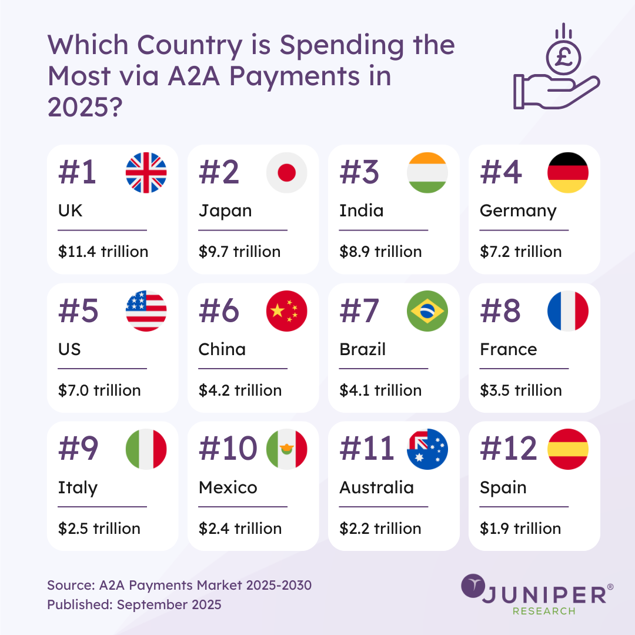

A new study by global tech strategists Juniper Research has revealed that the transaction value for Account-to-Account (A2A) payments globally will grow 113% over the next five years, from $91.5 trillion. The roll-out of real-time payment systems will enable new use cases such as instant payroll and real-time bill settlement.

The report identified enhanced data sharing under real-time payments as being key to enabling far greater use of AI and programmable payments for automation by businesses. This will enable real-time cash flow and improve working capital management; driving value for businesses.

Recurring Payments To Unlock Business Potential

Recurring payments capabilities, including Variable Recurring Payments (VRPs) for businesses, are critical for future A2A scheme success. In the UK specifically, non-sweeping VRPs will offer businesses enhanced flexibility to set up multiple payments at once within set approved parameters; minimising administrative strain and increasing flexibility.

According to Thomas Wilson, Research Analyst at Juniper Research: “VRPs represent a scalable recurring payment solution for businesses that will empower them to improve liquidity and optimise cash flow. Beyond VRPs, recurring payments are a key capability that must be developed to better compete with existing payment methods. By targeting emerging markets, vendors can capitalise by aligning with developing regulatory and market trends.”

While full-scale commercial deployment of VRPs is lagging in the UK market, in regions where recurring payments capabilities have been deployed, such as in Brazil with Pix Automático, adoption has been strong. Therefore, payments vendors must create robust recurring payments solutions to catalyse A2A adoption.

____________

An extract from the report, A2A Payments Market 2025-2030, is available as a free download.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: