Global Payments Inc. today announced results for the third quarter ended September 30, 2025. Third quarter 2025 GAAP revenue of $2.01 billion1, approximately flat, and adjusted net revenue of $2.43 billion, an increase of 6% constant currency ex-dispositions.

„We are pleased to deliver third quarter results that accelerated sequentially across our key financial metrics as we advance our transformation program,” said Cameron Bready, chief executive officer. „Our team continues to execute at a high level, positioning us well to deliver on our overall expectations for the year.”

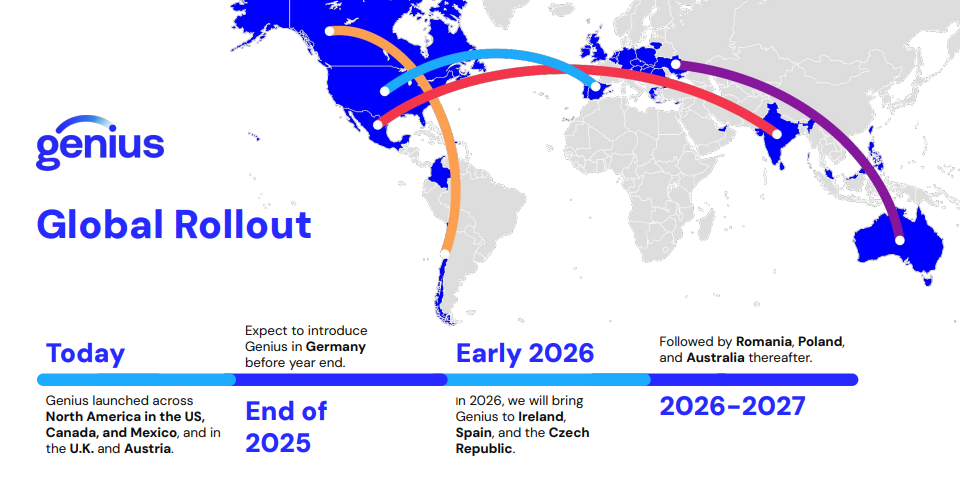

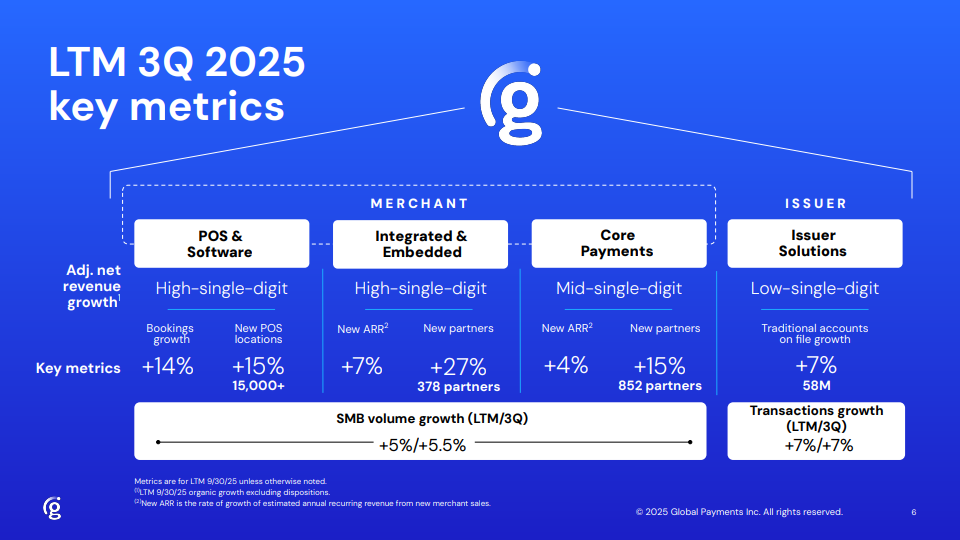

Bready continued, “Our Merchant business is exhibiting ongoing momentum with adjusted net revenue growth accelerating to 6% constant currency excluding dispositions. Our strategic focus remains on the development and roll-out of Genius, while also improving our overall sales effectiveness and unifying our business globally. In the few months since we launched Genius, monthly sales increased significantly, demonstrating how well Genius is resonating in the market.”

Bready concluded, “Further, we recently received merger control approval for our acquisition of Worldpay from the Competition & Markets Authority in the U.K., which is a critical regulatory milestone. Given the strong progress we have made with the regulatory approval process, we now expect to close our acquisition of Worldpay and divestiture of Issuer Solutions in the first quarter of 2026. We are eager to complete these transactions, which will catalyze our transformation and unlock compelling value creation opportunities by positioning Global Payments as a pureplay merchant solutions provider with sustainable revenue growth, leading scale, focused investments, and meaningful synergies.”

Third Quarter 2025 Summary

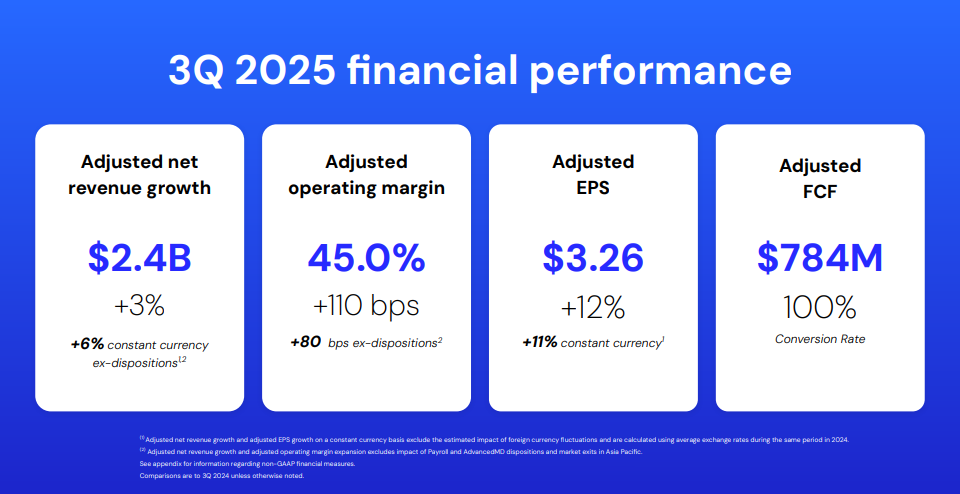

GAAP revenues were $2.01 billion1, diluted EPS were $2.64, and operating margin was 38.8%.

Adjusted net revenues increased 3% (6% constant currency excluding dispositions) to $2.43 billion.

Adjusted EPS increased 12% (11% constant currency) to $3.26.

Adjusted operating margin expanded 110 basis points to 45.0%.

2025 Outlook

“We are pleased with our financial and operational performance in the third quarter, which were consistent with our expectations and the outlook we previously provided,” said Josh Whipple, chief financial officer. “In addition to the financial metrics that Cameron referenced, we also produced strong adjusted free cash flow of $784 million in the quarter, allowing us to de-lever to 2.9-times adjusted net leverage at the end of the quarter, below the 3.0 times target we had committed to achieve by year end.”

Whipple concluded, „The company continues to expect constant currency adjusted net revenue growth in the range of 5% to 6%, excluding dispositions, for the full year. We still expect annual adjusted operating margin expansion to be more than 50 basis points, excluding dispositions, and for our constant currency adjusted earnings per share growth to be at the high end of the 10% to 11% range in 2025.”

Financial Reporting Considerations for Pending Issuer Solutions Transaction

Effective in the second quarter of 2025, the company began accounting for the Issuer Solutions business as discontinued operations as a result of the announced divestiture to Fidelity National Information Services. Until closing, Issuer Solutions will continue to operate as a business of Global Payments; accordingly, our non-GAAP financial measures reflect total company performance.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: