Europe’s banks see migrating core banking systems to the cloud and SaaS as a strategic priority, to improve customer experience and ensure operations are agile and secure. Also, they are more likely than those in other regions to expect neobanks to be their company’s biggest competitors in the next five years.

New research from Economist Impact supported by Temenos finds that European banks are fighting back against competition from platform players, neobanks and payment providers.

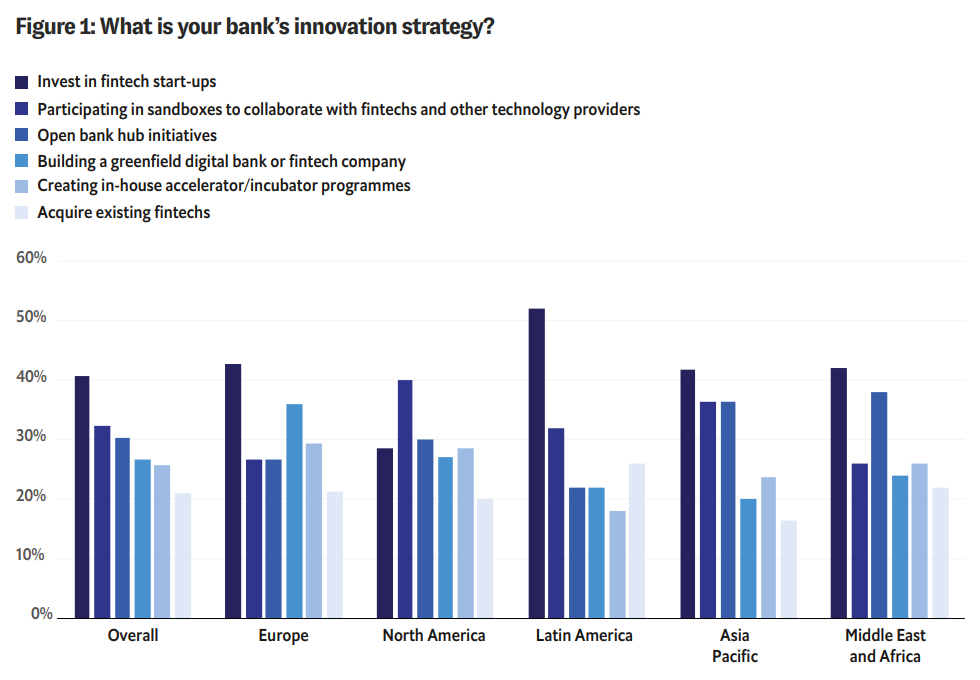

According to the study, “Challenging the challengers: Europe’s banks face the competition”, almost half (43%) are investing in fintech start-ups and a third (36%) are building their own greenfield digital bank or fintech company.

Our survey found that just 21% of senior executives in European banks believe that challenger banks will flourish, and 35% expect that there will be market consolidation. In response, they are continuing to build their own greenfield digital banks or fintech companies at a higher level than banks in other regions (see Figure 1).

But they are also exploring collaboration by investing in fintech start-ups, creating banking super-apps or ecosystems that bring in the offerings of fintech firms, and providing “banking as a service” offerings to fintech firms and other companies.

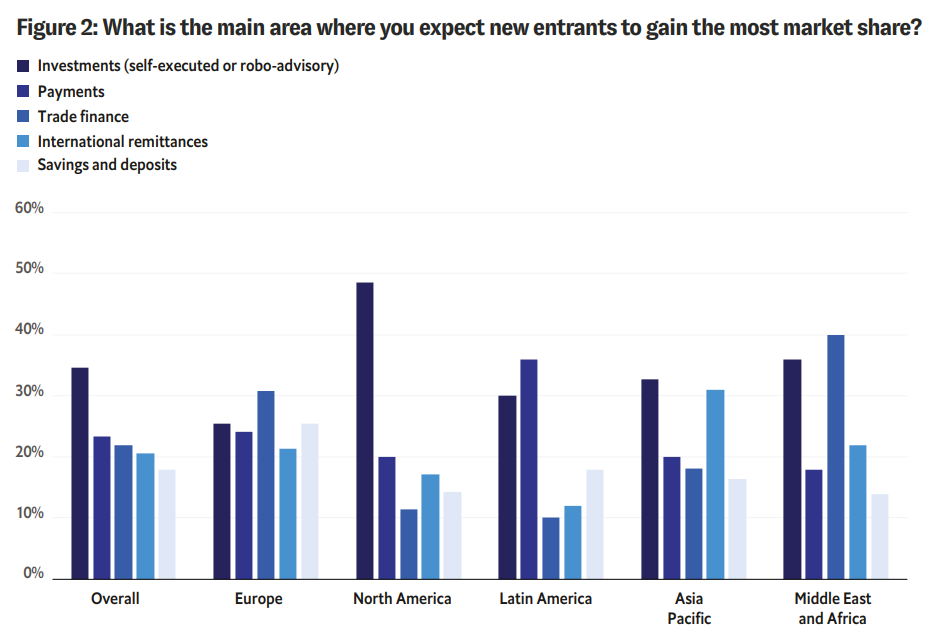

The report reveals European banks are more likely to view neobanks as their company’s biggest competitors in the next five years compared to other regions. However, payment players and technology providers continue to be top of mind, with payments being the space European banks predict new entrants will gain the most market share (see Figure 2). HSBC recently launched Zing, a new multi-currency payments app to compete with the likes of Wise and Revolut.

“We see people moving money from a traditional bank into a Wise account to make an international transfer, which adds an extra step,” said Roisin Levine, head of UK and Europe partnerships at Wise. “[It’s] great that we have customers that want to use our service so much that they will do that. However, the best possible experience is where the product fits perfectly so you can make a payment from wherever you bank—getting all the good parts of a fintech experience, but within one environment.”

European banks are acknowledging this as well. So while they are maintaining their own product offerings, they are also becoming aggregators of third-party banking and/or non-banking products, more so than banks in other regions (see Figure 3).

This is fuelling a rise in co-operation with fintech firms like Wise that have direct to consumer offerings, but also with “infrastructure players, B2B fintechs, who have a core offering that banks can plug and play, using a variety of different players for different offerings like payments,” Ms Levine says.

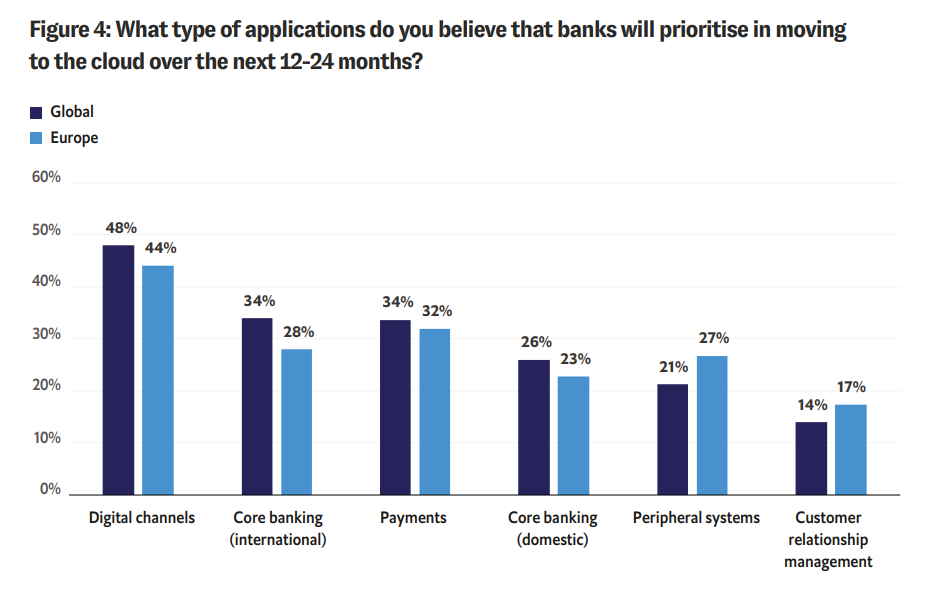

European banks are also migrating core banking systems to public cloud and SaaS in greater numbers than their counterparts in other regions. Over a fifth (21%) of European banks see cloud as a strategic priority, ensuring their operations are agile and secure to compete with more nimble competitors. AI is also a key part of their technology investment strategy, particularly to improve the customer experience and support digital marketing, with three quarters (75%) of European bankers believing that the banking sector will be significantly impacted by generative AI. Digital channels are the main focus of migration for European banks (see Figure 4).

Jonathan Birdwell – Global Head of Policy & Insights, Economist Impact, said: “Fintechs and neobanks took the lead in using new technologies to provide better customer experiences. European banks are now fighting back, emulating the way non-traditional players have used technology to reach consumers who had been underserved by traditional financial services, and to appeal to existing customers with support in managing their personal finances.”

Kanika Hope – Chief Strategy Officer, Temenos, said: “The competitive landscape is shifting. As neobanks and fintechs experience growing pains and face funding difficulties, Europe’s banks are taking advantage of the opportunities afforded by open banking by pursuing collaborations with their challengers to offer a wider range of better services to their customers. They are also investing in technology, using cloud-native banking platforms and SaaS to improve the customer experience and ensure their operations are agile and secure.”

Temenos, a trusted SaaS provider to 700 banks, recently launched end-to-end SaaS services for Retail, Business and Corporate Banking with over 120 pre-configured products, processes and 700 APIs, to enable banks to deploy software solutions in just 24 hours and significantly reduce modernization costs. The company also recently announced Temenos LEAP, a new AI-powered offering that helps banks modernize faster to the latest cloud-native Temenos technology.

_______________

Economist Impact conducted a study, commissioned by Temenos, to understand emerging trends in the banking industry. This report presents insights from a global survey of 300 executives in retail, commercial and private banking spanning Europe (25%), North America (23%), Asia Pacific (18%), Middle East and Africa (17%), and Latin America (17%). Respondents perform various job functions, such as IT, customer service, finance, marketing and sales, strategy and business development, and general management, among others. Half of the respondents were C-suite executives. This is the seventh year that Economist Impact has conducted this survey. The research also included interviews with industry practitioners to gain further insights.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: