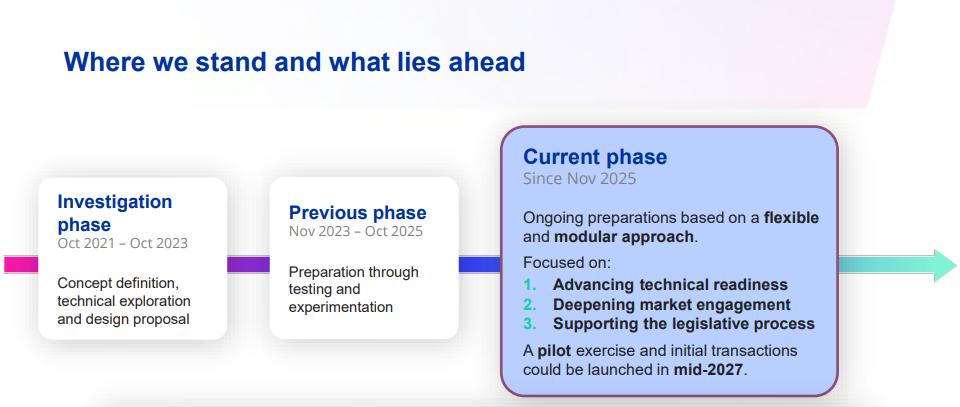

A 12-month digital euro pilot could start in the second half of 2027, conducted in a controlled Eurosystem environment involving real-world transactions. A limited number of PSPs, merchants and Eurosystem staff will participate. PSP selection will start in the first quarter of 2026. Four use cases will be tested.

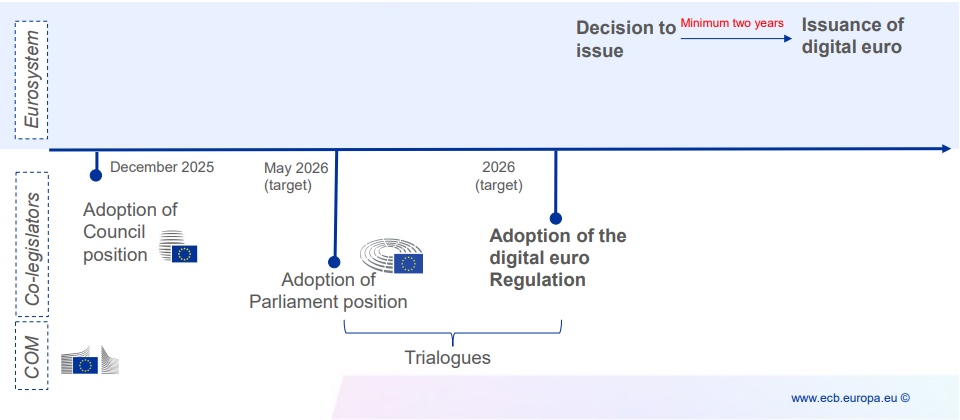

„We aim to be ready for a potential first issuance of the digital euro during 2029. This is based on a working assumption that the EU co-legislators will adopt the Regulation on the establishment of the digital euro in the course of 2026.”, said Piero Cipollone, member of the Executive Board of the European Central Bank.

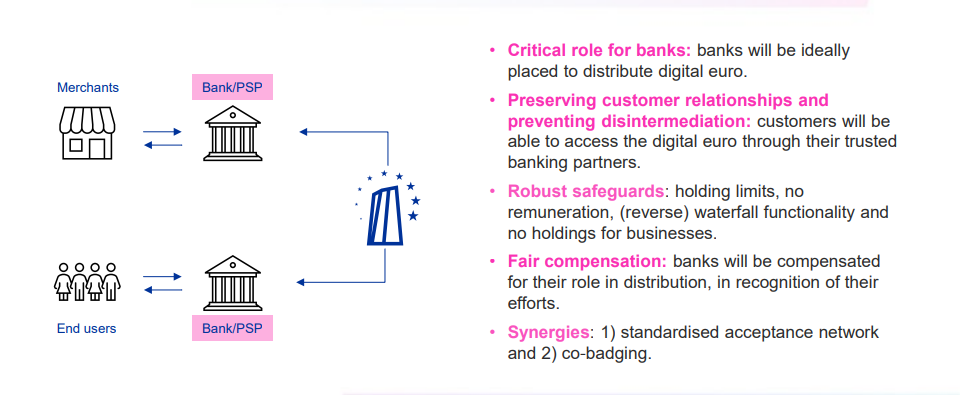

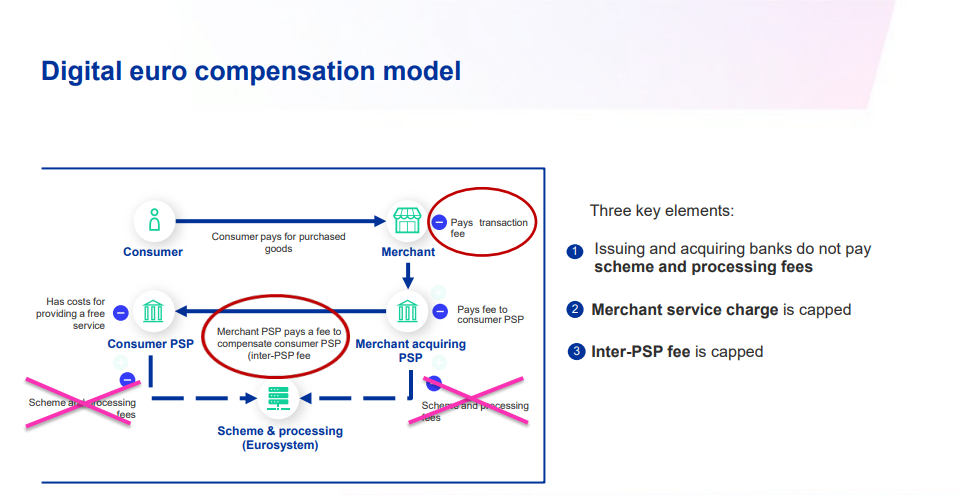

Banks and EU-licensed payment service providers (PSPs) will be at the core of digital euro distribution.

Synergies

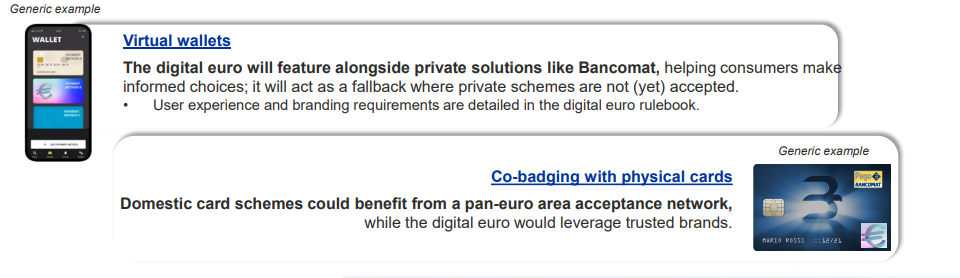

First, digital euro to be integrated into existing solutions through co-badging. The digital euro would coexist with and complement private solutions. It will be possible to integrate the digital euro into existing digital and physical payment solutions. This will eliminate the need to pay international card scheme fees for euro area cross-border transactions, fostering independence from such schemes.

Second, private solutions can leverage standardised euro area acceptance network to roll out at scale without having to invest heavily in their own network. Digital euro establishes a European acceptance infrastructure with standards open to private solutions. Domestic solutions adopt digital euro standards and achieve pan-European reach without heavy investment.

Digital euro pilot

The Eurosystem pilot aims to fine-tune the digital euro’s design and ensure its technical readiness.

. A 12-month pilot, starting in the second half of 2027, conducted in a controlled Eurosystem environment involving real-world transactions.

. A limited number of PSPs, merchants and Eurosystem staff will participate. PSP selection will start in the first quarter of 2026.

. Four use cases will be tested.

. The Eurosystem will gather and apply feedback continuously throughout the pilot to further optimise the digital euro.

Status of the digital euro legislative process

The Council of the European Union adopted its position on the digital euro on 19 December 2025. This marked a key milestone in the legislative process and is a strong statement of support from Member States for the main pillars of the digital euro as contained in the European Commission’s proposal, i.e. legal tender status, offline and online use, mandatory distribution by banks, weighted average fee caps and free basic services for consumers.

Key changes by the Council relating to banking sector demands

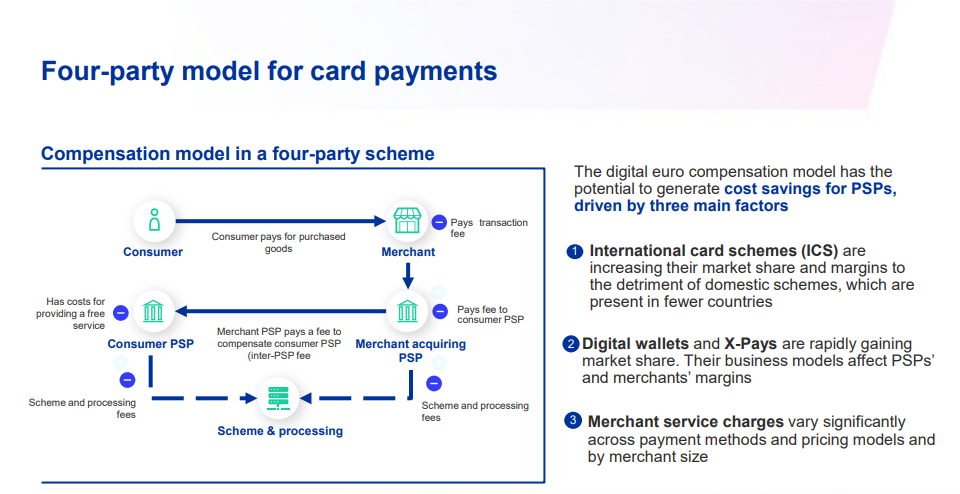

. Compensation: for a transitional period of at least five years, fee caps would be set at a level comparable to the average fees for payments made with debit cards that can be used both at the point of sale and for e-commerce. As PSPs would not pay scheme fees for digital euro, it would generate ample fee revenue.

. Open funding: banks would not be obliged to provide funding/defunding services for a digital euro payment account that is not held with them. Availability would depend on bilateral contracts, which could include compensation.

. Cash services: cash conversion would only be obligatory to provide for PSPs that provide cash services for comparable means of payment and only need to be provided in the same manner as the PSP provides them for comparable means of payment. This allows for a reasonable fee to be charged for cash conversions and an interPSP fee to align with current business models.

. Multiple accounts and joint accounts: PSPs would provide this to consumers on a voluntary basis.

. User interfaces: increases prominence of banks’ interfaces for accessing the digital euro.

. Access to mobile devices: introduces more stringent rules for phone manufacturers to give PSPs access to the software and hardware in mobile devices for providing (offline) digital euro.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: