There was a surge in mobile wallet use for payments from 42% of UK adults in 2023 to 57% in 2024, according to UK Finance figures, BBC reports.

„People are more comfortable leaving their home with just their phone,” said Adrian Buckle, its head of research. He said the „change of consumer behaviour” was clear as last year marked the first time 50% of adults used mobile payments at least once a month.

Consumers are increasingly storing card details on phones or watches and making contactless payments backed up by facial or fingerprint verification, instead of pressing in a PIN.

The proportion of adults regularly using physical contactless cards dipped slightly as a result, although debit cards remain the most popular way to pay. Cash has continued to become less common in transactions – although nearly 50 million people still used ATMs.

A quarter of Brits used BNPL services, up from 14% in 2023, with younger adults the most frequent users, according to Finextra.

Overall, the total number of payments made in the UK last year was 48.6 billion payments, up by 1.5%. Consumers were responsible for 84% of these, with businesses, government and not-for-profit organisations accounting for 16%.

Cash was used for 4.4 billion payments compared with six billion in 2023. For the first time, cash accounted for less than 10% of all payments.

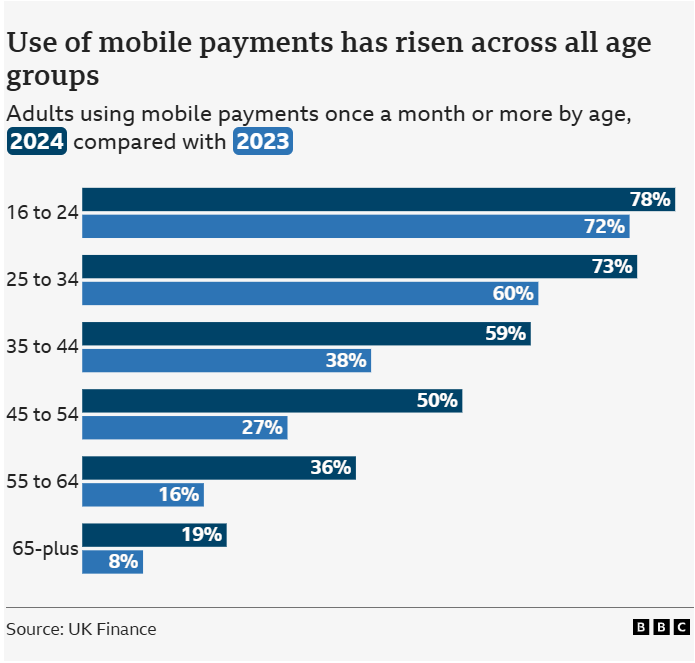

„Cash fell below 10% of all payments,” Mr Buckle said. „These changes weren’t just driven by younger consumers. We saw growth in mobile wallets and Buy Now Pay Later across older age groups too, highlighting how digital payments are becoming more mainstream across the board.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: