For every transaction, whether peer-to-peer (P2P) or peer-to-merchant (P2M), Feedzai platform will provide a fraud risk score that PSPs will use alongside their own controls when deciding whether to approve or decline a payment.

The European Central Bank (ECB) has concluded a framework agreement in ranking with Feedzai as the first-ranked tenderer, to provide the central fraud detection and prevention mechanism for the digital euro.

Representing 440 million citizens and more than $17 trillion in GDP, the eurozone is the world’s second-largest economy. The introduction of the digital euro would mark the most significant monetary innovation in Europe since the launch of the common currency in 1999.

„The framework agreement for the risk and fraud management component has an estimated value of €79.1 million and a maximum value of €237.3 million. In partnership with its subcontractor PwC, Feedzai would deliver a state-of-the-art central fraud detection and prevention mechanism, ensuring full compliance with EU security, privacy, and data protection standards.” – according to the press release.

While the framework agreements set the terms for potential future work, the actual development of the components, or certain parts of them, will be decided at a later stage. Following the framework agreement conclusion, Feedzai and other successful tenderers will work with the ECB to finalize planning and timelines. Under the guidance of the ECB Governing Council and in line with EU legislation, this work will cover the design, integration, and development of the Digital Euro Service Platform (DESP).

Feedzai’s Role: Central Fraud Detection and Prevention

Feedzai has been selected as the first-ranked tenderer in the framework agreement to provide the central fraud detection and prevention solution for the future digital euro. Its role is to contribute to safeguarding transactions from fraud by enriching payment service providers’ (PSPs) own risk management with insights derived from a central infrastructure-level view.

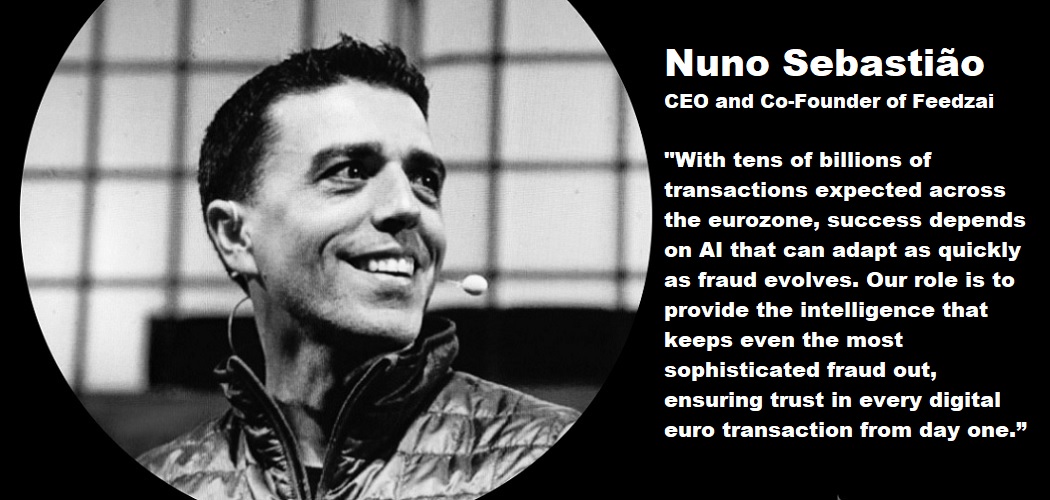

Nuno Sebastião, CEO and Co-Founder of Feedzai, said: “Being selected as the first-ranked tenderer in the framework agreement to secure the digital euro is both an honor and a responsibility. With tens of billions of transactions expected across the eurozone, success depends on AI that can adapt as quickly as fraud evolves. Our role is to provide the intelligence that keeps even the most sophisticated fraud out, ensuring trust in every digital euro transaction from day one.”

Liviu Chirita, PwC’s Global Financial Crime Technology Leader and Dominik Schauerte, Germany Financial Crime Technology Leader, said: “This is one of the most consequential digital infrastructure projects in Europe’s history — a foundation for trust in the digital age. Together with Feedzai and the European Central Bank, we are building the safeguards that will protect millions of people and businesses across borders. At PwC, we bring the scale, expertise, and regulatory insight needed to secure this transformation from day one. This is about more than preventing fraud — it’s about enabling Europe to lead with integrity, resilience, and technological sovereignty.”

The ECB underlines that the digital euro would contribute to Europe’s resilience, inclusion, and technological sovereignty. While primarily designed to meet the needs of euro area citizens and businesses, the initiative is being followed closely by other central banks as part of wider international discussions on the future of money.

Company Momentum: $2B Valuation and $75M Investment Round

On the same day as the ECB announcement, Feedzai also announced it has increased its valuation to $2 billion after a new investment round of approximately $75 million. The round adds new institutional investors Lince Capital, Iberis Capital, and Explorer Investments, alongside renewed backing from Oxy Capital and Buenavista Equity Partners.

Nuno Sebastião, CEO and Co-Founder of Feedzai, said: “Fraud isn’t just numbers on a balance sheet. It’s families losing their life savings and businesses losing customers. Protecting people and organizations from financial crime is why we built Feedzai. It’s our steadfast mission to keep commerce safe. This new investment round enables us to continue driving innovation to defend against whatever comes next, so that every form of payment, even those yet to be imagined, can be trusted and adopted safely.”

Growth and Innovation

Feedzai protects more than 70 billion in annualized payment volume across card transactions and bill payments. Over the past year, the company has:

Launched breakthrough products: Feedzai Orchestration and Feedzai IQ™, empowering financial institutions to make more intelligent, rapid, and precise risk assessments.

Delivered measurable customer impact: Doubling outcomes to more than $2B in losses prevented and saving 20M+ analyst hours.

Advanced responsible AI leadership: Introducing the TRUST Framework to embed fairness, explainability, and security into every facet of GenAI model development.

Feedzai’s AI-native RiskOps platform consolidates fragmented point solutions into a single, modern financial crime prevention stack, powering fraud, risk, and anti-money laundering operations for global financial institutions.

Vasco Pereira Coutinho, CEO at Lince Capital, said: “Feedzai’s ability to execute across multiple product lines while scaling globally places them in the elite tier of software companies,” said. “Financial fraud is one of the defining risks of our time, and Feedzai combines proven technology with deep expertise to protect both banks and their customers. With its AI-driven, end-to-end approach to risk operations, Feedzai is uniquely positioned to transform the industry.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: