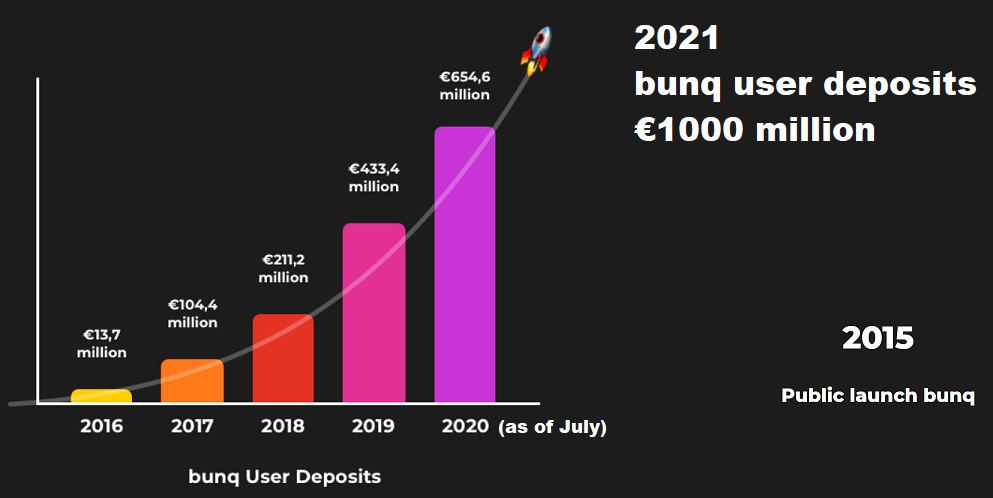

„We’ve just reached €1 billion in user deposits. This beautiful amount has more than doubled for the second year in a row,” bunq, the Dutch challenger bank, recently announced in a blog post.

In 2019, user deposits grew from €211m to over €433m, only to more than double again a year later.

Also, Bunq will be the first neobank outside of Germany to offer its customers the chance to receive a German International Bank Account Numbers (IBAN).

„The brand new German IBAN empowers you to use your bunq account for all payments, direct debits, or receiving your salary – all hassle-free and without worrying about IBAN discrimination,” according to the company.

„For now, this feature is available for our new German bunqers with Personal accounts (…) Germany is just the beginning – we’re looking to continue offering local IBANs in other countries based on feedback gathered from you, the lovely bunq community,” bunq says.

Earlier this year, Bunq became the first fintech to join the TARGET Instant Payment Settlement network developed by the European Central Bank. The move will give Bunq’s users access to instant payments with banks both in its native Netherlands, but also across Europe too.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: