Finqware is the only Romanian start-up in the Sifted 250 — the Europe’s fastest-growing companies of 2025

The Sifted 250 ranks Europe’s 250 startups with the highest percentage revenue growth over the past three financial years, calculated using a two-year compound annual growth rate (CAGR).

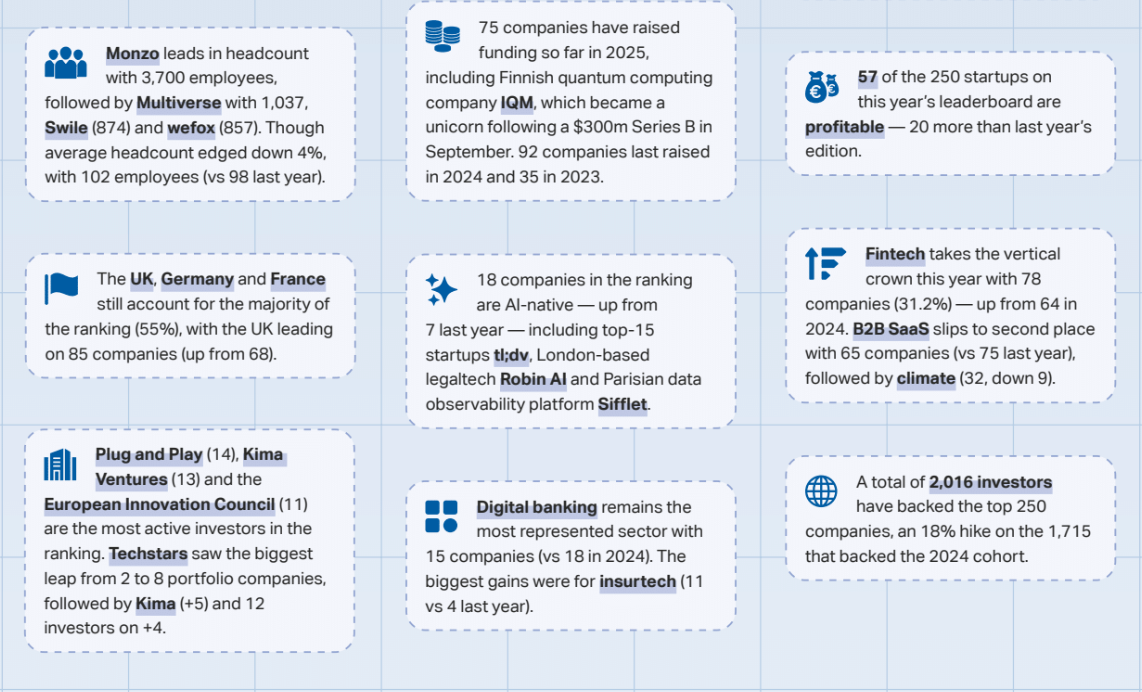

Now in its second year, the Sifted 250 takes readers on a tour of Europe’s fastest-growing startups. These companies are scalling across every corner of the continent, from fintech powerhouses in London to climate innovators in Berlin and AI pionners in Stockholm.

Some are already household names, others are just breaking into the spotlight. What unites them is momentum: fast-growing revenues, sharpened efficiency and the determination to become tomorrow’s category leaders. The result is a snapshot of an ecosystem that’s evolving quickly – and shaping Europe’s economic future in the process.

Finqware stands as the only Romanian start-up included in the Sifted 250, positioned 101st, with a two-year compound annual growth rate (CAGR) of 209.11%. Within the fintech segment, it holds the 26th position among nearly 80 companies. Finqware is a treasury automation platform for multi-entity, cross-border organizations, providing real-time cash management, payments, collections and reporting on top of Open Banking.

Qualification criteria

To be eligible, companies had to meet the following criteria:

. private and independent

. headquartered in Europe (excluding Azerbaijan, Belarus, Israel, Russia and Turkey)

. majority of revenue must be generated by proprietary technology

. founded in or after 2010

Financially, startups had to have:

. at least three years of revenue data, either between 2021-2023, 2022-2024 or 2023-2025 depending on filing dates, across comparable accounting periods of at least 26 weeks;

. revenue (annualised if necessary) of at least 50,000 euro or 42,000 british pounds in the base year (2021, 2022 or 2023) and at least 500,000 euro (420,000 british pounds) in the most recent financial year (2023, 2024 or 2025)

Companies were required to submit signed documentation to support disclosed financial information not publicly available.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: