PayPal Holdings Inc. announced that its Board of Directors has appointed Enrique Lores as President and CEO, effective March 1, 2026. Lores, who has served on the PayPal Board for nearly five years and as Board Chair since July 2024, succeeds Alex Chriss.

Today’s appointment follows a detailed evaluation conducted by the Board of Directors on the current position of the company relative to its competition and the broader industry landscape. While some progress has been made in a number of areas over the last two years, the pace of change and execution was not in line with the Board’s expectations. The Board is confident that the appointment of Lores, a seasoned executive with more than three decades of technology and commercial experience, will provide the leadership necessary to lead PayPal into its next chapter.

„Enrique is widely recognized as a visionary leader who prioritizes customer-centric innovation with demonstrable impact. His strong track record leading complex transformations and disciplined execution on a global basis will ensure PayPal maintains its leadership of the dynamic payments industry now and into the future,” said David W. Dorman – the new appointed Independent Board Chair of PayPal.

Lores joins PayPal after more than six years as President and CEO of HP Inc., where he successfully led the company through a period of strategic transition and innovation, expanding the business beyond its traditional PC and printing roots into services, subscriptions, and emerging future‑of‑work solutions, including AI‑enabled offerings. He was also the lead architect of and built on the HP/HPE separation, strengthening operating discipline, simplifying the cost structure, and positioning the company for long-term innovation.

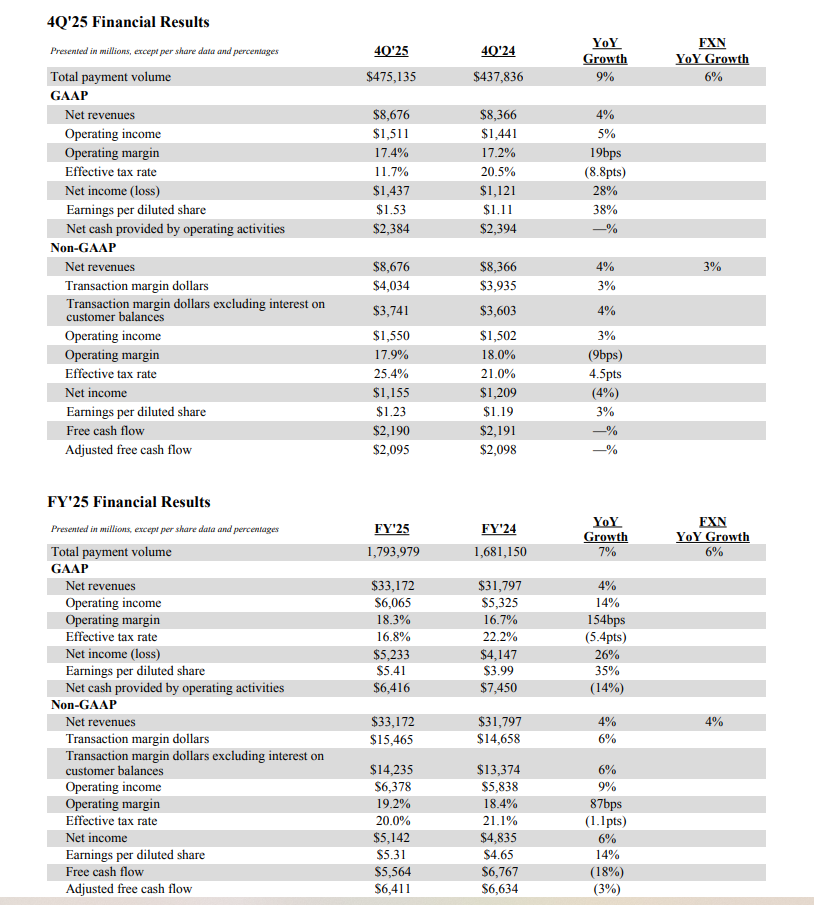

In the same day, PayPal also announced its fourth quarter and full year 2025 results for the period ended December 31, 2025. More details here.

„We grew revenue, transaction margin dollars, and earnings per share, underscoring the strength of our increasingly diversified platform. At the same time, our execution has not been where it needs to be, particularly in branded checkout. As announced today, the Board’s appointment of Enrique Lores as PayPal’s next President and CEO reflects a clear commitment to strengthening execution, innovation, and results. We are fully aligned on the path forward as PayPal enters its next chapter of growth.” said Jamie Miller, Interim CEO.

Market reaction: shares plunge more than 24% in two days

Simon Taylor, board member and founder of Global Digital Finance, has an explanation for this.

„Remember January 2024?

– Alex Chriss (the former PayPal CEO) went on CNBC promising to „shock the world.”

– The stock jumped 10% in a week on the hype alone.

– Two years later, the board says „the pace of change and execution was not in line with the Board’s expectations.”

What they tried to deliver:

– Fastlane — a one-click guest checkout to compete with Stripe Link and Shop Pay.

– Venmo monetization — finally making money from 64 million monthly actives.

– AI-driven personalization — the „next chapter” pitch from the 2024 innovation day.

What actually happened:

– Branded checkout growth SLOWED from 5% in Q3 to 3% in Q4.

– Morgan Stanley says they’re „losing pricing power and market share, forcing it to rely on volume to drive profit growth.”

– The upgrades are described as „slow and complex” by analysts.

– Q4 missed on both revenue ($8.7B vs $8.8B expected) and profit ($1.23 vs $1.28 expected).

The analyst view:

PayPal processed $1.79 trillion in payments last year.

439 million accounts.

But branded checkout — the core product, the thing that made PayPal PayPal — is bleeding share.

Meanwhile at Block:

– Jack Dorsey is back.

– They just shipped 100+ new products in a single release cycle.

– Cash App profit up 16% in Q2 2025.

– Block raised full-year profit guidance to $10.17 billion.

The difference? Block actually fixed its infrastructure first.

Dorsey spent 2024 reorganizing, cutting 10% headcount, consolidating five separate Square apps into one. PayPal kept announcing new features on top of infrastructure that still needed rebuilding.

Being fair:

Chriss inherited a mess.

Too many acquisitions.

Unclear focus.

A checkout experience that competitors had lapped.

He diagnosed it correctly:

. Fastlane is a good product. Venmo monetization is finally moving.

. The partnerships with Adyen, Amazon, Shopify were smart.

The problem? Two years wasn’t enough runway to rebuild the core while competitors kept shipping.

Without Chris, you have to wonder if an HP exec is the right call. Or a cost cutting signal.

PayPal needs someone who can grind through operational complexity.

Whether a hardware executive can move fast enough in fintech is the $50 billion question.

Sometimes „shocking the world” means admitting the boring work comes first.„

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: