Many of the bankers Evident has spoken to in recent months have said they are impressed by what Anthropic and Google are delivering.

New data from AI benchmarking and intelligence platform Evident suggests that many of the world’s largest banks are reducing their reliance on OpenAI as their primary large language model provider.

Since the Gen AI boom started some three years ago, banks have been the bellwether for AI adoption by business. The way they’re acting now could spell more bad news for OpenAI in 2026.

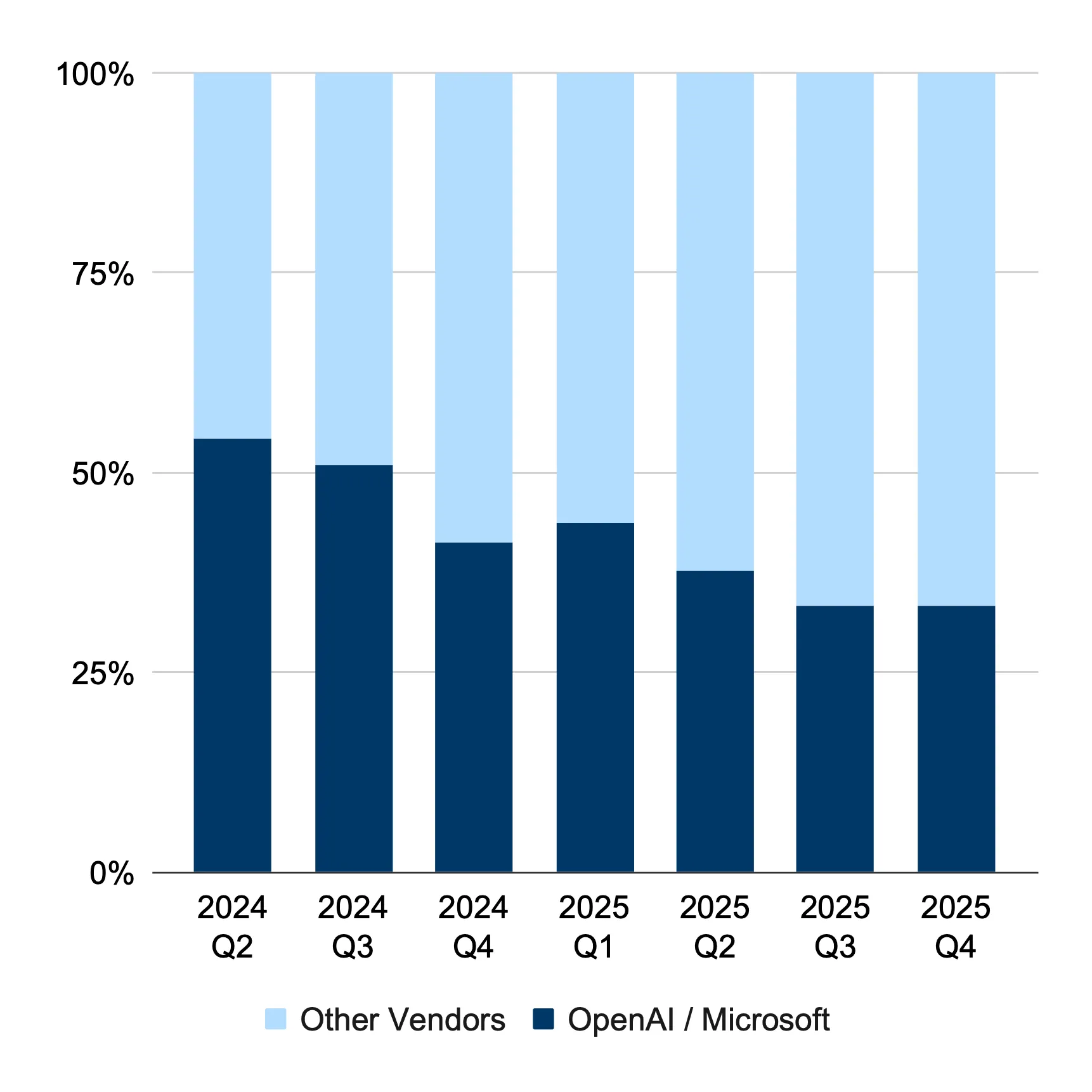

A year and a half ago, the ChatGPT-maker built the technology of choice for roughly half of the use cases that included vendor information announced by the 50 banks we track in the Evident AI Index. By the end of 2025, that dropped to just one-third, according to the Evident Use Case Tracker.

„OpenAI would have you believe this is the byproduct of the sector’s push for model agnosticism. But bankers we’ve spoken to in recent months tell a different story: OpenAI isn’t the only lab building what enterprises actually need right now, and competitors like Anthropic and Google are quickly gaining market share.” – Evident stated.

“Since the Gen AI boom began three years ago, banks have been the bellwether for enterprise AI adoption,” said Alexandra Mousavizadeh, co-founder and CEO of Evident. “The way they are behaving now could signal mounting challenges for OpenAI’s position in banking in 2026. Our data shows a marked shift away from OpenAI’s LLMs and towards a broader range of providers.”

“It’s no secret that many leading banks favour model agnosticism, which could account for some of the shift away from OpenAI,” Mousavizadeh adds. “However, many of the bankers we’ve spoken to in recent months have told us that they’re impressed by what Anthropic and Google are delivering. OpenAI still boasts successful partnerships with banks like BBVA and Morgan Stanley and retains a strong footprint in banking, so it will be interesting to see how the AI giant evolves its enterprise offering in the coming months.”

Of bank use cases that included vendor information, the share featuring OpenAI dropped from more than half to one-third in 18 months.

Source: Evident Use Case Tracker | Note: Includes only AI use cases at the 50 banks we track that reference specific vendors

Start with coding, arguably banking’s first “killer use case,” and one of the only areas where more than half of the tools in our Use Case Tracker demonstrate tangible ROI. On code generation and review, experts say Anthropic is at the top of the class. The fanfare around Claude Code in recent months suggests the public agrees. Google, meanwhile, is using its preexisting cloud relationships to give banks access to tools that can then get integrated into their systems more easily, as BNY demonstrated last month by bringing Gemini Enterprise together with its AI platform, Eliza.

You’re seeing defections from OpenAI beyond banking. Last month, Menlo Ventures (which has a financial stake in Anthropic) published data showing that 40% of enterprise workloads were now going to Anthropic models, compared to 27% for OpenAI and 21% for Google.

A year ago, OpenAI still had the market share lead, the venture firm’s data shows. Rivals’ growth with the corporates is paying off: At Davos last week, Anthropic CEO Dario Amodei said his company now gets 80% of its business from enterprise customers, compared to OpenAI’s 40%. OpenAI did not respond to a request for comment.

“Growth does not move in a perfectly smooth line,” OpenAI’s CFO Sarah Friar said recently. With how much competition there is now, she’s right. But if OpenAI continues losing ground, keeping that line pointing in the right direction will depend on the lab proving how much value its tech can create with each bank it works with.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: