Since August 2024, “Bank Transfer by Worldline” is available for merchants in 10 countries across Europe including: Austria, Belgium, Croatia, France, Germany, Italy, Luxembourg, the Netherlands, Slovenia and Spain. By the end of 2024, it will also be available in 4 more countries comprising of Poland, Slovakia, Czech Republic and Hungary.

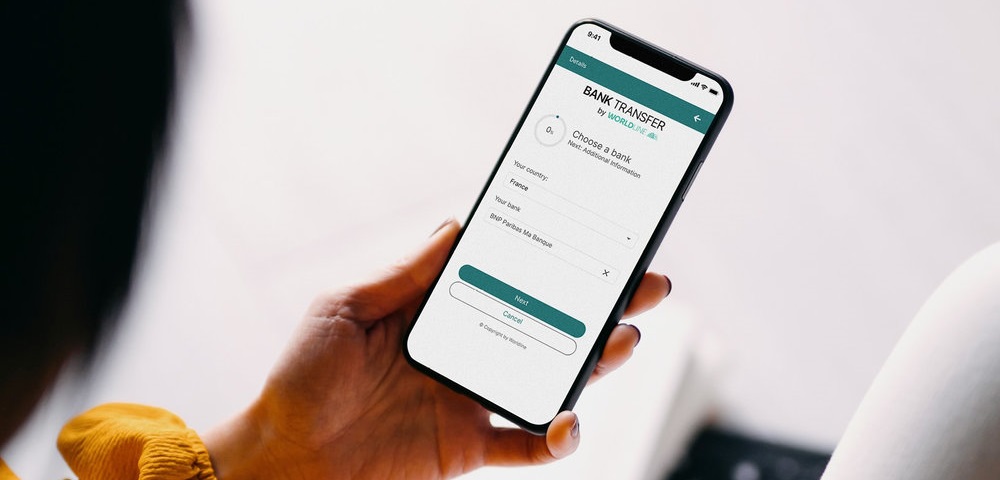

Worldline, a global leader in payment services, announces the launch of its account-to-account payment method named “Bank Transfer by Worldline”. The solution enables retailers to accept payments and completes the existing payment options offered to merchants.

„It also effectively addresses specific payment scenarios that traditional methods typically cannot accommodate, including invoices and high-value transactions. It delivers a seamless and secure payment experience for both customers and businesses throughout Europe.” – according to the press release.

The solution empowers these merchants to accept payments from a pool of approximately 300 million eligible customers*. „It has been piloted in these countries during the last 9 months and is now seamlessly integrated into around 500 of Worldline’s existing merchants’ online payment solutions and pay-by-link services. The offering will be further expanded to include all eligible merchants across the EU.” – the company explained.

It marks a significant advancement in account-to-account payment solutions, offering businesses a fully integrated payment experience with the Worldline brand at the forefront to build trust towards payers. Managed within Worldline’s robust merchant services ecosystem, this comprehensive solution features low-code integration, rapid settlement notifications, hassle-free refunds, and consolidated payout, reporting, and reconciliation, comparable to other payment methods.

This innovative solution particularly caters to businesses that handle high-value transactions, such as those in specialty retail, the public sector and B2B payments. By addressing common challenges like card limits and heightened fraud risk, “Bank Transfer by Worldline” minimizes the likelihood of declined transactions and reduces costs for merchants. Additionally, it offers cross-border capabilities that are essential for merchants operating in multiple markets.

Paul Marriott-Clarke, Head of Merchant Services at Worldline, stated: “With “Bank Transfer by Worldline”, we have developed a payment method grounded in trust and simplicity, leveraging existing European payment networks and offering innovative customer experience. This launch reinforces our commitment to making payment solutions accessible for all.”

Alessandro Baroni, Head of Financial Services at Worldline, commented: “By integrating Worldline’s open banking solution, which connects to over 3,500 banks across European countries, “Bank Transfer by Worldline” offers merchants a solution that simplifies payment initiation via bank transfer and unifies the customer experience.”

Andreas Jürgensen, Sales Operations Director at Camping Vision said: “We’re committed to enhancing our customers’ booking experience. Our pilot with “Bank Transfer by Worldline” has allowed us to implement an online payment solution that streamlines both our online and invoice payments. From other similar payment methods, we know our customers feel safe paying with their bank account. We believe enhanced security will increase bookings and improve conversion rates, supporting our goal of offering a customer-friendly payment method and benefiting our overall contribution to the campsite business.”

For more information on “Bank Transfer by Worldline”, please visit: business.worldline.com/account-to-account-payments

____________

* Number of customers with a European Bank account based in the 14 afore mentioned countries – Source: The Global Findex Database

Worldline helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. The company generated a 4.6 billion euros revenue in 2023

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: