Amounts sent to non-EU countries by EU residents up at €35.6 billion in 2018. Second highest inflows of personal transfers were recorded in Romania: €3.0 billion.

Amounts received from non-EU countries stable at €10.9 billion

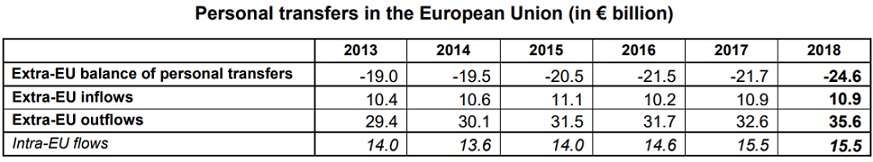

In 2018, flows of money sent by residents of the European Union (EU) to non-EU countries, referred to as personal transfers, amounted to €35.6 billion, compared with €32.6 billion in 2017, according to Eurostat. Inflows to the EU totalled €10.9 bn in 2018, unchanged compared with 2017.

This resulted in a negative balance (-€24.6 billionn) for the EU with the rest of the world. The majority of personal transfers consist of flows of money sent by migrants to their country of origin.

This News Release, issued by Eurostat, the statistical office of the European Union, presents annual data on personal transfers collected within the framework of Balance of Payments statistics.

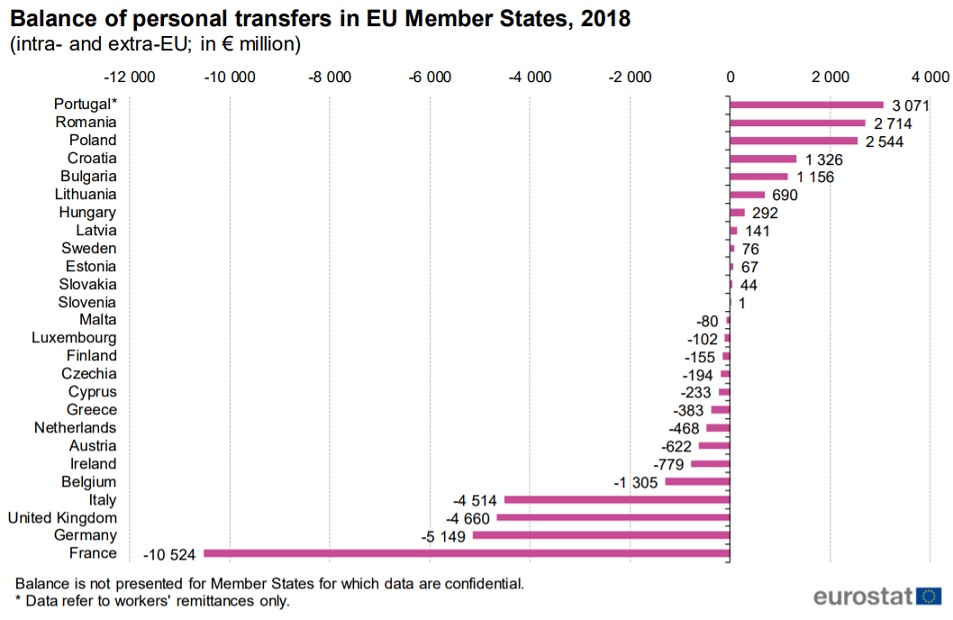

Largest surpluses in personal transfers in Portugal, largest deficit in France

Among Member States for which data are published, the outflows of personal transfers in 2018 were highest from France (€11.4 billion), followed by Spain (€7.7 billion – see country note), the United Kingdom (€7.0 billion), Italy (€6.5 billion) and Germany (€5.2 billion).

In contrast, the highest inflows were recorded in Portugal (€3.6 billion – see country note), ahead of Romania (€3.0 billion), Poland (€2.9 billion), the United Kingdom (€2.3 billion) and Italy (€2.0 billion). As a result, the largest surpluses in personal transfers were registered in 2018 in Portugal (+€3.1 billion), Romania (+€2.7 billion) and Poland (+€2.5 billion), while France (-€10.5 billion) recorded by far the largest deficit, followed by Germany (-€5.1 billion), the United Kingdom (-€4.7 billion) and Italy (-€4.5 billion).

Extra-EU personal transfers mostly directed to Africa and Asia

In 2018, the highest shares of intra-EU inflows among total inflows of personal transfers were recorded in Slovakia (99%), Hungary (90%), Luxembourg and Romania (both 89%), Poland (85%) and Sweden (83%).

On the contrary, extra-EU inflows accounted for about three-quarters of total inflows in France (74%) and for about two-thirds in Malta (63%) and Belgium (61%). Slovakia (97%), Luxembourg (88%), Ireland (79%) and Finland (70%) were the Member States that recorded the highest proportion of intra-EU outflows in total outflows.

For extra-EU outflows, the largest shares were observed in Slovenia (88%), Belgium (85%), Italy and Poland (both 83%), the Netherlands and Portugal (both 82%), and France (78%).

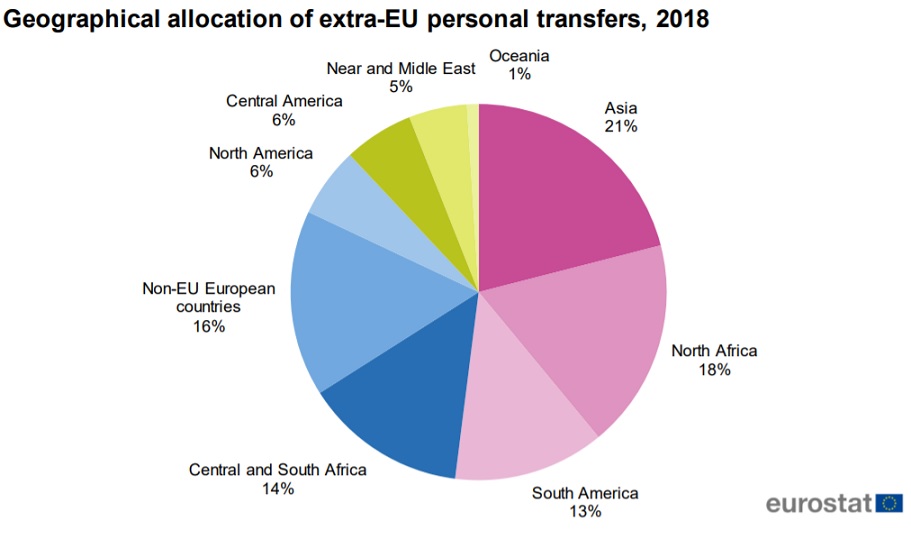

Extra-EU personal transfers were mostly directed to Asia (21% of total extra-EU outflows), followed by North Africa (18%), non-EU European countries (16%), Central and South Africa (14%) and South America (13%).

Methods and definitions

Personal transfers consist of all current transfers in cash or in kind between resident and non-resident households, disregarding the underlying source of income, the relationship between the households or the purpose of the transfer. Thus, the concept of personal transfers is seen to be broader than workers’ remittances (compensation of employees).

Country note: Spain and Portugal Data on personal transfers presented in this News Release refer only to workers’ remittances.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: