A new premiere, only at Banking 4.0: the first report on „Credit score” of the digital maturity in the Romanian banking system

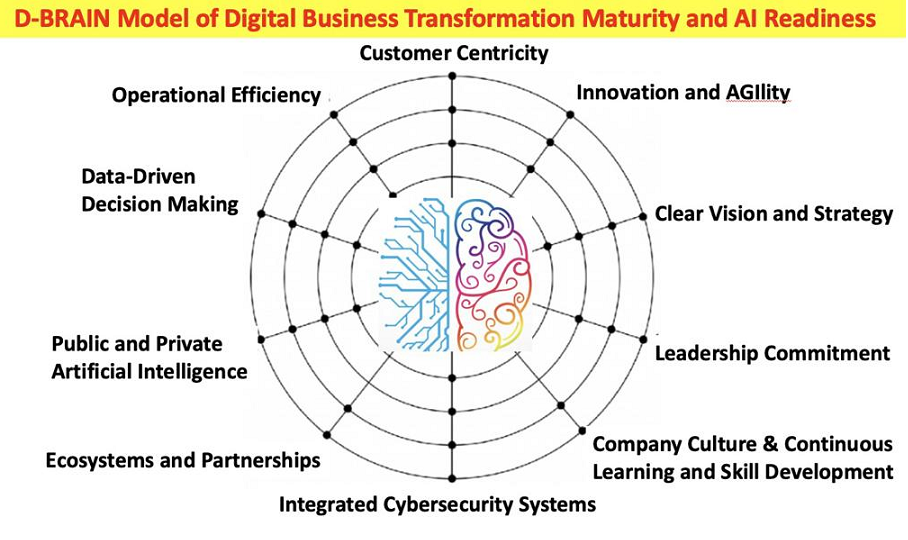

Developed by Startech Alliance, D-BRAIN is a new model of Digital Business Transformation which is integrating a practical scoring system on a 10 dimensions circumplex, evaluating a company digital maturity in the AI Age and offering real-life, practical solutions of improvements on all levels.

Using D-BRAIN model, Startech Alliance will evaluate the top 10 banks in Romania based on assets, and two neo-banks operating in Romania, Revolut and Raiffeisen Digital Bank. The results regarding the „credit score” of the digital transformation of these institutions will be presented by Bogdan Tudor – the CEO & founder of Startech, at Banking 4.0 – international conference focused on the emerging technologies impact on the banking development that will take place on November 22 and 23, in Sinaia.

Following 36 months of research, interviewing hundreds of companies that were successfully doing digital transformation projects, after a careful study of previous models of digital maturity including IDC, Forrester, Gartner, McKinsey and MIT CISR and integrating Artificial Intelligence at the core of the model Startech Alliance have developed the D-BRAIN model. This is followed by a solution oriented evaluation and scoring system on each business function that again is offering a practical, hands-on, let’s do it approach to digital transformation.

A complete scoring systems

Helping is not telling, but offering you as an organization or as a consultant a tool to objectively identify where you are right now and support you identify how you can improve based on 10 dimensions. Startech Alliance have selected these dimensions based on the impact on the digital transformation projects or digital business consultancy.

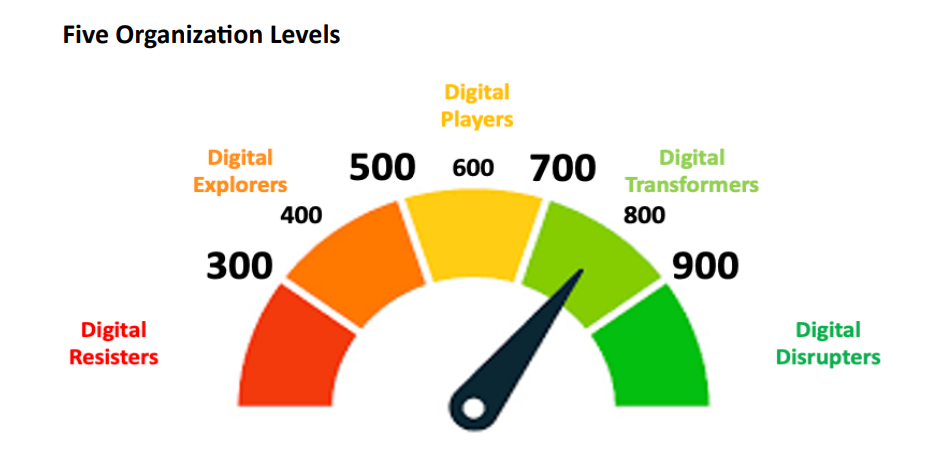

Using this scoring systems gives a progressive view of a company’s digital maturity.

Digital Transformation being a continuous journey, a company might oscillate between these categories or exist in more than one at a time, digital transformation spectrum being a broad continuum that showcases the varying degrees of digital maturity and adaptability among businesses.

On one end and probably about to reach the end, you have the Digital Resisters who cling to the past, often missing opportunities in the modern digital era. Their reluctance or inability to adapt places them at a significant disadvantage in today’s competitive market landscape.

Then, there are the Digital Explorers and Digital Players who have made noteworthy progress in their digital transformation journey. They’ve realized the need for change, have taken initial steps and are working towards better integration of digital tools and strategies. However, their efforts might still lack the depth, integration or strategic foresight needed to truly leverage the benefits of a digital world.

Further up the spectrum, Digital Transformers exemplify what it means to not just adapt but to leverage the digital realm for genuine competitive advantage. Their deep integration, customer-centric approach and proactive strategies position them as leaders within their industries. At the pinnacle, Digital Disrupters aren’t just part of the digital transformation conversation – they lead it.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: