New York’s Department of Financial Services said it was beginning an inquiry into Goldman Sachs’ credit card practices, according to Reuters.

Apple Inc co-founder Steve Wozniak joined in the online debate over accusations of gender discrimination by the algorithm behind the iPhone maker’s credit card, fuelling scrutiny of the newly launched Apple Card.

The criticism started on Thursday, after entrepreneur David Heinemeier Hansson railed against the Apple Card in a series of Twitter posts, saying it gave him 20 times the credit limit his wife received.

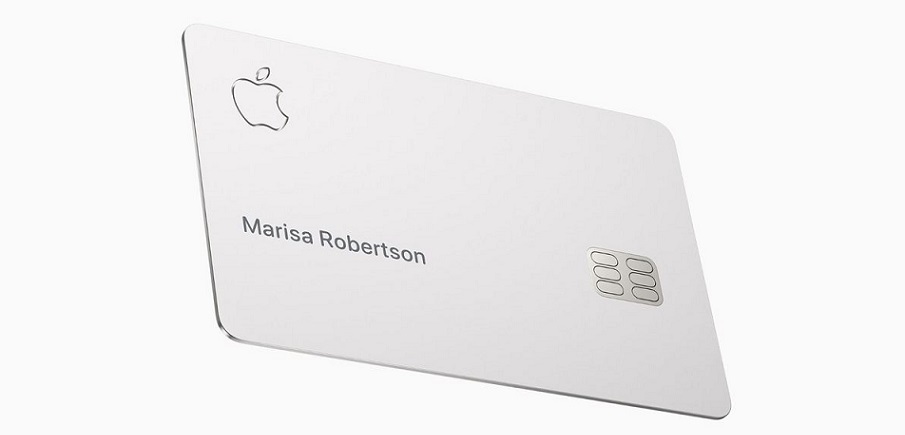

The much anticipated titanium credit card, part of a broader effort by Apple to derive greater revenue from services after years of heavy reliance on iPhone sales, was launched in August, in partnership with Goldman Sachs Group Inc.

In an email, Goldman said Apple Card applicants were evaluated independently, according to income and creditworthiness, taking into account factors such as personal credit scores and personal debt.

It was possible for two family members to receive significantly different credit decisions, the bank said, but added, “We have not, and will not, make decisions based on factors like gender.”

Hansson, who is the creator of web-application framework Ruby on Rails, did not disclose any specific income-related information for himself or his wife but tweeted that they filed joint tax returns and that his wife had a better credit score.

On Saturday, Wozniak chimed in with a similar experience, saying he got 10 times more credit on the card, compared with his wife.

“We have no separate bank or credit card accounts or any separate assets,” Wozniak said on Twitter, in reply to Hansson’s original tweet.

“Hard to get to a human for a correction though. It’s big tech in 2019.”

„New York law prohibits discrimination against protected classes of individuals,” Linda Lacewell, the superintendent of the New York State Department of Financial Services, wrote in a blog post. (bit.ly/2Ny1TUA)

That barred an algorithm, like any other method of determining creditworthiness, from disparate treatment based on individual characteristics such as age, creed, race, color, sex, sexual orientation, national origin, among others, she added.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: