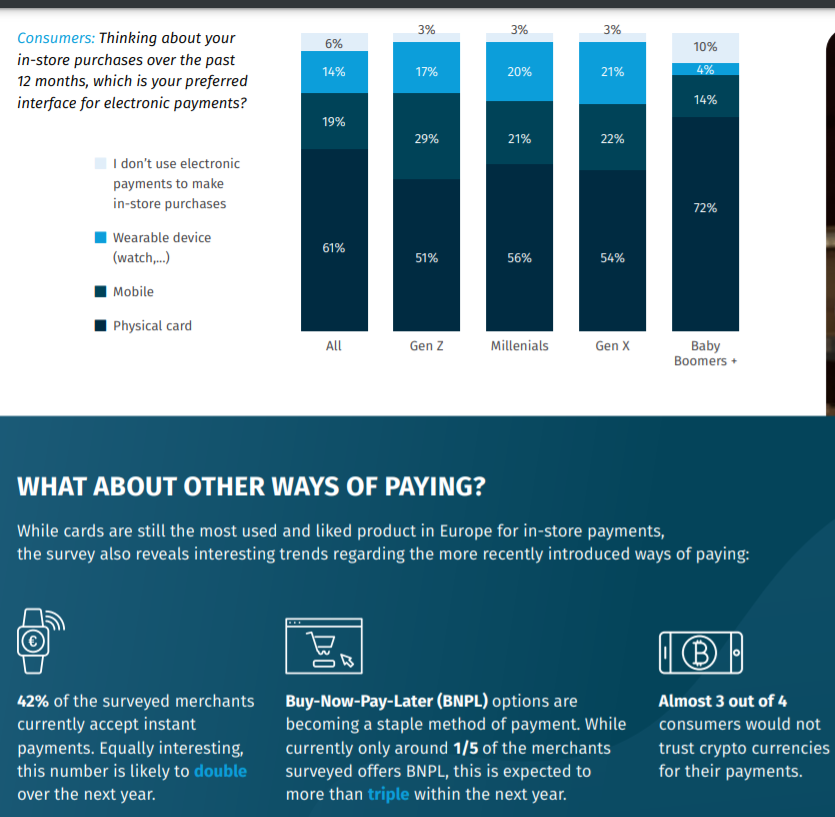

Buy-Now-Pay-Later (BNPL) options are becoming a staple method of payment. While currently only around 1/5 of the merchants surveyed offers BNPL, this is expected to more than triple within the next year, according to a Payments Europe research.

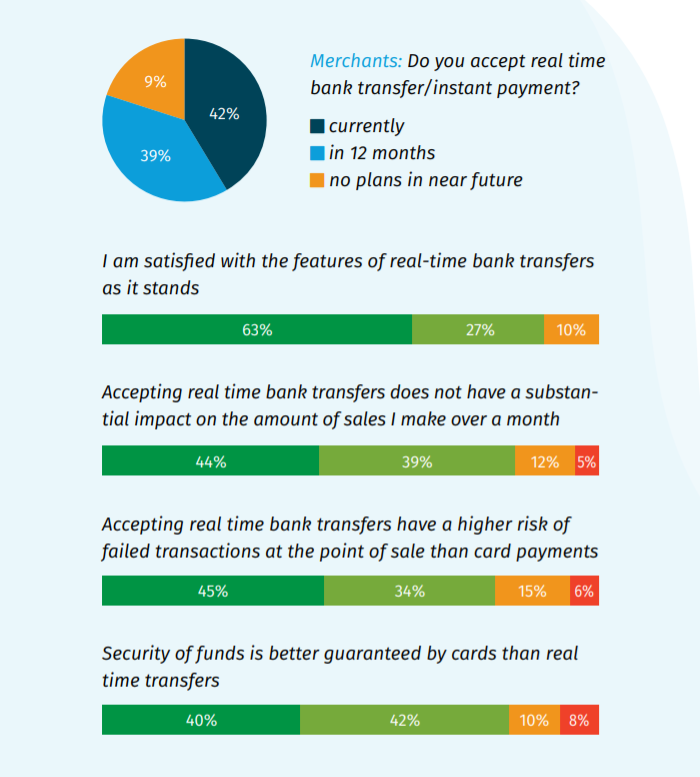

. 42% of the surveyed merchants currently accept instant payments. Equally interesting, this number is likely to double over the next year.

. Almost 3 out of 4 consumers would not trust crypto currencies for their payments.

In the report THE EVOLUTION OF THE EUROPEAN PAYMENTS MARKET: FROM CASH TO DIGITAL, WHAT DO EUROPEANS WANT, Payments Europe provides insights into the latest payment trends, particularly looking at the opinions of consumers and merchants regarding their preferred payment methods as well as the benefits provided by the existing solutions.

Based on surveys with consumers and merchants in Europe’s largest markets, the report also provides insight into where the market is heading and looks at the interplay between traditional forms of payments, such as cash and cards, with more recent payment options, such as instant payments.

1. Cash transactions are declining fast

In a recent study, the ECB concluded that cash is still the most widely used payment instrument. In 2019, almost 3 out of 4 payments made by consumers in-store were cash.

In 2021, Payments Europe survey concludes that around 80% of in-store transactions are electronic, and only 20% are cash. This number leans even slightly more in favour of electronic payments among the younger generation.

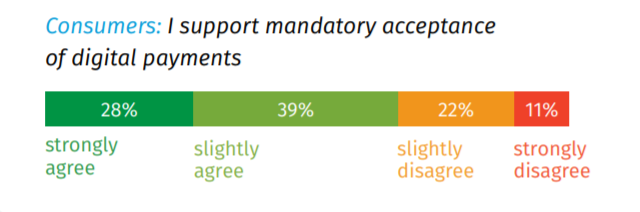

It also appears that consumers would like to see initiatives that would allow them to always pay electronically. When asked about government-supported payments initiatives, 67% of consumers said they would support mandatory acceptance of digital payments.

Some Government Finance Ministries are also looking at mandating digital payment acceptance, while also preserving the right to pay with cash, to reduce tax fraud.

COVID-19: THE RISE OF CONTACTLESS

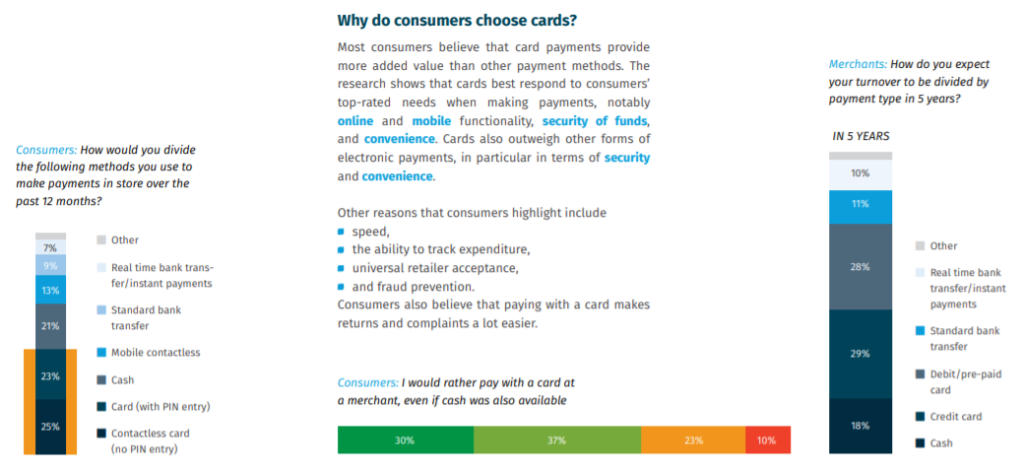

Contactless card payments have been the most widely used method in stores in the past 12 months – 25% of all transactions. Hygiene was identified as a determining factor in choosing contactless by 48% of surveyed consumers.

2 in 3 consumers agree that they now use contactless more often than before the pandemic, and a similar proportion agree that they now prefer to pay contactless.

The research also shows that a majority of European consumers feel comfortable paying contactless for amounts higher than 150 euro per transaction, above the 50 euro per transaction limit set by PSD2. On average, and whilst the exact per-transaction amount varies across countries, consumers indicate that they feel safe and comfortable paying contactless up to 187€.

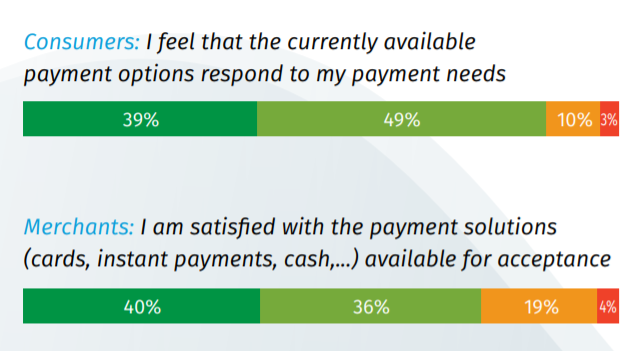

2. Consumers and merchants are happy with the available payment options

The European payment market is becoming increasingly diverse and there are more payment options available than ever. The research shows that 88% of consumers are satisfied with the payment options available and feel that these respond to their needs. 76% of merchants share this sentiment.

3. Physical cards continue to be the preferred method of payment, with mobile cards, mobile instant and BNPL on the rise

In the past year, card payments have accounted for almost half of in-store payments for consumers and more than half of merchants’ turnover. Merchants also expect that turnover brought by cards will be rising in the next five years, while cash usage is expected to decline.

Why do merchants choose cards?

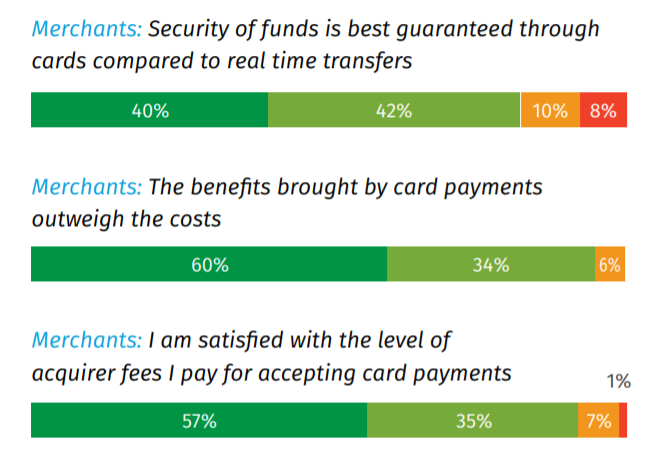

Like consumers, merchants also like cards the most. Security and costs of acceptance rank the highest when it comes to why merchants prefer to use card payments.

Over 4 in 5 European merchants agree that security of funds is best guaranteed through cards, compared to instant payments. Half of all merchants believe cards are best suited for preventing fraud.

Regarding the costs of cards, more than 9 in 10 European merchants believe that the benefits brought by card payments outweigh the costs and are satisfied with the level of acquirer fees they pay for accepting card payments.

Additional reasons that merchants highlight include access to value-adding data and insights, innovation and consumer experience, low risk of failed transactions at the point of sale, as well as ability to accept payments from foreign consumers.

PHYSICAL IS STILL THE MOST POPULAR – BUT MOBILE IS GAINING GROUND

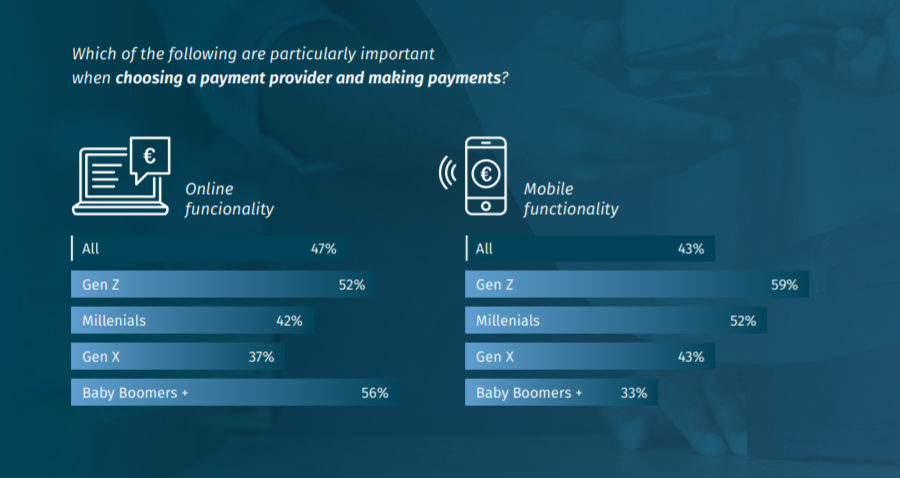

Physical cards are the preferred interface of all electronic payments. However, what appears to be a matter of age is the importance of mobile functionalities: the younger generations are much more drawn to mobile functionality as opposed to online, and this trend is likely to accelerate as they increasingly enter the consumer demographic over time.

Who should decide: consumers or merchants?

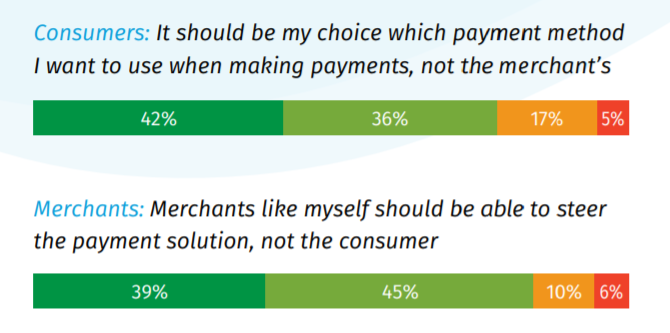

4 out of 5 European consumers believe that the choice as to which payment method to use when making a payment should sit with them, and not be guided by the merchant. Vice-versa, a similar majority of merchants (84%) believe that they should be able to guide the choice on which payment solution is used.

4. Instant payments are becoming increasingly widespread

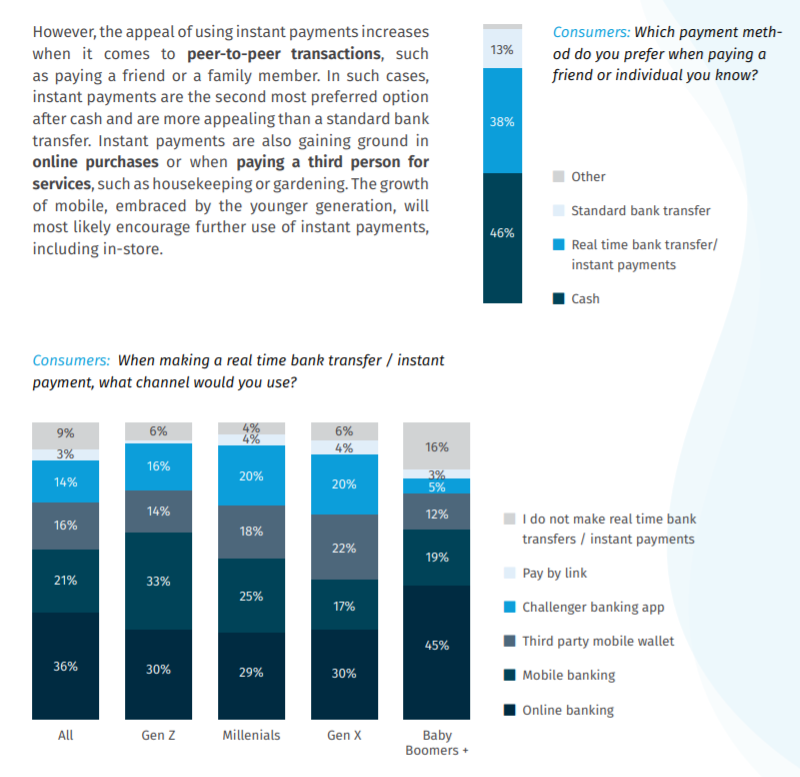

European consumers feel that instant payments are widely available, particularly for online purchases (60% of consumers). Almost half of consumers perceive them available also for person-to-person as well as in-store payments (43%). Only around 7% of European consumers, with the number being higher among the older generations, perceive that instant payments are not widely available.

Despite the high awareness and availability of instant payments, European consumers still need to get used to using them: only 7% of in-store transactions in the past 12 months were completed through instant payment. This is likely because of the perception of heightened risk when making an instant payment compared to other payment methods. Indeed, 89% of consumers in Europe believe there are risks linked to using real-time bank transfers / instant payments, with even more awareness of the risks among younger consumers.

Merchants will increasingly accept instant payments

9 out of 10 merchants confirm that they are satisfied with the current features of real-time bank transfers. While 2 in 5 merchants currently accept instant payments, this number is expected to almost double in the next 12 months considering the organic growth of instant payment acceptance. This will further increase competition amongst existing payment methods.

At the same time, merchants are unsure that increased acceptance on their side will have a substantial positive impact on their sales. 4 out of 5 of merchants believe that real-time bank transfers have a higher risk of failed transactions at the point of sale than card payments, despite the lower cost and value they can bring, and that security of funds is better guaranteed through cards compared to real-time transfers. There is a recognition that lower cost comes at the expense of the security and reliability offered by cards.

Thus, while we see an increase in the take-up of instant payments on the merchant side, there is still a preference for cards as the payment method that best responds to merchants’ needs.

Methodology of the research

This report is based on a study commissioned by Payments Europe and conducted by FTI Consulting from 9th to 21st July 2021. The survey was completed by 3,223 consumers living in France (544), Germany (539), Italy (530), Spain (540), Sweden (538) and Poland (532) and by 680 merchants working in retail both online and offline (France (109), Germany (110), Italy (110), Spain (110), Sweden (106) and Poland (103).

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: