Alternative payments account for nearly 60% of e-commerce market in India, reveals GlobalData

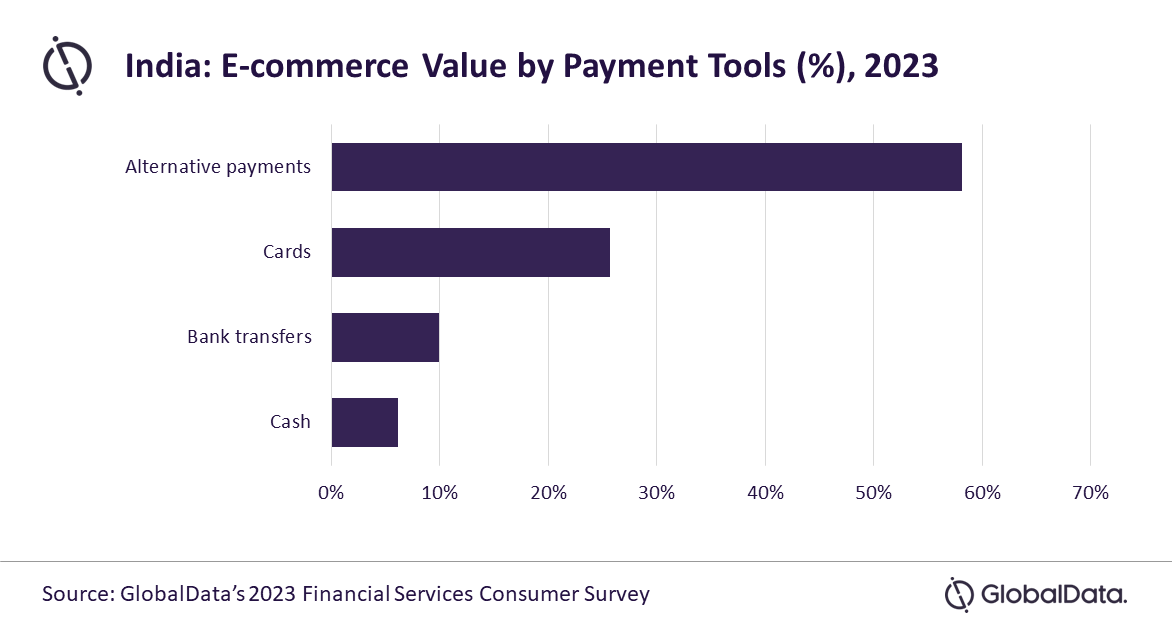

Alternative payment methods such as mobile and digital wallets completely dominate the e-commerce space in India. They have displaced cash and cards and are the most popular online payment method with 58.1% market share in 2023, finds GlobalData, a leading data and analytics company.

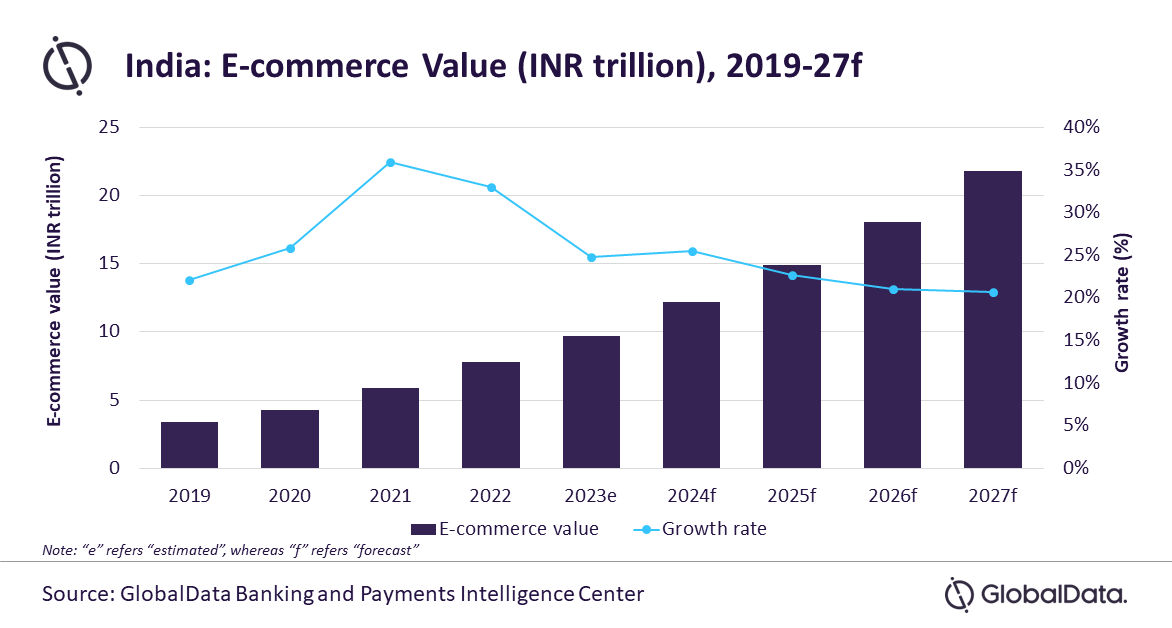

An analysis of GlobalData’s E-Commerce Analytics reveals that India’s e-commerce market value is set to increase at a compound annual growth rate (CAGR) of 28.2% from INR2.8 trillion ($33.9 billion) in 2018 to INR9.7 trillion ($117.3 billion) in 2023, driven by the rising internet and smartphone penetration, discounts, faster delivery options offered by online retailers, and the growing consumer preference for online shopping.

The Indian government also launched initiatives such as Startup India and Digital India, which also contributed to overall ecommerce growth. In addition, the COVID-19 pandemic too accelerated the shift to online shopping as wary consumers stayed home to avoid potential disease vectors.

This trend has persisted even after the reopening of physical stores. As a result, e-commerce payments in India are forecast to grow at a CAGR of 22.4% between 2023 and 2027 to reach INR21.8 trillion ($263.6 billion) in 2027.

Ravi Sharma – Lead Banking and Payments Analyst at GlobalData, comments: “Alternative payments have gained huge traction in India since the demonetization in 2016. The pandemic has accelerated this trend as both consumers and merchants preferred digital payments to avoid exposing themselves to disease vectors such as cash. The growing popularity of alternative payment brands among consumers and merchants also supported this trend.”

According to the GlobalData’s 2023 Financial Services Consumer Survey*, alternative payment solutions dominate e-commerce in India with a combined market share of 58.1% in 2023. They have consistently gained popularity among the Indian consumers in the last five years with some of the popular brands being Amazon Pay, Google Pay, and Paytm.

Payment cards are the second most popular e-commerce payment method in India with a share of 25.7% with credit and charge being the preferred card types accounting for a 15.4% share in 2023.

Cash, which is widely used for in-store retail payments in India, has seen a significant drop in the market share for online purchases, accounting for only 6.2% share.

Sharma concludes: “The uptrend in e-commerce sales in India is likely to continue over the next few years supported by the growing consumer preference, improving payment infrastructure, and growing popularity of alternative payment solutions with these solutions dominating the ecommerce payment space over the next few years.”

______________

*GlobalData’s 2023 Financial Services Consumer Survey was carried out in Q2 2023. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: