Mirela Ciobanu, Lead Editor at The Paypers, delves into key themes from Banking 4.0, including AI’s transformative role in finance, the risks of data manipulation in digital identities, and the growing impact of Web3, stablecoins, and CBDCs.

2024: the year of AI and its impact on our lives

AI has dominated discussions this year, sparking both excitement and fear about its impact. From automating routines and writing emails to planning holidays and managing finances, tools like ChatGPT and LLMs have become our digital copilots. This raises a critical question: Will we use the time saved for personal growth, or will we let these tools make us lazier? And how will financial services evolve?

At this year’s 10th edition of Banking 4.0 in Sinaia, Romania—set against the iconic backdrop of Dracula’s castle—AI took centre stage, overshadowing even the legendary dark forces. Bright minds from the CEE region gathered to explore how AI will shape the future of finance. Chatbots offering financial advice, AI-driven risk management, and task automation promise great benefits but also pose challenges such as bias, explainability, and black-box issues.

While technology is reshaping business, human connection remains vital. For example, while banking apps boost efficiency, they leave customer experiences impersonal. According to Accenture’s Life Trends 2024, 42% of consumers struggle to distinguish between financial brands. To thrive, banks must move beyond servicing and engage customers in meaningful conversations about their financial aspirations.

The event also covered key trends and regulations in payments: PSD3, PSR, the EU AI Act, the EUDI Wallet, and the rise of Web3 payments, stablecoins, and CBDCs. With every presentation, I became more immersed in the innovations shaping finance.

Over the next lines, I’ll share insights on three standout topics: AI in finance, digital identity, and Web3 payments.

From chatbots to actionable AI: the next evolution in digital banking

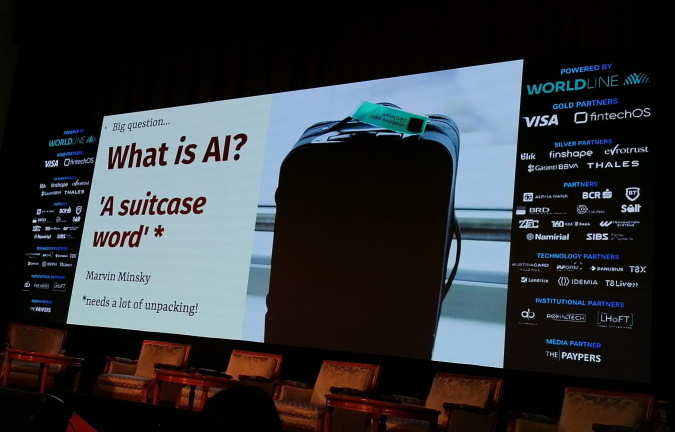

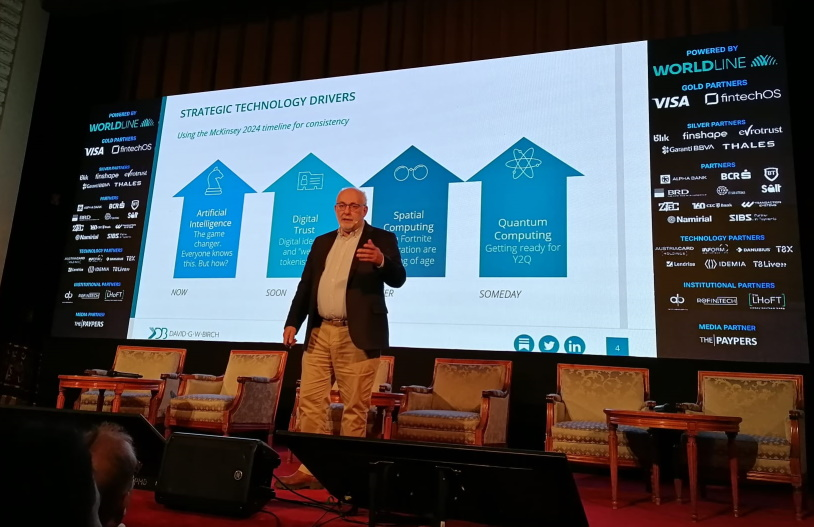

The day began with a keynote by David Birch, exploring the future beyond Open Banking, Embedded Finance, and BaaS. He identified four key drivers shaping the industry:

AI as a game changer: From simple chatbots to intelligent agents, AI is progressing rapidly. The focus is on systems with agency—those acting autonomously in complex environments. AI’s benefits include streamlined workflows, enhanced customer service, and automation, but risks like bias and lack of explainability remain.

Digital trust and the token economy: Robots will need ‘passports’ (digital identities) in the emerging token economy, which integrates CBDCs and tokenized reserves. This shift will reshape trust and security in financial systems.

Spatial computing: Tools like smart glasses will power interoperable metaverses, enabling digital identities and assets to move seamlessly across virtual worlds.

Quantum computing: The financial sector must prepare for ‘Y2Q’, a future where quantum computing disrupts current encryption.

AI’s integration into financial services is already transformative—revolutionising risk management, call centres, and customer engagement.

Yet, as AI replaces human roles, the focus shifts to intelligent systems, not physical robots. Why have robo-branches if customers avoid branches altogether? Instead, the future lies in digital banking for bots, where decisions hinge on APIs, uptime, and premium data—not ads or branding.

Protecting privacy: addressing data risks in EU digital identity wallets

Henk Marsman, Principal Consultant at Sonicbee, discussed the societal impact of digital identification and the risks of manipulating users into sharing more data than necessary through the EU Digital Identity Wallet. He highlighted that identity and access management is a cross-industry theme, encompassing sectors like manufacturing, banking, transportation, and government, with a key focus on the human element: individuals using services to improve their lives.

Digital identity wallets (like apps used for payments, travel, or event tickets) enable convenient data sharing. The EU’s efforts to unify this concept under the revised eIDAS regulation aim to create a standardised framework allowing individuals to use a single digital ID across member states. This wallet would store not only official documents like passports but also personal data, such as loyalty cards or concert tickets. While promising, this shift raises concerns about data sharing and manipulation.

Manipulation risks emerge from subtle tactics designed to encourage oversharing. For example, users might share sensitive data under pressure, such as limited-time discounts, or in exchange for convenience. Additionally, linking wallets to legal identities could reduce anonymity, a double-edged sword—helping combat cyberbullying but eroding privacy rights.

To address these risks, we need proportional protections that balance usability and safety. Just as helmets protect cyclists without requiring bulletproof vests, safeguards for digital wallets must be designed to prevent oversharing without creating excessive barriers. This development, he concluded, is ongoing across the EU, requiring thoughtful collaboration between governments, organisations, and technology providers to ensure digital identity wallets enhance trust without compromising individual rights.

Blockchain, Web3, tokenisation, and CBDCs: transforming payments and banking

In a panel discussion on the future of payments and banking, experts explored how technologies like Web3, blockchain, tokenised assets, and central bank digital currencies (CBDCs) are reshaping the landscape.

Felix Crisan, CEO of Netopia, argued that Web3 emerged as a market response to the financial system’s inertia over the past 50 years, failing to adapt to digitalisation. He viewed Web3 as an attempt to address longstanding gaps in the system. Meanwhile, Eliad Saporta, CEO of Coriunder, highlighted the potential of Web3 for cross-border payments, particularly in regions like Mexico and Africa, where traditional infrastructure has struggled. He cited examples of providers now supporting European merchants and facilitating financial inclusion, thanks to stablecoins and other decentralised technologies.

David Birch, however, offered a different perspective, stating that Web3 is fundamentally about tokenisation and decentralized finance (DeFi) rather than financial inclusion or cross-border payments. He emphasised that Web3 enables the exchange of tokens through so-called ‘smart contracts’ and might incidentally contribute to financial inclusion but isn’t inherently focused on it.

On the topic of blockchain, Samid Amnon, CEO of BitMint, praised its benefits in providing freedom, privacy, and reduced reliance on centralised authorities. However, its current inefficiencies, particularly in energy consumption and transaction speed, remain a challenge. One potential solution involves more centralised processes for validation and transactions, which could improve transparency and efficiency. For instance, users could manage and split tokenised assets directly on their mobile phones—whether representing currency or real estate—without relying on networks, servers, or intermediaries. This approach promises faster, more secure, and less energy-intensive systems, paving the way for a more practical and sustainable use of blockchain technology.

Nikola Skoric, CEO of Electrocoin, expanded on the benefits of tokenising financial and physical assets, like property titles or bonds, enabling fractional ownership and round-the-clock trading. He noted that this innovation opens opportunities for a wider class of investors, granting access to previously exclusive markets. The panellists provided examples such as HSBC’s tokenisation of gold, where digital claims on gold make trading more flexible while maintaining trust in the underlying asset. David Birch argued that tokenisation could even drive-up demand for physical assets, as seen with gold, due to its enhanced liquidity and accessibility.

Turning to CBDCs, the panel discussed their potential alongside stablecoins. Some key points stressed out include:

Stablecoin demand: Stablecoins, particularly those pegged to the US dollar, are in high demand globally. Countries like Turkey exhibit significant premiums on US dollar stablecoins compared to traditional dollar assets, showcasing their utility in unstable economies.

Missed opportunity: There’s confusion about why the US hasn’t issued a federal reserve digital dollar, as doing so would essentially provide an interest-free loan to the government, representing a massive financial opportunity.

Different goals: CBDCs and stablecoins serve distinct purposes. While stablecoins address market needs like cross-border transactions and value stability, CBDCs aim to fulfil state-led goals such as financial inclusion and improved remittance systems.

Critique of CBDC experiments: Many ongoing CBDC experiments are criticised as unproductive because they don’t align with the practical application of stablecoins. Specifically, the idea of a CBDC functioning like a stablecoin on a blockchain ledger is deemed impractical and unlikely.

In conclusion, the 10th edition of Banking 4.0 in Sinaia, Romania highlighted the growing influence of technology in finance—whether through AI, blockchain, or other digital solutions like digital identity—showcasing both its immense potential and its challenges. Regarding Web3 developments, while stablecoins are effectively addressing market demands, the development of CBDCs seems disconnected from these real-world needs, raising questions about their design and implementation.

A big thank you to Banking 4.0 for inviting us to participate in such an insightful event, offering valuable perspectives on the future of finance.

_____________

About Mirela Ciobanu

Mirela Ciobanu is Lead Editor at The Paypers, specialising in the Banking and Fintech domain. With a keen eye for industry trends, she is constantly on the lookout for the latest developments in digital assets, regtech, payment innovation, and fraud prevention. Mirela is particularly passionate about crypto, blockchain, DeFi, and fincrime investigations, and is a strong advocate for online data privacy and protection. As a skilled writer, Mirela strives to deliver accurate and informative insights to her readers, always in pursuit of the most compelling version of the truth. Connect with Mirela on LinkedIn or reach out via email at mirelac@thepaypers.com.

Mirela Ciobanu is Lead Editor at The Paypers, specialising in the Banking and Fintech domain. With a keen eye for industry trends, she is constantly on the lookout for the latest developments in digital assets, regtech, payment innovation, and fraud prevention. Mirela is particularly passionate about crypto, blockchain, DeFi, and fincrime investigations, and is a strong advocate for online data privacy and protection. As a skilled writer, Mirela strives to deliver accurate and informative insights to her readers, always in pursuit of the most compelling version of the truth. Connect with Mirela on LinkedIn or reach out via email at mirelac@thepaypers.com.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: