At launch next year, the AI financial assistant will help customers manage spending, savings, and investments, with plans to expand functionality across all financial products.

Lloyds Banking Group will launch „the UK’s first large-scale, multi-feature AI-powered financial assistant, set to transform the way over 21 million customers manage their money through the mobile app” – according to the press release. This launch is a key milestone in Lloyds Banking Group’s journey to embed AI as a core enabler across the business, supporting the Group to deliver world-class experiences for its customers.

„By harnessing cutting-edge artificial intelligence, the new AI financial assistant will provide 24/7 personalised financial coaching and work as a financial companion, capable of answering questions and providing guidance, alongside the ability to easily refer to expert human support when needed.” – the bank said.

Agentic AI: the next frontier

As the first UK bank to deploy agentic AI in this way to help customers manage their money, Lloyds is setting a new standard for innovation, responsibility, and customer empowerment in banking.

According to Lloyds Banking Group’s latest Consumer Digital Index, 56% of adults, around 28.8 million people, have used AI in the past 12 months to help manage their money. Among them, ChatGPT is the most popular platform, used by six in ten people.

While AI adoption is rapidly increasing, 8 in 10 people (80%) are concerned about receiving inaccurate or outdated information, and over two thirds (69%) are worried about a lack of personalisation based on their personal circumstances. The financial assistant tool will provide this tailored and personalised support, and unlike general purpose AI tools, can understand and respond to specific, hyper-personalised customer requests and retains memory to offer a more holistic experience, ensuring the generated answer is safe to present to customers.

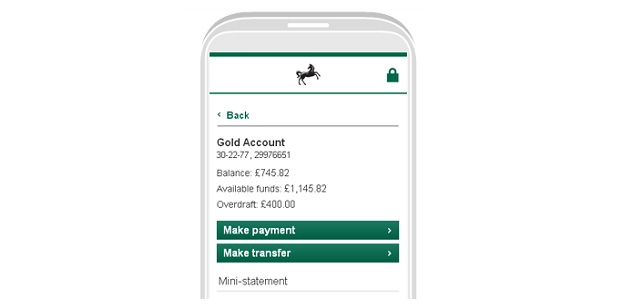

The AI financial assistant’s first two hero features will be a conversational tool that allows customers to request personalised spending insights, alongside a savings and investment tool that helps customers make informed financial decisions to plan for their financial futures, all within the secure environment of the app.

Following the initial pilot, it will expand and deepen the support it provides over time, with features covering spending, savings, and investments, and plans to expand across the full suite of financial products offered by Lloyds in 2026 and beyond, from mortgages, to car finance, to protection needs.

A technological leap for UK banking

Unlike existing virtual assistants, this solution leverages cutting-edge agentic AI, enabling natural conversations and hyper-personalised support. Customers can ask questions in their own words and receive instant, relevant answers from a personal secure AI agent.

The functionality is built on Lloyds Banking Group’s Generative AI and Agentic framework, a robust architecture that combines curated bank data with innovative technology, ensuring responses are accurate and tailored.

„Conversations within the assistant enable a personal customer experience, differentiating it from general-purpose AI models, which enables autonomous, goal-driven AI agents to act on behalf of customers, wrapped in guardrails to ensure safe and controlled behaviour. The AI financial assistant will also be able to seamlessly refer to expert colleagues when needed.” – the bank explained.

„Lloyds Banking Group is committed to leading the way in mobile banking and technology transformation. By becoming the first UK bank to bring agentic AI to our customers, we are taking a crucial step in helping millions of customers benefit from more control over their finances. This launch is not just about introducing new technology; it is a pivotal step in our strategy as we continue to reimagine the Group for our customers and colleagues.” – said Ranil Boteju, Chief Data and Analytics Officer at Lloyds Banking Group

He continued: „Our AI financial assistant is underpinned by Lloyds Banking Group’s robust AI assurance framework and guardrails, helping deliver safe, explainable and regulated AI-driven interactions. We believe this innovative tool will not only provide our customers with personalised, round-the-clock support, but also set a new benchmark for the responsible and effective use of AI in UK banking. Importantly, it provides instant and free access to personalised financial coaching.”

„This new technology will take the customer experience up a level by giving people access to a personal AI agent, empowering more people than ever to make informed decisions about their money. We’re excited to bring this feature to our customers in the coming months.” – said Helen Bierton, Chief Digital Officer at Lloyds Banking Group

Scalable, secure and responsible by design

The AI financial assistant will use generative AI for conversational interfaces and agentic frameworks to break down requests, plan actions and execute tasks using tools, for instance, converting natural language to code for transaction queries.

„The technology is underpinned by a robust architecture that embeds human accountability and explainability at every level. Curated bank data is used to ensure responses are accurate and tailored, differentiating the AI financial assistant from general-purpose models. Conversations within the AI financial assistant enable a customer experience that combines innovative technology with trusted expertise.” – the bank concluded.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: