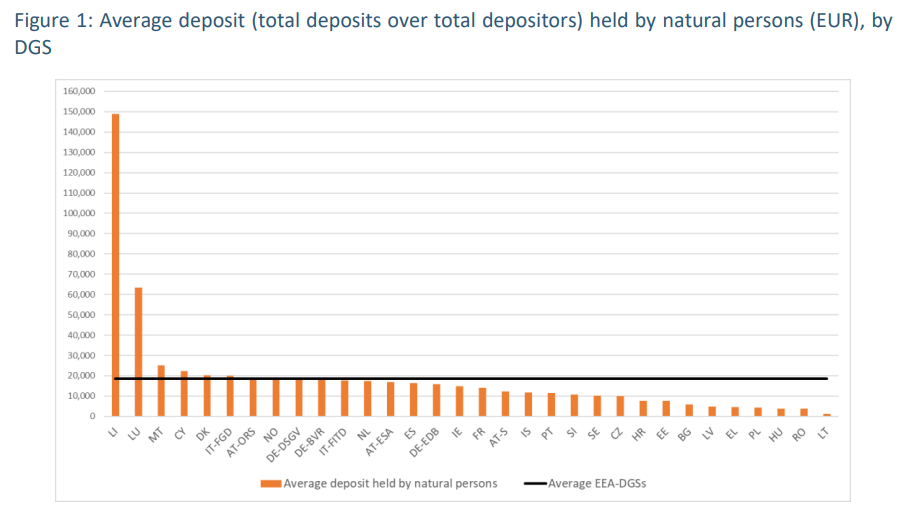

Figure 1 depicts the total eligible deposits over the number of eligible depositors for each DGS held by natural persons. This figure shows that the average deposit held by natural persons ranges from 1,309 EUR to 148,987 EUR with a median value among the DGSs at 14,398 EUR and an average across DGSs of 18,693 EUR. Only in LI and LU the average deposit held by a natural person is above 30,000 EUR.

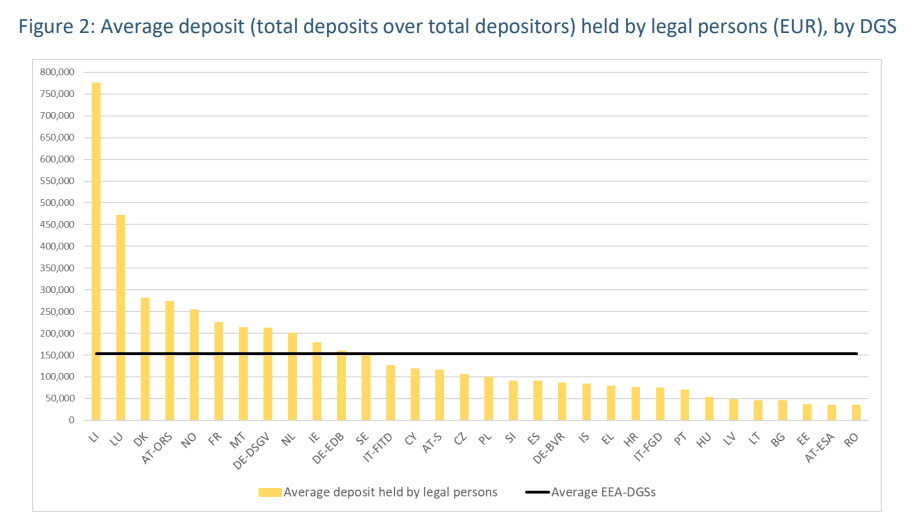

Figures 2 presents the total eligible deposits over the number of eligible depositors for each DGS held by legal persons. The figure shows that the average deposit held by legal persons ranges from 34,208 EUR and 775,926 EUR among the EEA DGSs with a median value at 101,839 EUR and an average across DGSs of 152,977 EUR. For half of the DGSs in the EEA countries, legal persons hold more than 100,000 EUR in their accounts on average.

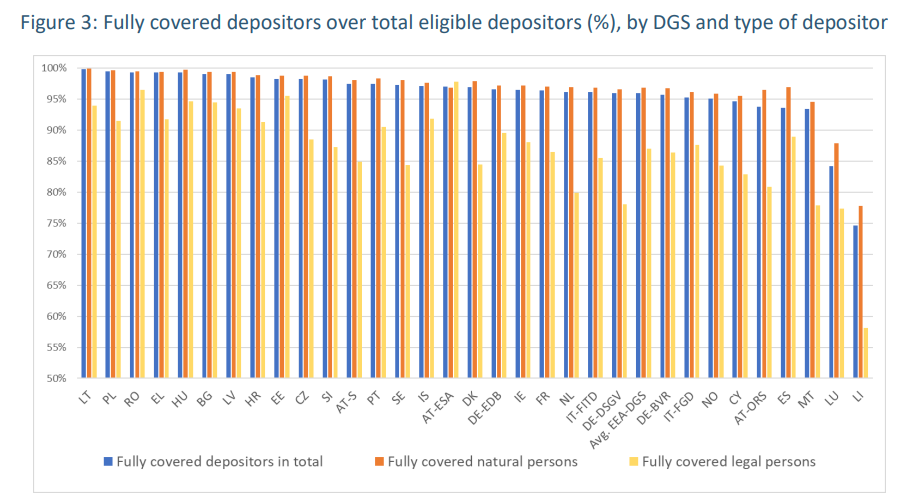

Figure 3 presents the proportion of fully covered depositors across the EU, by DGSs, including the subsets by natural persons and legal persons. The vertical axis starts at 50% full coverage for better readability. It shows that the proportion of fully covered depositors ranges from 74.7% to 99.8% with the median at 97.0% and an average across DGSs of 95.9%. That means, that across all DGSs, the vast majority of depositors are fully covered and thus have in principle no incentive to withdraw their deposits should they have concerns about the viability of their bank, because their deposits are covered in their entirety and would therefore be fully reimbursed.

The chart also shows that the proportion of natural persons that are fully covered (the median is 97.4% and on average 96.8%) is higher than that of legal persons (the median is 87.8% and the average is 87%), but that in both cases, the full coverage level is very high and thus the incentive to withdraw deposits is low.

More details here:

REPORT ON DEPOSIT COVERAGE IN RESPONSE TO EUROPEAN COMMISSION’S CALL FOR ADVICE

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: