Without an ID they can’t open a bank account, get a loan, or even vote. Joseph Thompson’s digital app allows people to prove and protect their identity, according to the World Economic Forum.

A legal identity is not just about opening a bank account: access to healthcare and your right to vote may depend on it. But just under 1 billion people in the world can’t prove who they are, according to the World Bank.

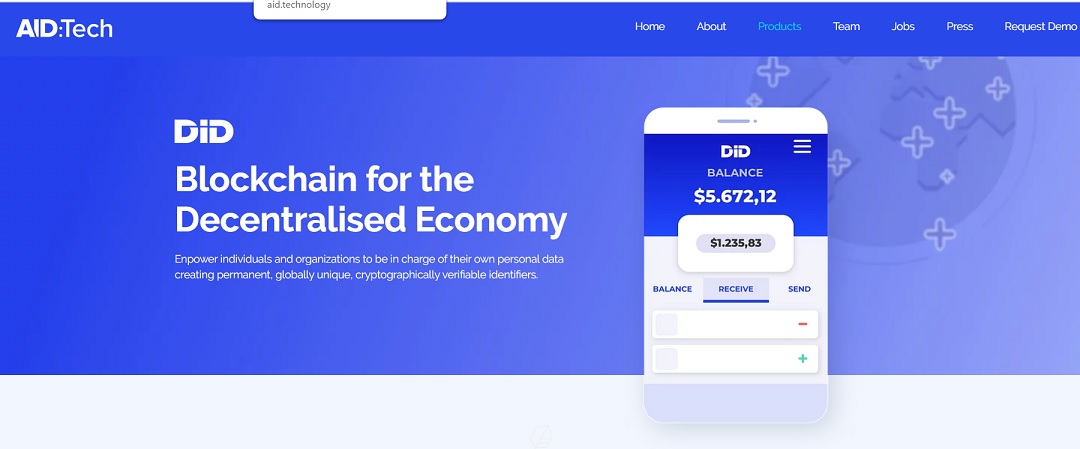

It’s an issue that tech entrepreneur Joseph Thompson has found a way to tackle. His start-up AID:Tech has created a digital app that allows people without official documents to create a personal legal identity.

A UN goal

Ensuring everyone has a legal identity, including birth registration, by 2030 is one of the United Nations’ Sustainable Development Goals (SDGs). It prompted the World Bank to launch its Identification for Development (ID4D) initiative in 2014.

The latest data from the Bank shows there are just over 987 million people in the world who have no legal identity, down from 1.5 billion in 2016. The majority live in low-income countries where almost 45% of women and 28% of men lack a legal ID.

For the almost 80 million people forced to flee their homes by war or persecution last year, the situation is even worse. Identity documents are often lost in the confusion and yet they can be vital to the success of their claim for refugee status.

A smartphone solution

Thompson’s app uses blockchain to preserve the user’s digital identity from interference, making it accessible only to the person whose ID it holds. As a digital solution, it goes with the grain of how many people in emerging economies manage their finances using smartphones.

A study of 15 developing nations identified 600 million people who have a smartphone but don’t have a bank account. Many of these people use digital payment apps to manage their money and these transactions can be used to digitally verify their identity.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: