A nation of social shoppers: 2.5 million Brits are buying on mobile every day

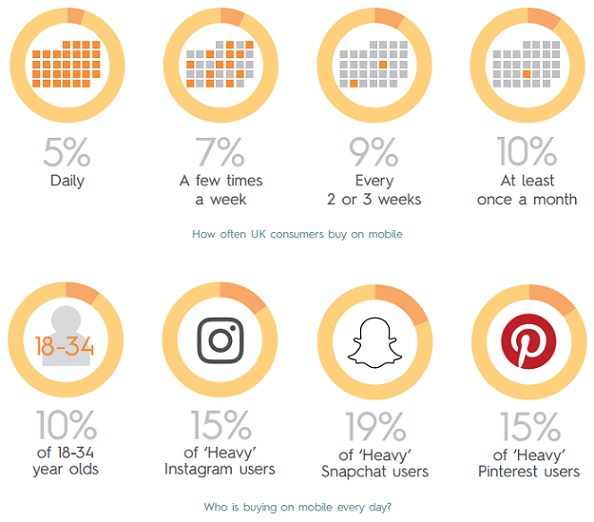

5% of the UK population – and a tenth (10%) of 18-34 year olds in the UK – say they now buy products and services on their mobile phone “every day”, according to the latest Criterio research that explores the core motivations behind mobile shopping in the UK today. Heavy social media use and habitual mobile buying are also going hand-in-hand – 19% of daily Snapchat users, and 15% of daily Instagram and Pinterest users are buying on their mobile phone every day.

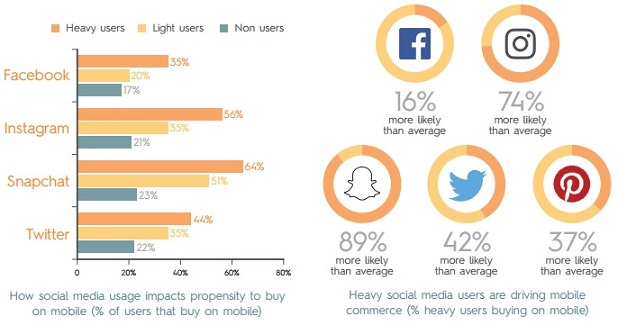

Heavy social media users are by far the biggest mobile shoppers in the UK. 35% of daily Facebook users have bought on mobile, compared to just 17% of non-Facebook users. The biggest mobile buyers are heavy Snapchat (64% have bought on mobile) and Instagram (56%) users.

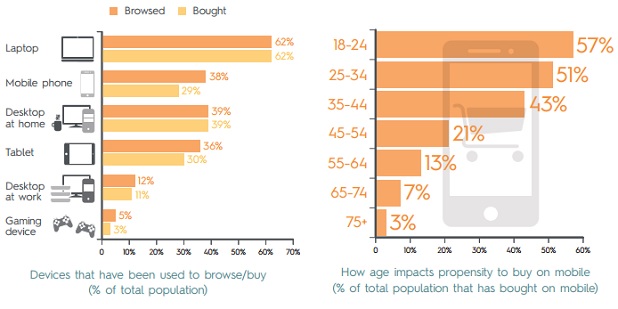

Despite the freedom and flexibility that buying on mobile provides, the most common places where Brits are buying on their mobile – in front of the TV (33% of UK consumers) and in bed at night (27%) – are in the home.

“We can now see that shopping on mobile is becoming a daily routine for large sections of the population, suggesting that smartphones are creating greater emotional ties behind consumer and brand. In addition, these findings show that browsing Facebook, Instagram and Pinterest in front of the TV at night is driving the growth of mobile commerce, just as much as mobile’s innate portability.”, said Jason Morse, Vice President, Mobile Products at Criteo.

This report is based on the findings of an ICM survey of 2,023 adults in the UK aged 18+, between the 18th and 20th May 2016. Interviews were conducted across the country and the results have been weighted to the profile of adults. ICM is a member of the British Polling Council.

Download full report: ‘A portrait of mobile performance: Measuring the pleasure in UK mobile shopping in 2016’

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: