A new study by global tech strategists Juniper Research has found that B2B payments will exceed $224 trillion in transaction value globally in 2030; up from $186 trillion in 2025. This 20% rise will be driven by economic growth within emerging markets, as business activity and trade diversify.

The research found that virtual card will be the fastest-growing B2B payment channel over the next five years, with a 370% increase in transaction value. The report noted the configurability of virtual cards and their integration within procurement processes as critical to their rapid growth.

“Unlocking card acceptance in emerging markets is the linchpin for the next wave of B2B card transaction growth. Supplier acceptance remains a major hurdle, but deploying low-cost acceptance solutions across key supply chain networks will accelerate adoption. This strategy positions virtual cards to ride the strong growth trajectory of emerging markets,” explained Michael Greenwood, Senior Research Analyst at Juniper Research.

Top 5 B2B Payments Leaders Revealed

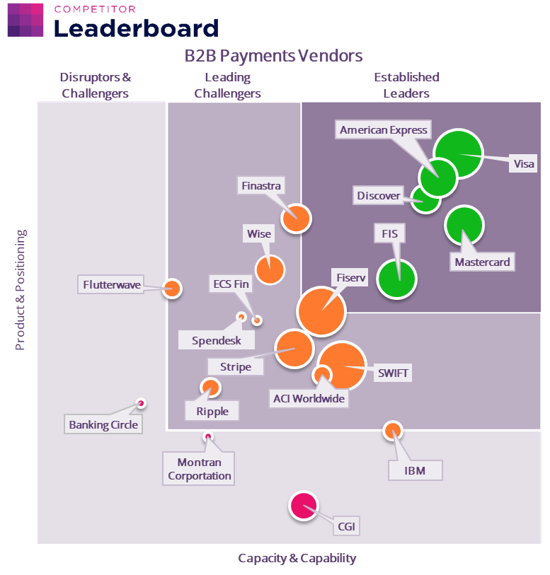

Juniper Research’s recent B2B Payments Competitor Leaderboard evaluated 19 key B2B payments players against robust criteria, including size of operations, commercial proposition, and comprehensiveness of payments capabilities. The top 5 vendors for 2025 are: Visa, American Express, Mastercard, Discover and FIS.

Juniper Research found that leading vendors are prioritising the expansion of their virtual card capabilities; enhancing their card portfolios by enabling new use cases and controls.

“To differentiate, specialists must offer tools that battle the many inefficiencies within B2B payments. B2B payments systems must reduce complexity, not increase it, or vendors will lose out to faster-moving rivals,” Greenwood concluded.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: