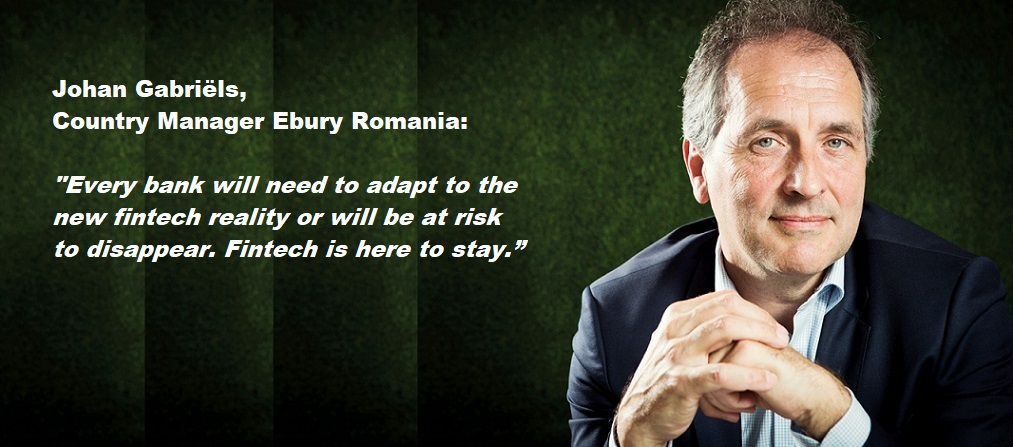

Johan Gabriëls, Country Manager Ebury Romania, in an interview with Business Review about the future of Fintech companies in Romania.

Ebury estimates that from the 12.300 companies in Romania having a turnover above 1M€ and having a substantial amount of international payments, about 13% are already working with a Fintech company while another 30% are considering adding a real competitor to their current banking relationships over the next year.

“Romania has exceeded all our expectations with respect to number of clients ready to explore alternatives to traditional banking services. We have passed the level of early adopters and are now moving to the early majority”, said Johan Gabriëls, Country Manager Romania.

Having relevant experience in banking as well as in leading fintech companies in Romania, Johan Gabriëls has acquired an excellent understanding about both the traditional financial sector as well as its challengers.

“I used to work for Capital One, today one of the top retail banks in the US, but early 2000 one of over 50 monoline credit card companies, said Johan. ‘I believe the future of fintech companies will be very much the same as what happened to these ‘monoline’ credit card companies. Some will be very successful and become a mainstream brand, some fintechs will be bought by traditional banks while others will disappear’.

“What is clear however is that every bank will need to adapt to the new fintech reality or will be at risk to disappear. Fintech is here to stay.”, said Johan.

Ebury, as a fintech company, provides FX liquidity, volatility risk management and international payments. The company, who opened a branch in Bucharest one year ago, is focused only on SME’s and large local corporates, not retail.

Ebury Romania ended its first year of activity on the local market with a client portfolio in excess of 250 companies, currently adding 50 new corporate and SME clients every month.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: