Digital banking is dead. The playbook for what comes next. The invisible bank series.

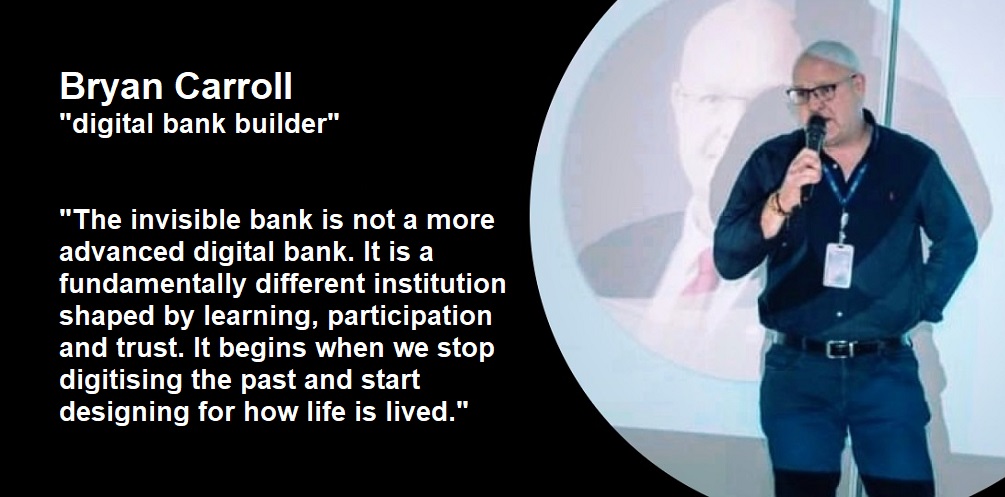

an article by Bryan Carroll – Digital Bank Builder. Hands On Launch and Scale Up Leader. CEO. CIO. COO. CPO. Advisory and Execution Expert. AI Enabled Banking. 5 Digital Banks Across Asia. Middle East. Africa. Europe.

So far in this series I have explored how I see the value in banking shifting from the visible to the invisible, how balance sheets will transform as intelligence, participation and trust become the true sources of advantage, and why traditional digital transformation has reached its limits. I have shared the emergence of what I call the Digital Halo and why it matters. Today I want to move from what is changing to how the next generation bank should be built. The invisible bank, and a practical playbook required to make it real.

Looking Back at the Digital Banking Era

For more than a decade the global banking industry has worked hard to digitise. Paper became screens. Branches became apps. Queues became clicks. Expectations shifted permanently. Yet beneath the surface, much of the architecture remained unchanged and the promise of transformation stalled.

Apps became the new branches. Dashboards became the new filing cabinets. Data lakes became data swamps. RPA became a bandage over broken processes rather than a redesign of them. Large teams continued manually reconciling spreadsheets and correcting decisions made by systems that were never designed to learn.

Digital banking made access faster and more convenient. It did not fundamentally change how value is created.

Where Value Is Moving

The centre of value in banking is shifting from physical assets to invisible ones. From capital and distribution to intelligence and participation. From selling products to understanding behaviour. From transactions to relationships.

Most leaders recognise this direction. The challenge is execution. Many institutions remain structured to operate branches and processes rather than ecosystems and learning systems. Decision making built around hierarchy rather than autonomy. Delivery measured in projects instead of outcomes. Culture shaped to protect the past rather than build the future.

Those structures cannot support compounding intelligence. They cannot create the Digital Halo. And they will not win the next decade.

So the question becomes what is the playbook for what comes next.

How to Build the Invisible Bank – The Practical Playbook

This is not theory. It is a playbook shaped by real experience co founding, leading as CEO, building and scaling a digital bank from zero in Southeast Asia, and by supporting other clients, banks and founders to build digital banks across regions including Africa, the Middle East and Europe. In those environments assumptions break quickly and progress is measured in real behaviour rather than presentations. For example, when we introduced behavioural telemetry and weekly learning loops in Vietnam, engagement depth increased by more than forty per cent in twelve weeks. I witnessed a client, an African Digital Wallet, apply similar techniques and see merchant participation velocity double within five months with zero additional marketing spend.

Here is my playbook, step by step. In this playbook, when I refer to engagement depth, I mean meaningful usage across multiple everyday journeys, not just logins or clicks.

Playbook Step 1. Fix the Data

The past decade showed us that data is the biggest barrier to real transformation. Banks invested heavily in digital channels but left fragmented, inconsistent and inaccessible data beneath them. Everything begins with data. Without clean, connected and real time data there is no foundation for intelligence or trust. Automation can buy time, but it cannot compensate for structural weakness.

What strong foundations look like

• A single customer identity across the organisation

• Real time access rather than overnight batch processing

• Data quality owned by product teams instead of committees

In one market, we unified identity across eighteen legacy systems, reducing onboarding time from days to minutes and enabling predictive decisioning that increased approval rates by twenty two per cent with no additional risk.

If this part is wrong, nothing else works.

Playbook Step 2. Build Learning Loops

Invisible banks learn continuously and adapt based on real customer behaviour rather than governance cycles.

This requires

• Telemetry embedded in every interaction

• Weekly improvement cycles rather than annual releases

• Participation and engagement tracked as core performance signals

A practical example In Southeast Asia, we instrumented every screen of onboarding, payments and everyday journeys with telemetry. We could see exactly where customers hesitated or abandoned. Instead of writing a business case for a quarterly steering committee, the team redesigned the journey in a week, tested multiple versions live and deployed the winning version days later. Conversion increased by more than twenty five per cent with zero additional marketing.

Speed of learning became the differentiator. The organisations that learn fastest will lead.

Playbook Step 3. Design for Everyday Life

The invisible bank does not demand attention. It integrates into the lives people already live.

Where to focus

• Removing friction in onboarding, payments, savings and credit

• Integrating into salary, mobility, commerce, health, education and utilities

• Partnering rather than building everything internally

When we integrated banking into everyday salary and mobility experiences, daily active usage rose sharply because effort was removed rather than added. Globally, banks that become the default salary account achieve significantly higher engagement and retention because income flow anchors financial rhythm.

When a bank becomes part of everyday life, trust emerges without visibility.

Playbook Step 4. Hire for Behaviour, Not Only Technology

Technology enables value. Human insight creates it.

What this means in practice

• Hiring psychologists, sociologists, behavioural scientists and service designers

• Studying real behaviour rather than inventing personas ( a pet hate of mine)

• Cross functional teams accountable for outcomes rather than deliverables

In Vietnam, two of my earliest hires were a psychologist and a sociologist. Their insights shaped product direction more powerfully than any roadmap.

If you understand behaviour, you understand value.

Playbook Step 5. Treat Trust as Capital

Without trust, data does not flow and intelligence cannot learn.

To build trust intentionally

• Radical clarity on how data is used and how value returns to customers

• Explainable decisions rather than black box automation

• Returning value as a principle, not an exception

Trust compounds and becomes the most powerful balance sheet asset.

Playbook Step 6. Build Participation, Not Distribution

Digital banking expanded channels. Invisible banking builds ecosystems.

To create participation

• Value loops between customers, merchants and communities

• Rewards for behaviour rather than balance size

• Services that improve through usage

Ecosystems become engines.

Playbook Step 7. Build an Adaptive Technology Architecture

The invisible bank cannot be built on legacy assumptions. It requires technology designed for speed, learning and participation.

What the foundation should enable •

Real time event driven processing

• Open APIs and modular services

• A unified data platform with automated lineage

• Machine learning in live decisioning

• Cloud native infrastructure

• Embedded security and resilience

The invisible bank must be secure, explainable and auditable by design. Cyber security cannot sit isolated and audit cannot be retrospective inspection. Modern architecture requires real time monitoring, traceable decision paths, zero trust security and automated compliance evidence.

Technology alone does not create advantage. It enables the organisation to learn and scale faster.

The Metrics That Matter

Traditional banking metrics like downloads, logins and NPS measure visibility rather than value. They describe activity, not impact. The invisible bank needs a new dashboard that reflects learning, participation and trust.

Engagement depth – Measures how customers use multiple meaningful everyday journeys such as salary, mobility, payments, savings and credit, rather than simply logging in. Depth predicts retention and share of life.

Participation velocity – The time it takes for a new product or feature to reach meaningful organic scale without paid acquisition. A signal of ecosystem strength and compounding network effects.

Learning speed – The time from observing a behavioural signal to releasing a live improvement. The fastest learners win because they improve outcomes weekly rather than annually.

Trust capital – The volume and growth rate of data that customers choose to share willingly because they see value returned. The most predictive indicator of future capability.

Halo value – Incremental value created across the ecosystem from participation. For example, when customers help merchants grow and merchants improve customer experiences, increasing overall economic benefit.

Behavioural outcomes – The measurable improvement in customer wellbeing such as reduced financial stress, improved savings habits or lower delinquency, rather than vanity engagement numbers.

Decision explainability – The ability to show transparently how automated decisions were made and prove they are fair, compliant and auditable in real time.

These are the economics of the future balance sheet. They measure capability, participation and trust. They indicate whether a bank is becoming invisible, valued and indispensable

The Maturity Model

Traditional — Product and branch led

Digital — Access and convenience

Intelligent — Data driven personalisation

Invisible — Embedded, participatory and continuously learning

Competitive advantage depends on how quickly an organisation moves from Digital to Invisible.

The Roadmap

Foundations — Data, architecture and identity Proof: Clean, real-time and unified data

Learning — Telemetry and continuous iteration Proof: Weekly improvements and measurable uplift

Participation — Build ecosystem value loops Proof: Network effects and organic scale

Halo Economics — Trust and intelligence at scale Proof: Compounding value and behavioural outcomes

Transformation fails when phases are attempted out of sequence.

A Direct Challenge to CEOs, CIOs, COOs, CMOs, CROs and CTOs

If you are leading a bank today, this article should feel uncomfortable. The question is not whether you understand the invisible bank. The question is whether you are willing to dismantle the structures that protect the visible one.

If these questions feel inconvenient, the competition is already ahead. If they feel irrelevant, the competition has already won.

The decade will not reward the cautious. It will erase them.

Leadership Readiness Test

- Do we know where all critical data lives and can we access it in real time

- Can we deliver meaningful product change weekly

- Do we measure participation as a primary performance signal

- Would customers willingly share more data tomorrow

- Do teams own outcomes rather than deliverables

- If the app disappeared tomorrow, would customers feel its absence

If the answer is no to three or more, the journey has not yet begun.

A Closing Reflection

The invisible bank is not a more advanced digital bank. It is a fundamentally different institution shaped by learning, participation and trust. It begins when we stop digitising the past and start designing for how life is lived.

Some banks will make the shift. Others will protect quarterly optics until the decade closes around them.

What Comes Next

If the invisible bank is the destination, the operating model is the engine. It requires smaller cross functional teams accountable for outcomes, rapid experimentation and real time decision intelligence. That is where real transformation begins. In the next article, I will outline how I believe that operating model should be designed and built.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: