A survey of 34 central banks around the world showed 15% are now less inclined to issue a CBDC, up from 0% in 2022

Though the majority of central banks still intend to go ahead with their plans, almost a third have been forced to delay their issuance timelines and the proportion of central banks that say they are less inclined to issue than last year has risen to 15% from zero in 2022.

A new report by OMFIF’s Digital Monetary Institute, produced in partnership with Giesecke+Devrient, reveals how central banks’ opinions on issuing a retail CBDC are evolving. While many central banks believe they will soon be ready to issue, some are perhaps not sufficiently concerned about the pace of change in the payments ecosystem. Despite the long wait for CBDC issuance, OMFIF’s survey provides reason for optimism. Many of the technical challenges involved in issuing a CBDC have been overcome in the past year.

The report examines the current state of CBDC development and highlights the remaining challenges facing central banks. ‘CBDCs: It’s time for action’ also sheds light on the potential benefits that swift deployment of a CBDC can offer. While some of these have been built into central banks’ strategies, others are less frequently touted but may prove important.

Key findings:

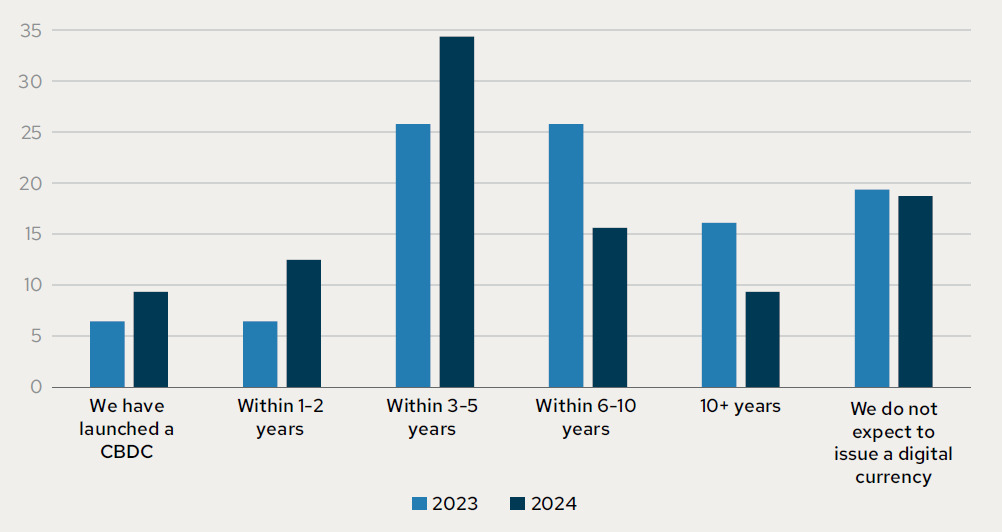

. Three-quarters of central bank survey respondents expect to issue a CBDC. Where 34% expect to issue one in 3-5 years, 91% have done or will conduct feasibility studies.

. One-third of central banks have delayed their issuance timelines. This is for a variety of reasons, including economic situations and political will.

. Financial inclusion and preserving central bank monetary sovereignty are the leading motivations for emerging market central banks (44%) and developed market central banks (50%), respectively.

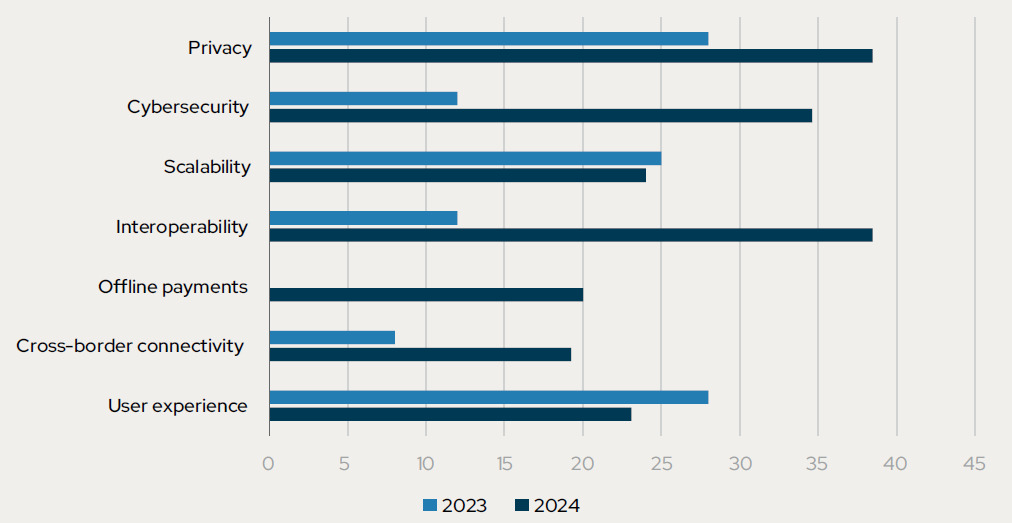

. Central banks have made remarkable progress in addressing the major technical requirements of issuing a CBDC. The biggest jumps have been in interoperability, cybersecurity and offline payments.

. Previously ranked as the most challenging feature to deliver, 20% of surveyed central banks report improved satisfaction with progress in offline payments, up from 0% in 2023.

. Central banks’ focus is turning to optimising user experience. The share of respondents that identified it as the most challenging area more than doubled to 27%.

OMFIF survey of 34 central banks indicates that CBDC issuance is getting closer, albeit gradually (Figure 1). The road to issuance is far from smooth, however. Though the majority of central banks still intend to go ahead with their plans, almost a third have been forced to delay their issuance timelines and the proportion of central banks that say they are less inclined to issue than last year has risen to 15% from zero in 2022.

Figure 1. Most central banks expect to issue a CBDC

When do you expect to issue a central bank digital currency? Share of respondents, %

Perhaps the most striking element of good news from the survey is that technical challenges are no longer a serious obstacle for the vast majority of central banks. In previous years, OMFIF’s survey revealed that central banks were wrestling with delivering technical features like offline payments, privacy and interoperability with existing payments systems.

This year’s survey indicates that central banks are vastly more satisfied with their progress on almost every key technical issue than they were last year (Figure 2). Although offline payments was still selected as the most challenging feature to deliver, the proportion was smaller than last year and satisfaction with progress had climbed substantially, reflecting a number of successful pilots in offline payments.

The exception to the general improvement is on user experience, where a much higher proportion than in previous years rated this as the most challenging feature of a CBDC to design. However, OMFIF believes that this reflects technical progress on the more existential challenges of delivering a CBDC. Without improving satisfaction on major technical topics like privacy and interoperability, it is unlikely that central banks would have advanced to the stage of focusing on designing user experience.

Figure 2. Satisfaction with progress climbs in key areas

In which areas of CBDC design are you most satisfied with the progress made? Share of respondents, %

This year, the report delves deeper into the rationale underpinning the issuance of CBDCs. It finds that motivations for issuance are split between emerging and developed markets: 44% of emerging market respondents chose promoting financial inclusion as their primary motivation, while 50% of developed markets chose preserving central bank monetary sovereignty. Offline payments are a particularly important consideration for financial inclusion since they help to make a CBDC accessible in remote areas without or with only intermittent access to internet connectivity.

Finally, the report examines the ways in which the payments system is already undergoing dramatic changes from innovation in the private sector. While this innovation is welcome, for the digital payments world to operate entirely on private forms of money, including new forms from beyond the banking sector, it would compromise the important role of central bank money as monetary anchor.

By developing a CBDC, central banks can maintain their mandate as issuers of sovereign money and provide a secure digital infrastructure on which service providers can innovate and offer new financial products and services.

‘It’s time to make the decisive step to create a public digital payment ecosystem with CBDC,’ said Wolfram Seidemann – chief executive officer of G+D Currency Technology. ‘CBDCs hold significant potential for advancing the digital economy. By offering a public infrastructure, central banks can pave the way for innovative financial products and services, while reducing fragmentation in the financial system.’

___________

OMFIF is an independent think tank for central banking, economic policy and public investment, providing a neutral platform for public and private sector engagement worldwide. With teams in London and the US, OMFIF focuses on global policy and investment themes relating to central banks, sovereign funds, pension funds, regulators and treasuries. Global public investors with investable assets of $43tn are at the heart of this network.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: