the European Payments Council (EPC) published two new documents detailing the key differences between the 2025 One-Leg Out Instant Credit Transfer (OCT Inst) and SEPA Instant Credit Transfer (SCT Inst) scheme rulebooks.

The publications aim to support payment service providers (PSPs) in understanding the main distinctions between the two instant credit transfer schemes.

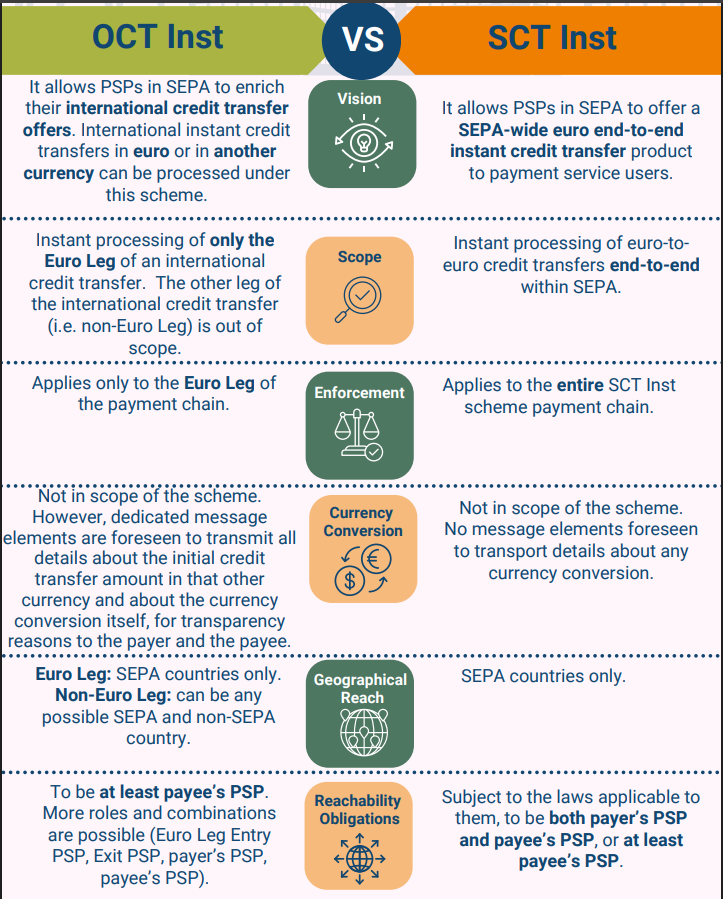

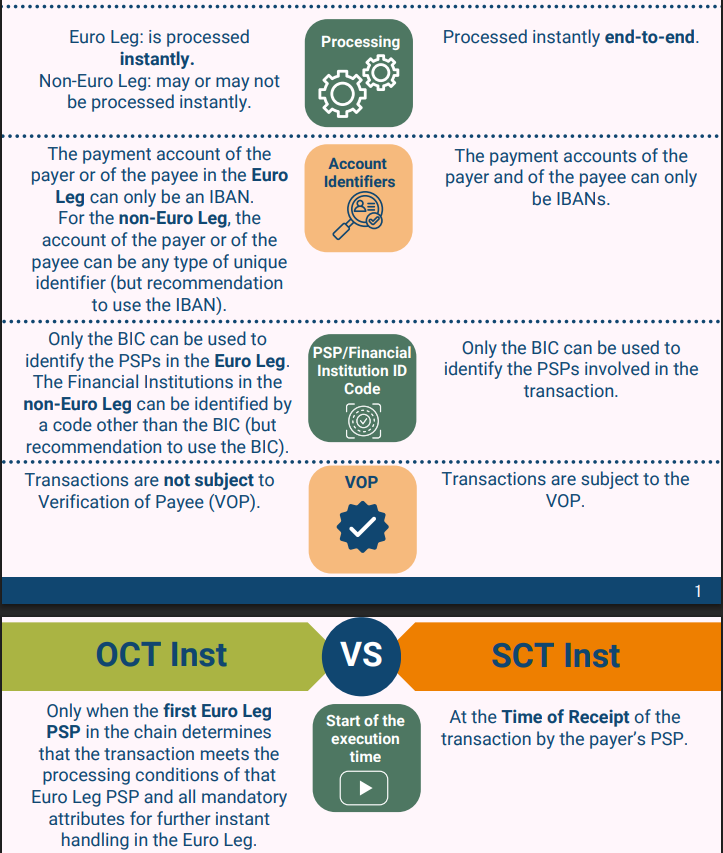

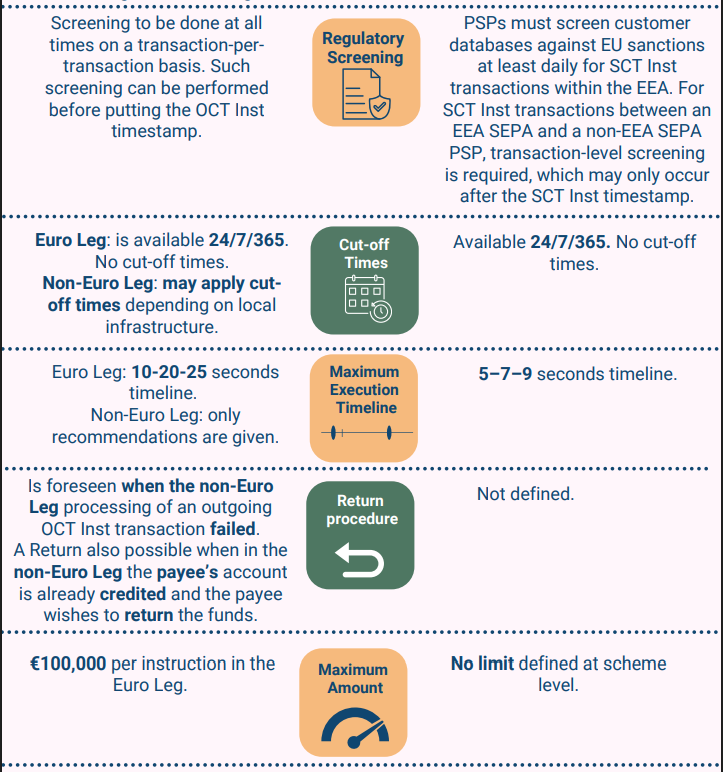

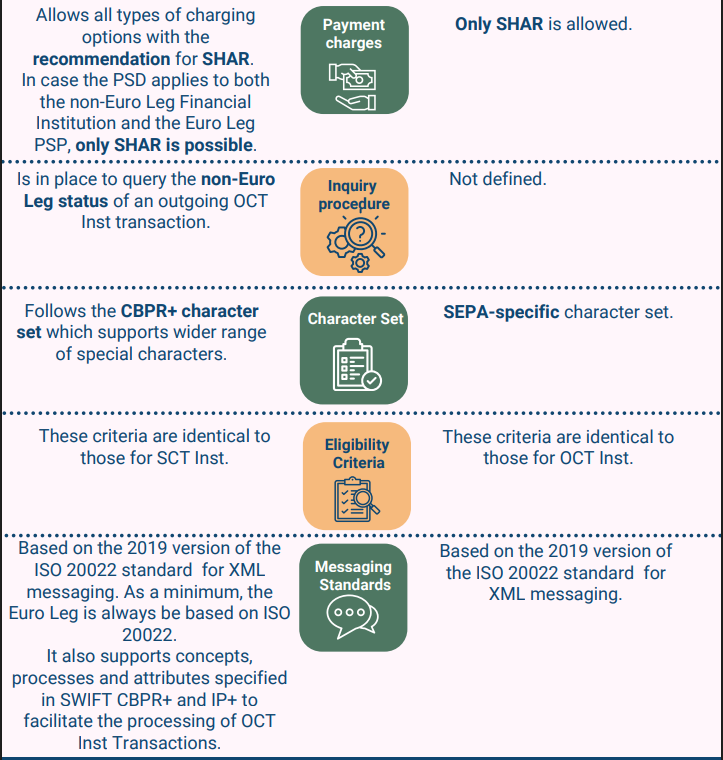

The infographic Key Differences between the 2025 OCT Inst and SCT Inst Scheme Rulebooks (EPC203-25) gives a concise, visual overview of the main differences between the two schemes.

The document Key Differences between the 2025 OCT Inst and SCT Inst Scheme Rulebooks (EPC204-25) makes a more detailed comparison between the two schemes.

Both documents will help PSPs to quickly grasp the operational and procedural differences between the OCT Inst and SCT Inst schemes. The EPC will update these documents whenever further clarification is needed.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: