Consumers are using their NFC-enabled smart devices for an ever-increasing number of applications to enable convenience in their daily lives. The publication of the NFC Forum’s bi-annual Near Field Communication (NFC) Usage and Adoption Study [1] highlighted this trend, with users embracing a device-first future, thanks to their growing familiarity, comfortability and understanding of NFC technology.

Here are five key takeaways from the study:

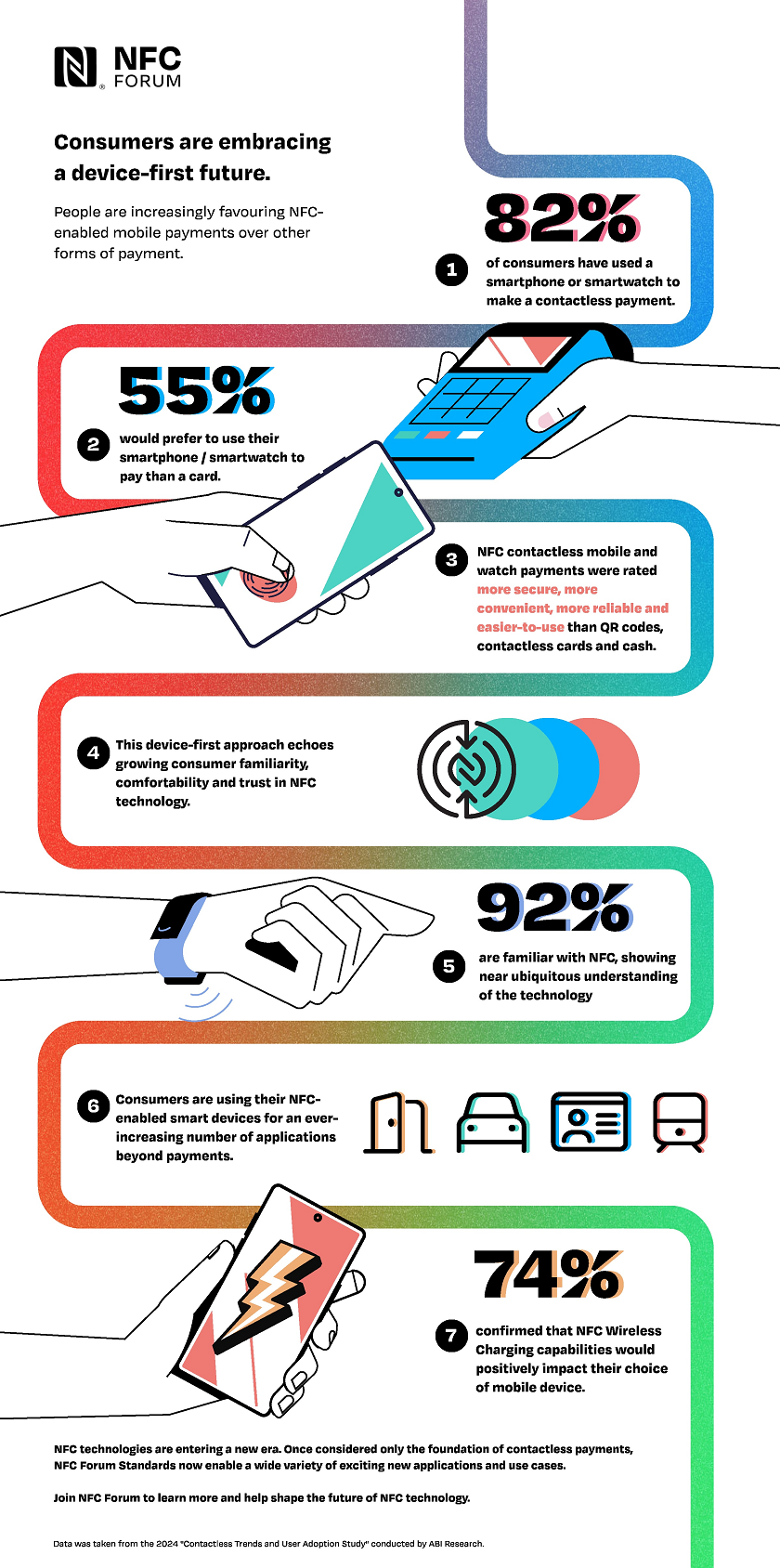

1. More than 80% of those surveyed confirmed that they have used a smartphone or smartwatch to make contactless payments.

More and more people are now using a smartphone or watch to make contactless payments. Daily usage of a smartphone to make payments also significantly increased from the 2022 study. This highlights a greater reliance on NFC and growing consumer confidence in using the technology to make payments.

2. The majority of consumers (55%) now prefer to use their mobile phone or wearable to pay over a contactless card.

Cards remain the single most popular contactless payment method, thanks to years of built-up usage and understanding of the technology. However, the study showed an increasing shift towards device-first options such as NFC mobile and smartwatch payments, with the majority (55%) of consumers now preferring these digital solutions, compared to 47% in the 2022 edition of the study.

3. Consumer familiarity and understanding of NFC technology continues to grow at both a global and regional level.

73% of consumers now regard themselves as ‘familiar’ or ‘very familiar’ with NFC contactless technology – an increase from 67% in the 2022 edition of the study. This familiarity and understanding of NFC are echoed both globally and at a regional level, resulting in increased adoption, new applications and higher usage of the technology.

4. 95% of respondents have left their physical wallet or purse at home on at least one occasion, choosing to rely solely on mobile payments; 53% do so multiple times a week.

People are increasingly willing to leave their cash or physical cards at home in favour of mobile payments, demonstrating how NFC is becoming fundamental in enabling consumers’ daily activities.

This shift from physical wallets to a device-first approach will continue to accelerate in the coming years, with consumer usage of digital wallets already diversifying to store transportation tickets (89% of respondents), event tickets (87%), and membership cards (84%).

5. NFC contactless mobile and watch payments were rated the most secure, most convenient, most reliable, and easiest-to-use way to pay in-person – more than QR codes, contactless cards, and cash.

Mobile payment wallets are considered superior to other payment methods by consumers when it comes to security, convenience, reliability and ease of use. These are the core driving factors behind the shift towards a device-first future, as users embrace solutions that make their daily lives easier without sacrificing on security, trust or performance.

Download the full study / listen to NFC Forum recent webinar on the findings to learn more.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: