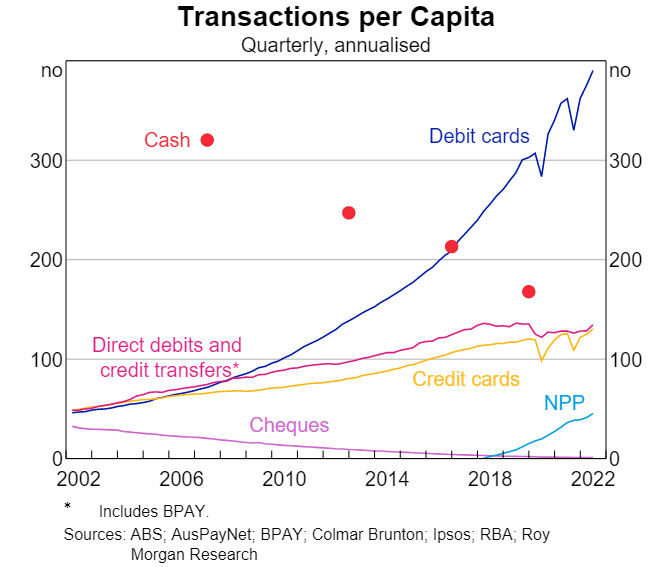

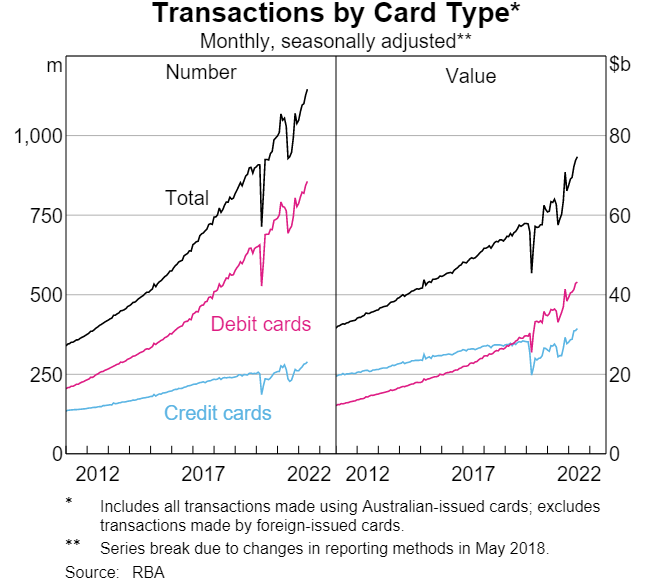

In 2021/22, Australians made around 650 electronic transactions per person on average, compared to about 300 a decade earlier, according to Reserve Bank of Australia. Around 75 per cent of these transactions by number used debit and credit cards, which are the most commonly used retail payment methods in Australia. When measured by the value of transactions, direct debits and credit transfers processed through the direct entry system account for the bulk of non-cash retail payments.

Strong growth in card payments over the past decade or so has been driven by the rising popularity of debit cards. According to data from the BIS, the number of debit card transactions per person in Australia is among the highest in the world.[7] Around 75 per cent of card payments in Australia were made with a debit card during 2021/22, compared to 62 per cent 10 years ago (Graph 2.2). Growth in debit card use accelerated during the pandemic, with spending on debit cards (by value) around 40 per cent higher in the first half of 2022 than in the second half of 2019. By contrast, the value of credit card spending was only 6 per cent higher over the same period.

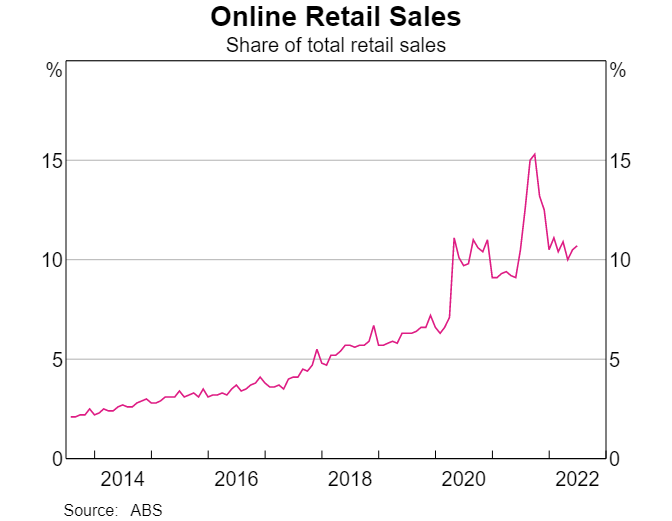

Another long-run trend that has been reinforced by the pandemic is an increase in the share of retail purchases being made online. The share of retail sales conducted online increased sharply during periods of pandemic-related lockdowns, and remains higher than it was prior to the pandemic (Graph 2.3). Data from the Australian Bureau of Statistics show that just over 10 per cent of retail sales were conducted online in the June quarter of 2022, compared to around 7 per cent at the end of 2019. This suggests that the pandemic may have induced a permanent change in shopping preferences for some consumers, which reinforces the trend increase in the use of electronic payment methods.

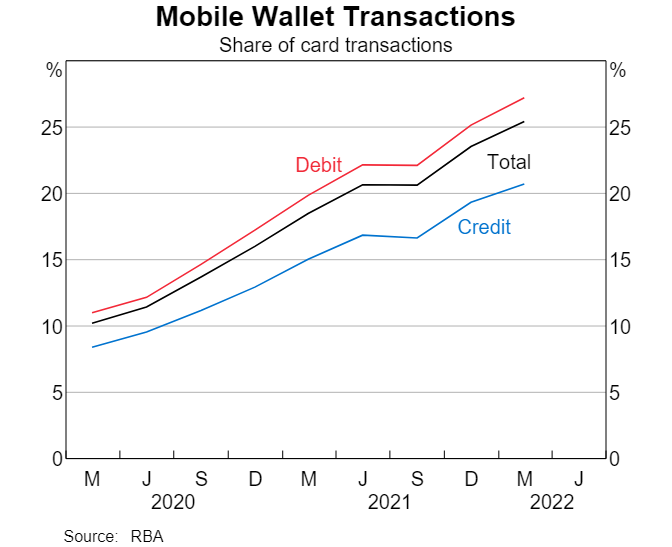

Over the past few years, there has also been a marked shift to card payments being made with mobile wallets offered by large technology companies, such as Apple Pay, Google Pay and Samsung Pay. These wallets enable consumers to store digital representations of their debit and/or credit cards in their smartphone or other mobile devices (such as a smart watch). These can then be used to make contactless payments at the point of sale and, in some cases, online payments.

The Bank has recently begun collecting data on mobile wallet use in Australia from major card issuers. The share of debit and credit card transactions made via mobile wallets more than doubled between the March quarter of 2020 and the March quarter of 2022, from 10 to 25 per cent (Graph 2.4). A higher proportion of debit card than credit card payments are made using mobile wallets. For example, 27 per cent of debit card transactions (by number) were made via a mobile wallet in the March quarter of 2022, compared to 21 per cent of credit card transactions.

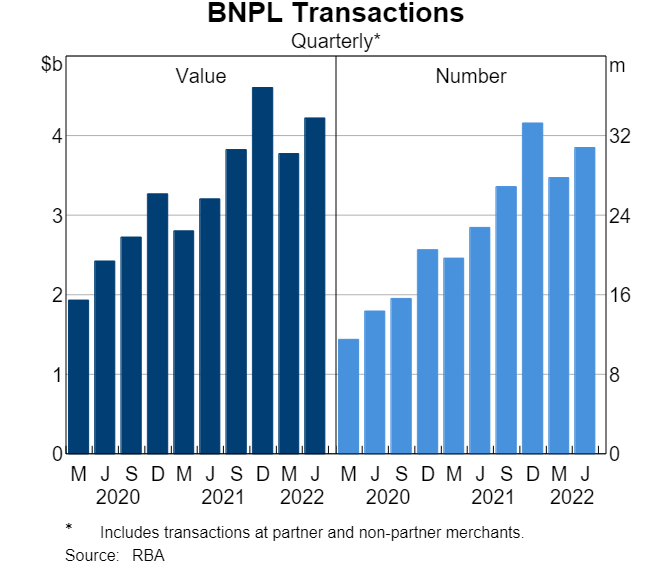

‘Buy now, pay later’ transactions grew strongly through the pandemic

Based on data collected by the Bank from a sample of BNPL providers, BNPL transactions have continued to grow strongly through the COVID-19 pandemic. The value of BNPL transactions increased by around 37 per cent in 2021/22 to $16 billion (Graph 2.5), equivalent to around 2 per cent of Australian card purchases.[8] The number of active Australian BNPL customer accounts also increased, from 5 million to around 7 million accounts over the year to June (though some consumers hold accounts with multiple providers).

Over the past year, a number of new providers entered the Australian BNPL market, and some larger existing payment providers have introduced BNPL options to their existing payment services. The range of merchants accepting BNPL transactions has also increased, including as a result of some BNPL providers leveraging existing card acceptance arrangements to enable BNPL purchases at almost any merchant that accepts card payments.

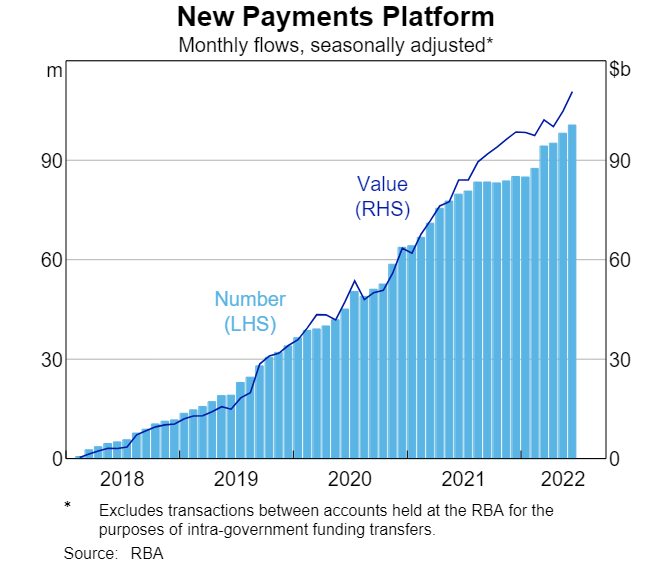

Use of Australia’s fast account-to-account payments system, the NPP, has continued to grow since its launch in 2018. The NPP enables consumers, businesses and government agencies to make real-time, data-rich payments 24 hours a day, every day of the year. Over 100 payment providers, including some non-bank payment service providers, now offer NPP services to almost 90 million customer accounts. Over the past year, the NPP processed more than a billion transactions worth more than $1 trillion (Graph 2.8). The NPP now processes more than 25 per cent of the total number of account-to-account payments, up from around 22 per cent a year earlier.

At the same time, there has been increased uptake of the NPP’s PayID service. This service allows NPP payments to be addressed to a payee’s registered mobile phone number, email address or Australian Business Number rather than to a BSB and account number. By addressing a payment to a PayID, the payer can check the account name of the payee prior to completing the transaction, which can help in avoiding mistaken payments and some types of scams. In mid-2022 there were around 11 million registered PayIDs in Australia, up from around 8 million a year earlier. While the share of payments made using PayIDs has been increasing, the majority of NPP payments are still addressed to BSB and account numbers.

In the past year, some payments previously processed via the direct entry system have migrated to the NPP. This has included some types of government payments, with the NPP utilised to provide disaster relief and COVID-19-related support payments to affected households in near real time, including on weekends. The number of direct entry payments has been broadly flat, increasing by around 4 per cent over the year to July. The NPP’s new PayTo service is expected to accelerate this migration of direct entry payments. PayTo provides direct debit-like functionality, allowing consumers to pre-authorise standing arrangements for businesses to initiate fast payments from their bank accounts. The service will act as a modern alternative to the current direct debit system, providing customers with greater visibility and control over their PayTo agreements. PayTo could also be used as an alternative payment method for in-person or online transactions, and to streamline certain business payments such as payroll. While the service went live in July 2022, consumer uptake will take time as many banks are yet to enable the service for their customer accounts.

More details:

Payments System Board Annual Report – 2022: The Evolving Retail Payments Landscape

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: