Onboarding the local Orange Money customer base will allow Alpha Bank Romania to strengthen its market position by significantly expanding its customer portfolio.

Alpha Bank Romania announces that it has signed a business transfer agreement with Orange Money Romania to acquire the consumer ecosystem built by the company, that encompasses its customer portfolio, top-of-the-market digital assets (mobile application), credit card portfolio and employees.

„The transaction will further enhance Alpha Bank Romania’s proven banking expertise and innovation tradition with the fully digital approach and agile environment of Orange Money Romania, thus allowing it to become one of the key players in the Romanian digital banking space. In addition, the bank’s skilled and experienced team will be complemented by the pool of highly talented Orange Money Romania employees to create one of the best digital services-oriented teams in the market.” according to the press release.

„Orange Money customers will continue to benefit from existing products and services, while they will also gain access to the full range of banking products and services that Alpha Bank Romania provides on the local market. At the same time, the transaction will allow the bank to offer customers a stronger digital proposition by incorporating Orange Money’s digital assets and evolving it into a state-of-the-art mobile banking application.” the bank explains.

The transaction completion is subject to receiving all regulatory approvals and fulfilling other customary closing conditions.

„Alpha Bank Romania has combined tradition and innovation since the launch of its operations and this acquisition is part of the bank’s strategy to strengthen its position in the market and offer a superior digital experience to its customers. We are delighted to benefit from the strengths of Orange Money Romania and excited by the opportunity to build an ecosystem of digital solutions for our customers. Our strategic thinking, flexibility and long-term vision are thus complemented by an infusion of agility and expertise in the field of market-leading digital financial services”, said Sergiu Oprescu – Executive President of Alpha Bank Romania and General Manager of the International Network of the Alpha Bank Group.

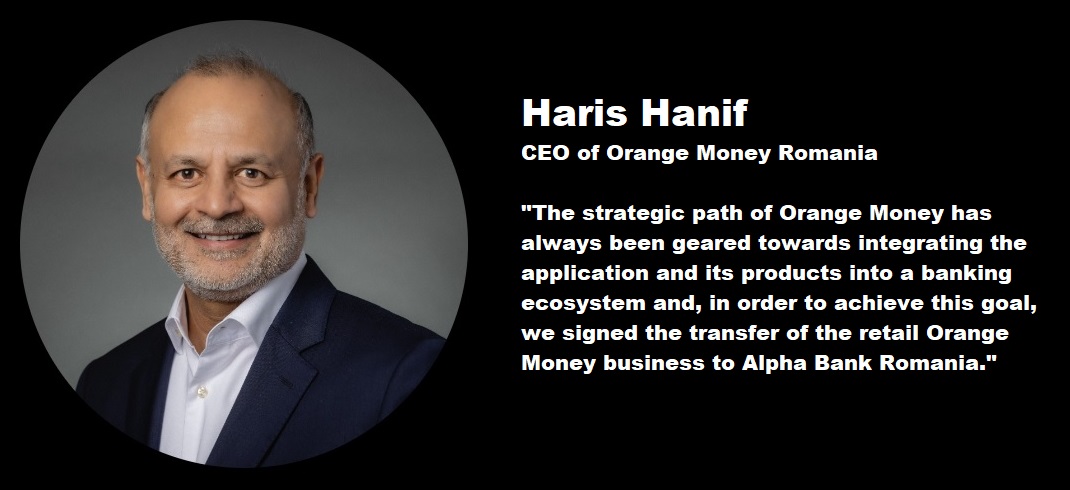

„Thanks to a strong team of digital banking specialists, Orange Money Romania has grown steadily, becoming a top digital financial solution, recognized by customers and the market for the quality of its services and innovative vision. The strategic path of Orange Money has always been geared towards integrating the application and its products into a banking ecosystem and, in order to achieve this goal, we signed the transfer of the retail Orange Money business to Alpha Bank Romania. Alpha Bank’s expertise will provide continuity to our customers, and their banking products will also enhance the suite of services to which Orange Money users have access today”, said Haris Hanif – CEO of Orange Money Romania.

Alpha Bank Romania is a member of the Alpha Bank Group, one of the largest banking and financial groups in Greece. The international activities of the Group are extended, in addition to Romania, to the United Kingdom, Luxemburg and Cyprus.

Alpha Bank Romania ranks among the top 10 banks in the country, with universal banking operations. The Bank has had a national presence of almost 30 years, offering a wide range of modern services and products for individuals, SMEs and the corporate segment. It is one of the financial institutions that have innovated the banking sector in Romania, being the first bank to launch an application that transforms an Android mobile device into a POS terminal. It was also the first bank in Romania to issue covered bonds in 2019 and the first in the market to introduce housing loans. For more information: https://www.alphabank.ro.

About Orange Money Romania

Orange, the leader of the telecom market in Romania, launched in 2016 Orange Money, a 100% digital alternative to traditional banking services. Orange Money allows clients to transfer money and pay bills without fees, based on an easy-to-use, secure and intuitive interface. In a few minutes, Orange Money users can open a current account in RON with their own IBAN, and can immediately make transfers in the country or abroad, online payments or payments with the smartphone or smartwatch by using the virtual debit and credit cards. The Orange Money credit card provides customers with packages with extra benefits that can be accessed depending on their payment needs and lifestyle. Data verification, credit line approval, document signing, and virtual credit card issuance are simple and fast from the smartphone. For more info about Orange Money Romania: https://www.orange.ro/money.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: