The Financial Services Union have launched the findings of a substantial research project into the possible effects of Artificial Intelligence (AI) in the Financial Services Sector. The research was undertaken in partnership with TASC, the think tank for social change in Ireland. The report examined both the opportunities and challenges posed by AI and provides an in-depth analysis of its impact on workers, businesses, and the future of financial services in Ireland.

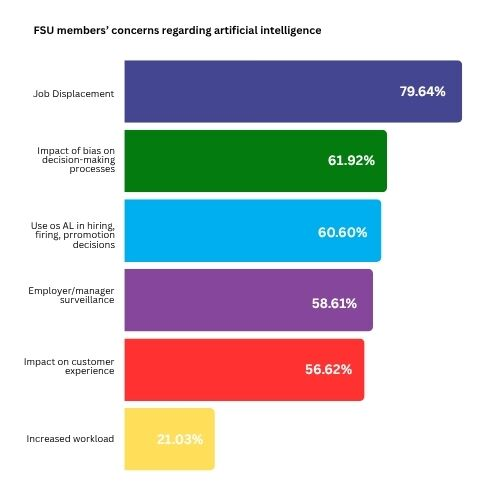

The findings reveal widespread concern:

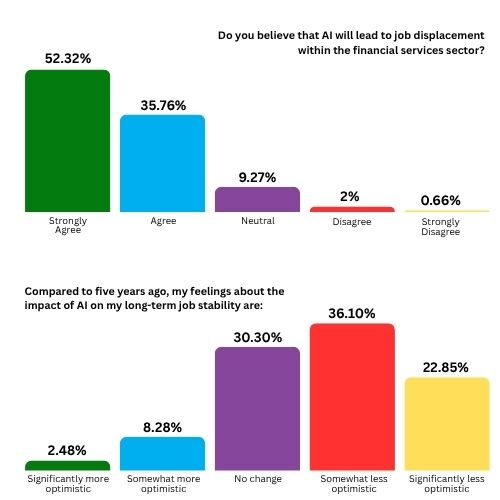

88% of respondents believe AI will lead to job displacement and 60% report feeling less secure in their roles than they did five years ago. While many workers acknowledge AI’s potential benefits, including increased efficiency and improved decision-making, these advantages are overshadowed by fears of job loss, wage stagnation, and intensified managerial oversight.

Over 61% of respondents expressed unease about AI being used in hiring, firing, and promotion decisions. Furthermore, 58% of workers are concerned about increased managerial oversight and surveillance through AI systems, fearing a loss of privacy and greater performance monitoring.

Despite these concerns, some workers recognised AI’s positive impacts. Around 45% of respondents feel AI may lead to less time spent on administrative tasks and 30% feel it may improve data analytics.

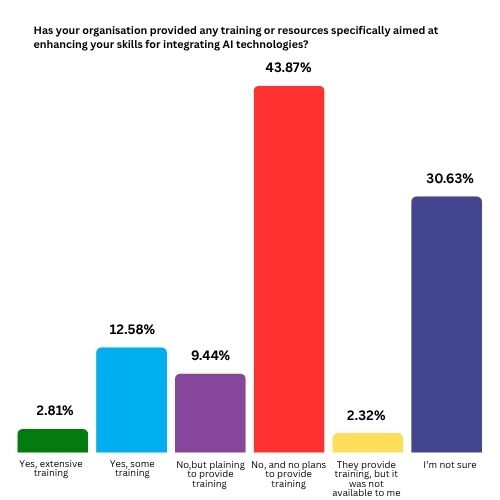

When asked has you organisation provided any training or resources specifically aimed at enhancing your skills for integrating AI technologies, 43% responded they had not received any training and there were no plans to provided training. It is incumbent on employers to provide inclusive training to employees and to make it easily accessible and relevant to their position. A one fits all training module is not sufficient.

Commenting on the research findings John O’Connell, General Secretary of the FSU said:

“The research is indicative of the concerns the FSU are hearing on a weekly basis from workers across the sector. The use of artificial intelligence is expanding at an alarming rate across the financial services sector, and it is incumbent on all key stakeholders to ensure AI is used for the benefit of workers and consumers.

It is evident that workers feel unprepared and have justified concerns about the role that AI could possibly play in the future. Ensuring a fair transition requires a shared commitment from all stakeholders— employers, workers, policymakers, and trade unions.

The FSU have successfully concluded an AI agreement with Bank of Ireland (BOI) which commits the bank to collectively bargain any changes that may occur due to the expansion of AI. A collaborative approach such as that reached with BOI will not only help mitigate job displacement risks but also create opportunities for innovation, career growth, and economic stability.

This research confirms that AI is not just a technological development: it is a major social and economic shift. Successful AI integration must centre around more than profits and productivity by accounting for the wider disruptions it causes, including to workers’ rights, job security, and the environment.”

Commenting Molly Newell, researcher at TASC said: “As a leader in the European financial services sector, Ireland has a responsibility to be at the forefront of a fair and responsible AI transition – one that safeguards rights, promotes inclusion, and shares the benefits of innovation.

A just transition means placing workers at the heart of decision-making. That includes ensuring collective bargaining, preventing bias and intrusive surveillance by employers, and providing meaningful upskilling opportunities.

Without clear commitments to equity, inclusion, and transparency, the widespread adoption of AI in financial services risks deepening existing inequalities. We must ensure this technology serves the common good – strengthening, rather than undermining, social and economic cohesion.”

Report: https://www.fsunion.org/latest/accounting-forworkersin-the-age-of-ai/

___________

Methodology

This report draws upon a literature review and survey data to provide an overview of AI adoption and workforce impact in Ireland’s financial services sector. The methodology includes both qualitative and quantitative data sources, with a focus on triangulating insights from academic literature, industry reports, and government policy.

To understand attitudes of workers in Ireland’s financial services sector, the Financial Services Union surveyed staff working in financial services – over the course of 113 days in the Summer and Autumn of 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: