Brex and Capital One are announcing the largest bank-fintech deal in history for $5.15B, „joining forces to build the most important financial platform for businesses in the US”.

Capital One Financial Corporation, the only major U.S. bank to migrate entirely to the public cloud, announced that it has entered into a definitive agreement to acquire Brex, in a combination of stock and cash transaction valued at $5.15 billion.

Thirty years ago, Capital One pioneered the concept of fintech. Rich Fairbank founded the company with the idea that data and technology would revolutionize consumer credit card underwriting. And it did. Capital One became the 6th largest bank and the 3rd largest credit card in the US, and one of the most tech-forward banks in the world, serving millions of consumers and businesses.

Brex is a modern, AI-native software platform offering intelligent finance solutions that make it easy for businesses to issue corporate cards, automate expense management and make secure, real-time payments. The company also leverages AI agents to help customers automate complex workflows to reduce manual review and control spend.

”Since our founding, we set out to build a payments company at the frontier of the technology revolution,” said Richard D. Fairbank, Founder, Chairman, and Chief Executive Officer of Capital One. “Acquiring Brex accelerates this journey, especially in the business payments marketplace.”

“Brex invented the integrated combination of corporate credit cards, spend management software and banking together in a single platform. They have taken the rarest of journeys for a fintech, building a vertically integrated platform from the bottom of the tech stack to the top,” added Fairbank.

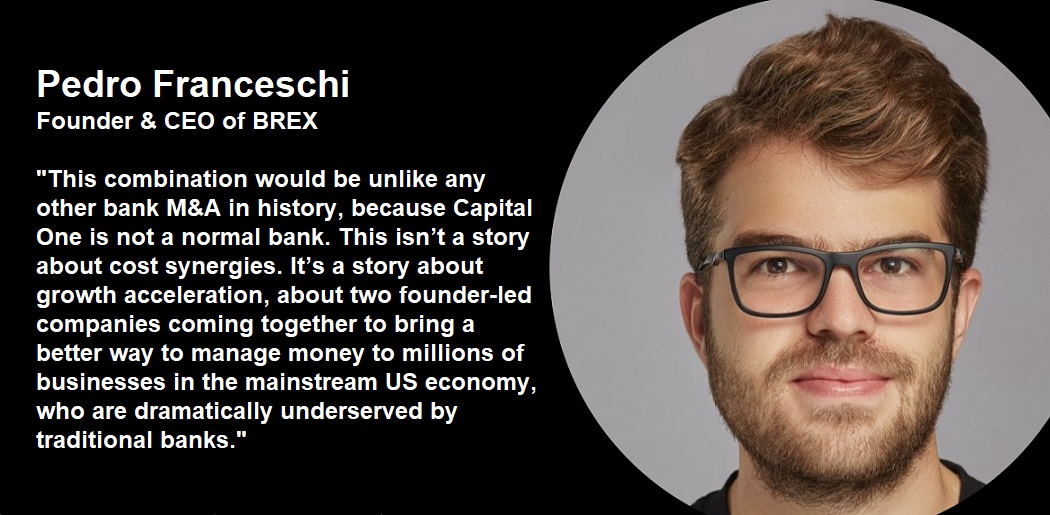

“We started Brex in 2017 as a category creator – bringing together financial services and software into one AI-native platform,” said Pedro Franceschi, Founder and CEO of Brex. “Now we get to supercharge our next chapter in partnership with the team at Capital One. Together, we’ll maximize founder mode by combining Brex’s payments expertise and spend management software with Capital One’s massive scale, sophisticated underwriting, and compelling brand to accelerate growth and increase the speed at which we can offer better finance solutions to the millions of businesses in the U.S. mainstream economy.”

Pedro continued: „Spending time with Rich and the Capital One team, it was clear that this combination would be unlike any other bank M&A in history, because Capital One is not a normal bank. This isn’t a story about cost synergies. It’s a story about growth acceleration, about two founder-led companies coming together to bring a better way to manage money to millions of businesses in the mainstream US economy, who are dramatically underserved by traditional banks.

To give you a sense of the scale of what we’ll build together, Capital One today operates orders of magnitude ahead of Brex on almost any metric: $900B in annual card GMV, $700B in assets, $150B in market cap, a $6B marketing budget, and a $6B R&D budget. By combining Brex’s technology, product, and go-to-market success with Capital One’s unprecedented scale, brand, distribution, and balance sheet, we will supercharge our go-to-market and product development with levels of investment that will accelerate our mission by over a decade.”

Upon completion of the transaction, Franceschi will continue to lead Brex as part of Capital One.

The transaction is expected to close in the middle of calendar year 2026, subject to the satisfaction of customary closing conditions.

___________

Capital One Financial Corporation (NYSE: COF) is a leading technology-based financial services company with $475.8 billion in deposits and $669.0 billion in total assets as of December 31, 2025. Headquartered in McLean, Virginia, the company operates as a premier global payments provider and diversified financial institution, delivering a broad suite of products and consumer lifestyle and shopping experiences through its Credit Card, Consumer Banking including its Global Payment Network, and Commercial Banking lines of business. As the only major U.S. bank to migrate entirely to the public cloud, Capital One leverages proprietary data and advanced analytics to democratize financial tools across its primary markets in the United States, Canada, and the United Kingdom.

Brex is the intelligent finance platform that empowers growing companies to spend smarter and move faster – in more than 50 countries. By combining the world’s smartest corporate card with intuitive spend management software and banking, Brex enables founders and finance teams to accelerate operations, gain real-time visibility, and control spend effortlessly. Brex’s AI-powered automation and world-class service eliminate manual expense and accounting tasks for customers. Over 25,000 of the world’s best companies, from startups to enterprises, run their finances on Brex – including DoorDash, TikTok, Anthropic, Robinhood, Crowdstrike, Zoom, Plaid, Intel, SeatGeek and the Boston Celtics.

Related articles:

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: