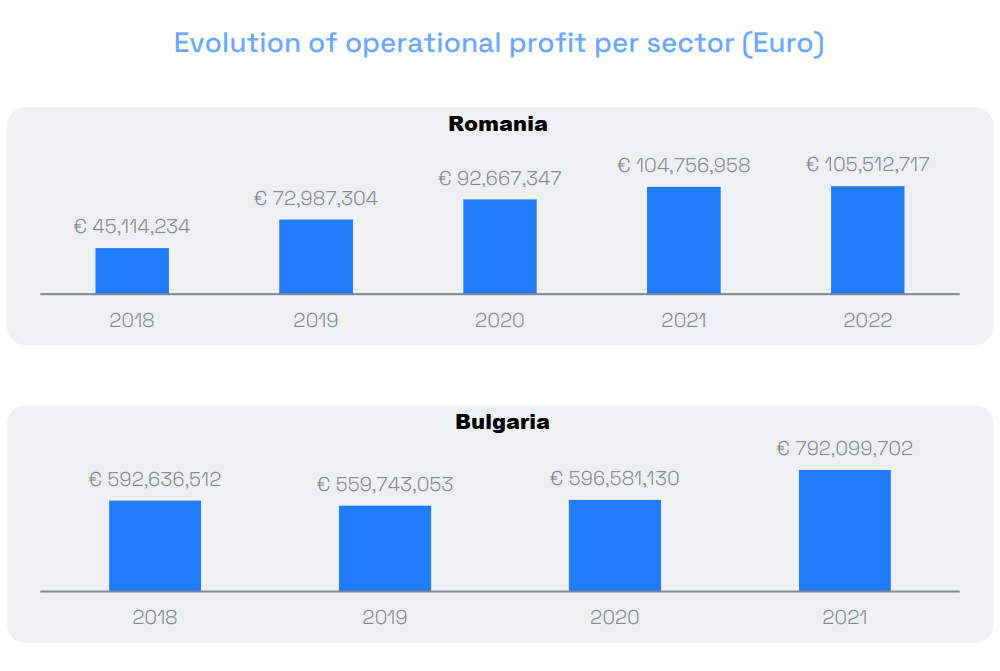

Although it has fewer assets, Bulgaria’s fintech sector is 11 times more profitable compared to Romania. 2021 data – RoFin.tech report.

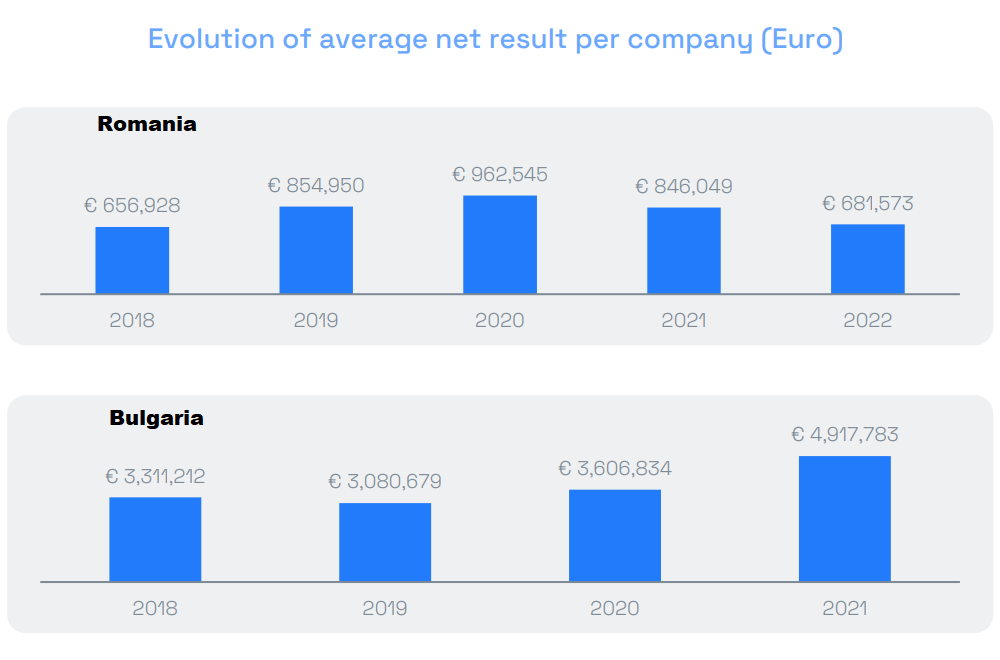

The latest comparable data (2021 data) shows that the net result of the fintech sector in Romania was 70 mil. euros while in Bulgaria the same indicator reached 767 mil. euros. The entire group of companies analyzed in the Report includes 240 companies that were identified by the authors and classified as Fintechs in Romania and Bulgaria. The group includes 84 companies for Romania and 156 companies for Bulgaria.

The Romanian Fintech Association launched the Romania-Bulgaria Fintech Report. The report aims to provide an overview of the recent developments influencing the Romanian FinTech sector and the main characteristics and challenges of the FinTechs. It is coordinated by the Bucharest Business School from the Bucharest University of Economic Studies in cooperation with the Romanian Fintech Association (ROFINTECH). The Bulgarian counterparts are represented by the Faculty of Economics and Business Administration at Sofia University Saint Kliment Ohridski and the Bulgarian Fintech Association.

Bulgarian Fintech ecosystem

The focal point of the fintech sector in Bulgaria is concentrated within the nation’s three largest cities – Sofia, Plovdiv, and Varna, among which Sofia accommodates 131 out of the total 156 Bulgarian fintech firms.

The report highlights that a vast majority (92%) of Bulgarian fintech enterprises qualify as small and medium-sized enterprises, characterized by turnovers of less than €50 million and employing fewer than 250 individuals.

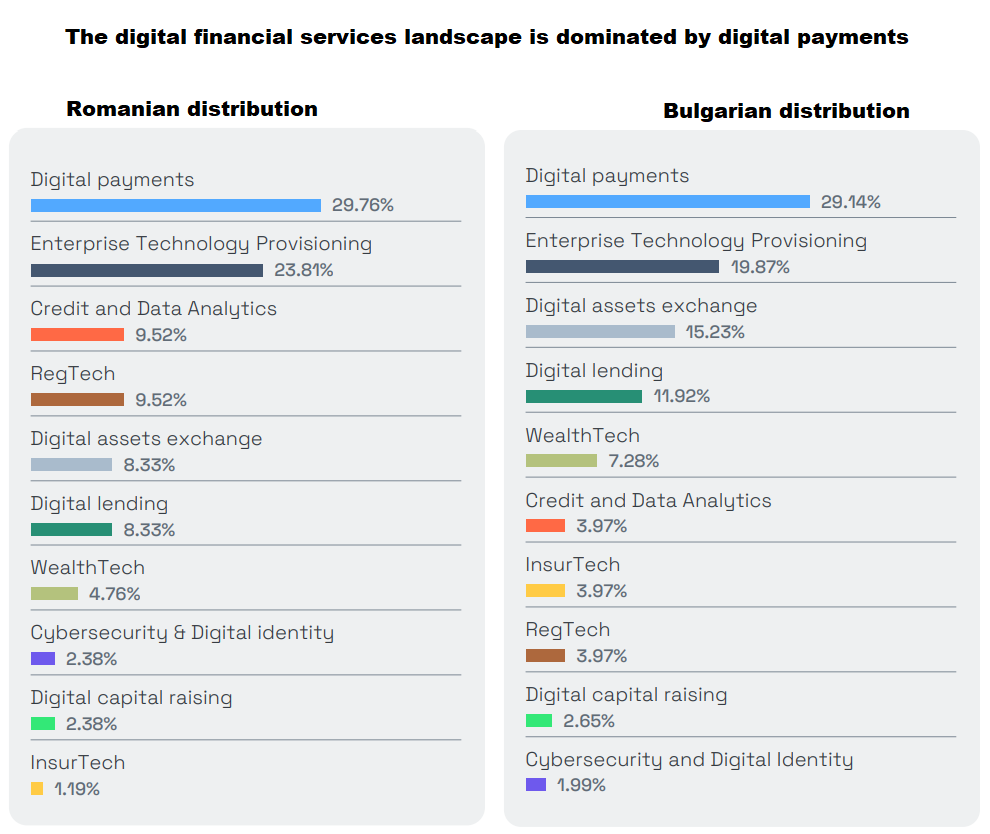

Among the diverse array of business models prevalent in the Bulgarian fintech landscape, digital payments emerge as a prominent niche, accounting for a quarter of the sector, followed by enterprise technology provisioning (18%) and digital asset exchange (15%). Notably, digital payments fintechs emerge as the primary revenue contributor, constituting 54% of the BGN 1.828 billion (~ EUR 0.9 billion) total revenue of the sector in 2021.

Furthermore, the Bulgarian digital payments segment exhibits a blend of indigenous companies such as Paynetics, Borica, and Paysera Bulgaria alongside foreign direct investments including Paysafe, SumUp, and Nuvei. Remarkably, although the credit and data analytics fintech sector comprises only six firms primarily engaged in credit scoring for banks, it emerges as the fourth-largest revenue contributor, contributing 8% to the sector’s total revenue in 2021.

Although the technology field and finance are thought to be predominantly men-dominated, in Bulgaria we observe a parity, 44% of all employed in the Bulgarian FinTech industry are women. Another important aspect is that the average age of the employees is 35.4 years.

Distribution of the Fintech companies based on type of activity

The digital financial services landscape is heavily dominated by Digital Payments, Enterprise Technology Provisioning, and Digital Assets Exchange.

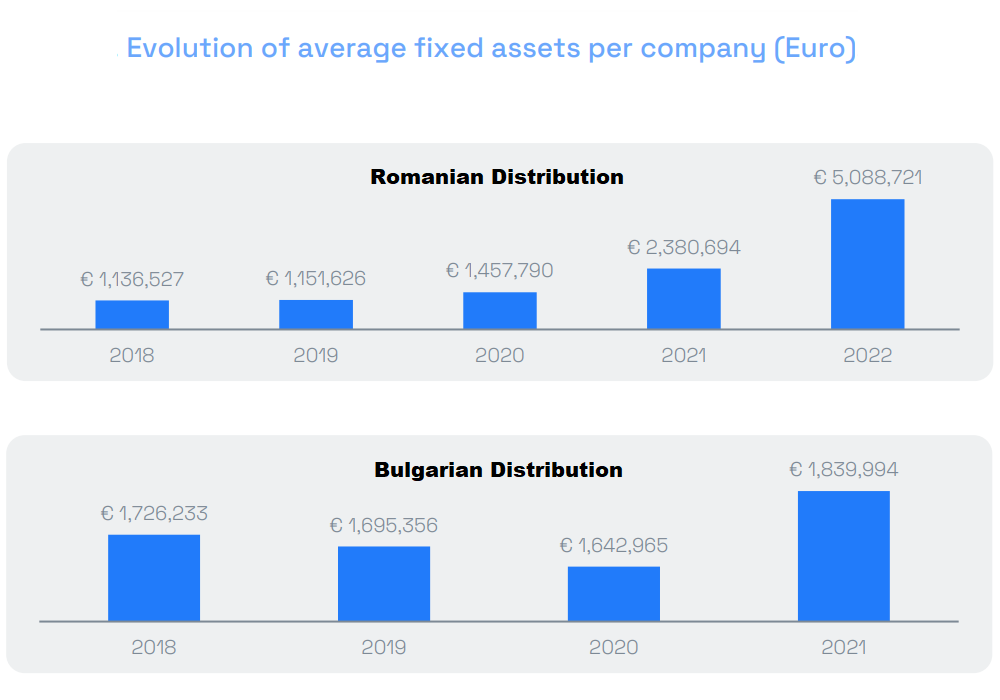

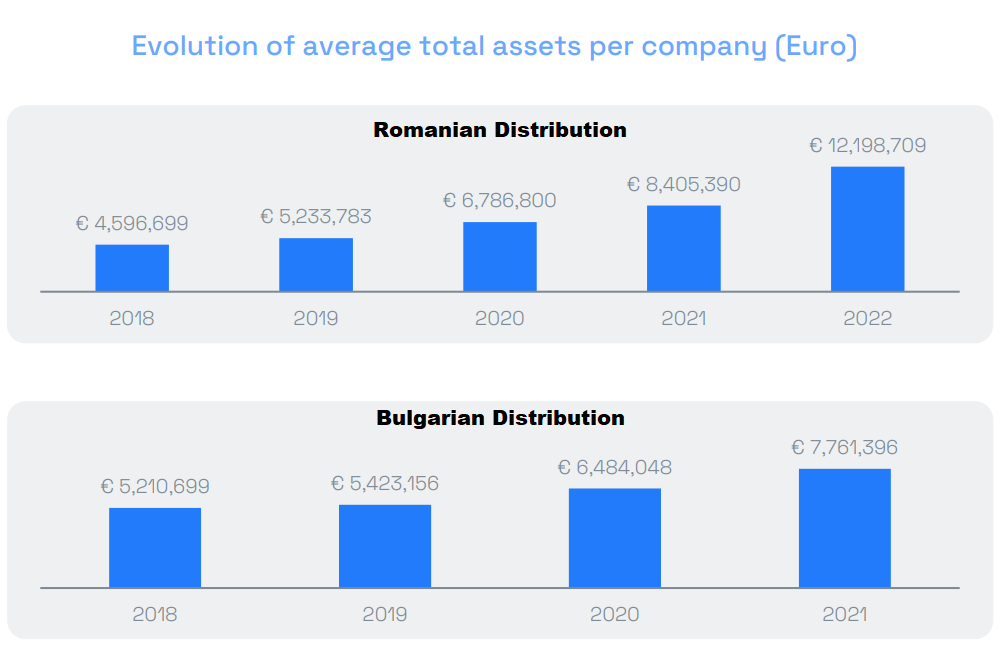

Business Performance

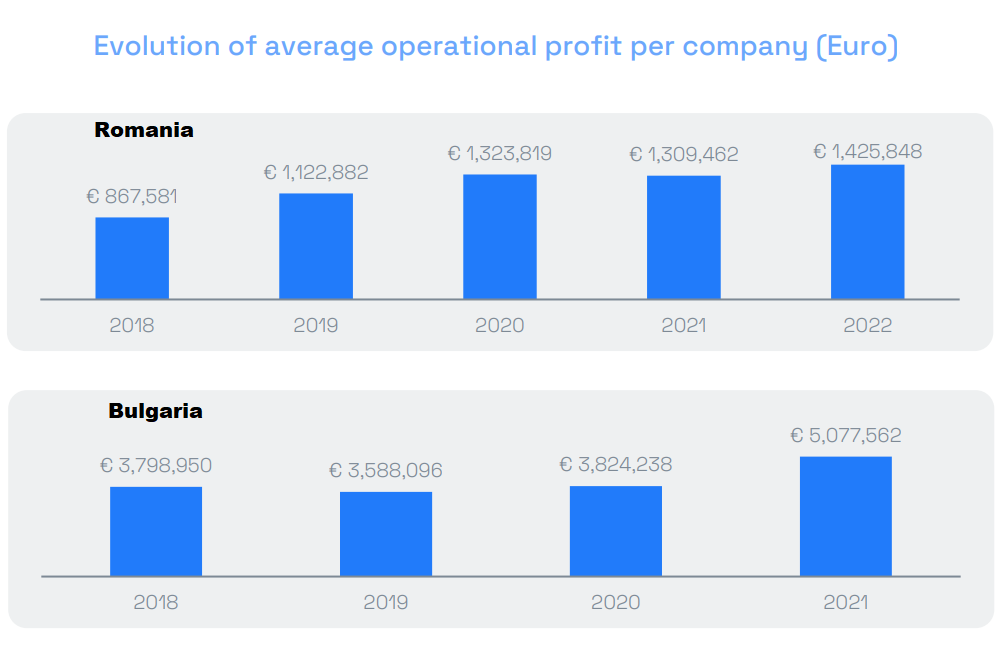

As you can see from the charts below, compared to Romania, Bulgarian fintechs has four times more employees per company and present relatively the same level of assets per company. Interestingly, in terms of ability to generate profit, Bulgaria performs much better: fintech companies in Bulgaria generate almost 11 times more profit than their counterparts in Romania. The latest comparable data (2021 data) shows that the net result of the sector in Romania was 70 mil. euros while in Bulgaria the same indicator reached 767 mil. euros.

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: