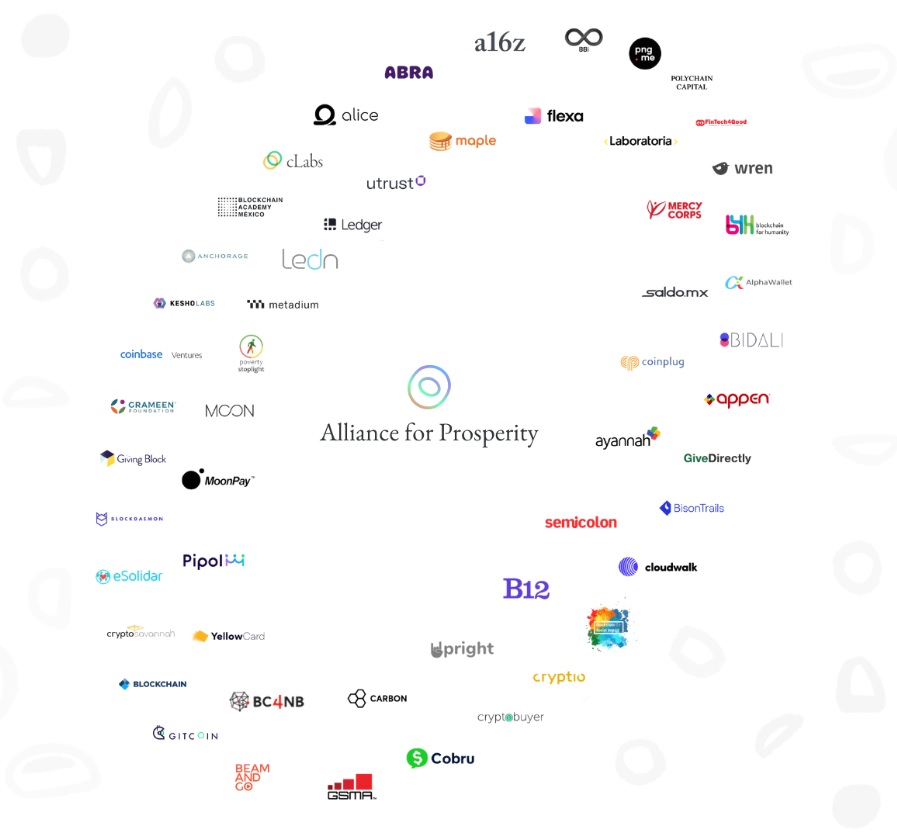

Libra is getting some competition. The Celo Foundation has signed up 50 members to its ‘Alliance for Prosperity’, an effort to use blockchain technology and digital assets to „enable prosperity for everyone”.

Today the Celo Foundation announced fifty founding members of the Celo Alliance for Prosperity. The Alliance members are all committed, in their own unique way, to helping ensure that Celo — a decentralized and open source platform — delivers on its mission to enable prosperity for everyone. All Alliance members support an open, decentralized, and transparent approach to addressing this opportunity.

The goal of the Alliance is to bring organizations together to help with the shared vision of making digital assets more accessible and useful in the real world. Today less than 5% of global citizens benefit from the speed, transparency, utility, and low cost of using blockchain technology (source). The Alliance members have a plan to change that and are committed to leveraging the power of Celo’s innovative blockchain technology to create solutions that work across devices, carriers, & countries.

The Alliance for Prosperity is focused on use cases, furthering the mission of financial inclusion and prosperity, and adoption of Celo’s technology. Members have all committed to integrating with the Celo platform and enabling the outlined use cases (i.e. give, earn, send, lend, etc).

Members include a Nobel Prize winning global micro lender, a highly innovative payment processor in Brazil, a company enabling mobile top ups with Celo Dollars around the world, leading global humanitarian aid organizations, an exchange in Africa that supports nine different fiat currencies, two of the largest blockchain wallets, leading blockchain infrastructure providers, and two of the most highly regarded investment firms.

Celo Dollars in Action

Alliance members are pursuing a diverse set of use cases, including powering mobile and online work, enabling faster and affordable remittances, reducing the operational complexities of delivering humanitarian aid, facilitating payments, and enabling microlending. Their combined reach is over 400 million people.

For example, humanitarian aid organizations will be using Celo Dollars instead of distributing food or fiat in order to reduce the cost of sending perishable items or prepaid cards.

„We saw some of these challenges firsthand last year with our research in Nyarugusu, a Tanzanian refugee camp, and are excited about the potential use of Celo Dollars as a more effective alternative. This is just one of the many ways Alliance members will further Celo’s mission of prosperity for everyone through concrete action.”, Celo Foundation said.

Celo – an open platform that makes financial tools accessible to anyone with a mobile phone

Celo is a platform that is open and open-source, allowing for an ecosystem of powerful applications built on top, including easier cash transfer programs, peer-to-peer lending, collaborative small-scale insurance, and other digital assets and wallets.

To create a truly inclusive financial system, Core started by building an infrastructure to serve those excluded from the current system. Celo’s protocol includes unique features that create a seamless user experience on mobile phones.

Celo’s platform is powered by the community. Users can earn currency by hosting software that forwards mobile devices’ requests or validates their transactions.

White Paper

Celo is a proof-of-stake based blockchain with smart contracts. The technology uses a phone number-based identity system with address-based encryption and eigentrust-based reputation.

For more details download pdf – Celo: A Multi-Asset Cryptographic Protocol for Decentralized Social Payments

Stability Analysis

Celo’s stablecoins are stable value currencies, implemented by an algorithmic reserve-backed stabilization mechanism. The first stablecoin, cUSD, is pegged to the US Dollar.

For more details download pdf – An Analysis of the Stability Characteristics of Celo

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: