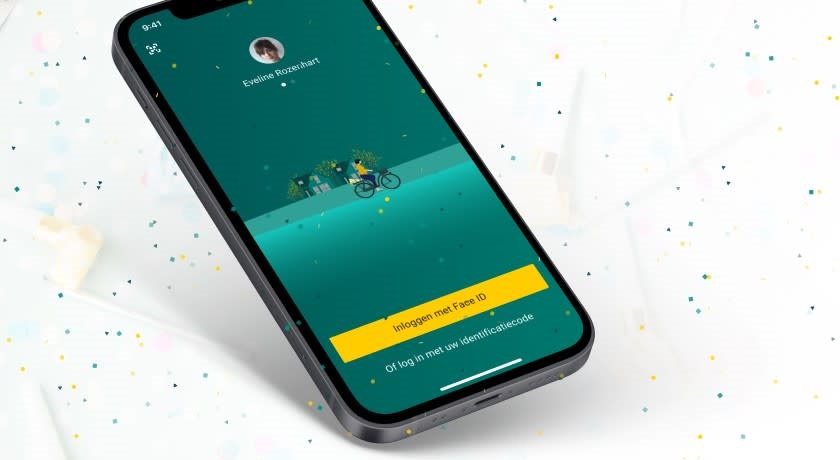

ABN AMRO app breaks record with 1,000,000,000 logins in one year. More than four out of five clients used the app in 2020.

In 2020, the ABN AMRO app broke the magic boundary of 1 billion login moments in one calendar year for the first time. More than four out of five clients used the ABN AMRO app in 2020, with around half rating it 9 out of 10 or higher. On average, a customer logged in 390 times this year.

“To get right down to it: we expect this number to rise further in the future and to stay above 1 billion annually,” says Hans Pothuizen, Lead Product Owner of the ABN AMRO app. “The number of logins has been on the rise in recent years. At the same time, a growing number of clients are using the app for the first time. The new functions we’ll be adding in the coming period should help drive this number up.”

The number of iDEAL payments made through the app also broke records this year: 51% more payments were made in January and February of 2020 than in the same period the previous year. Online purchases really took flight during Covid-19, with a more than 60% increase in iDEAL payments made through the app in these months.

Even clients who previously conducted their banking affairs in the traditional way contributed to the record numbers. Senior citizens, for instance, are increasingly turning to the app. Hans: “Use of the app among people aged 65 years and older has grown in the past five years.” These clients often start off by using the app on their tablet, a nice big screen that is usually only used at home.

The app is increasingly becoming a 24/7 digital office – a good reason for us to rename it the ABN AMRO app earlier this year. Hans: “Now clients can easily open an account themselves, right in the app. The Help function has been improved too, allowing clients to chat with our employees and our chatbot, Anna. Plus the transaction overview is much easier to read. And clients can now log in to Internet Banking without an e.dentifier.”

How will the app change in 2021?

There are a number of great new functions coming up, keeping the ABN AMRO app at the head of the pack. Hans: “It will soon be possible to open a joint account in the app. And we’re going to make transfers easier to carry out and the app more accessible. We’re doing this to ensure that disabled clients, for instance the blind, can easily use the app.„

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: