Trump’s pension reform puts crypto at the heart of US retirement savings debate, says GlobalData

President Donald Trump’s proposal to permit alternative assets, including cryptocurrencies, within 401(k) retirement accounts signals a landmark shift in the US pension landscape. If enacted, the reform is set to redefine long-term savings by blending traditional investments with high-volatility assets. While potentially appealing to Millennials and Gen Z, the move raises questions about risk management, portfolio stability, and retirement security, according to GlobalData, a leading data and analytics company.

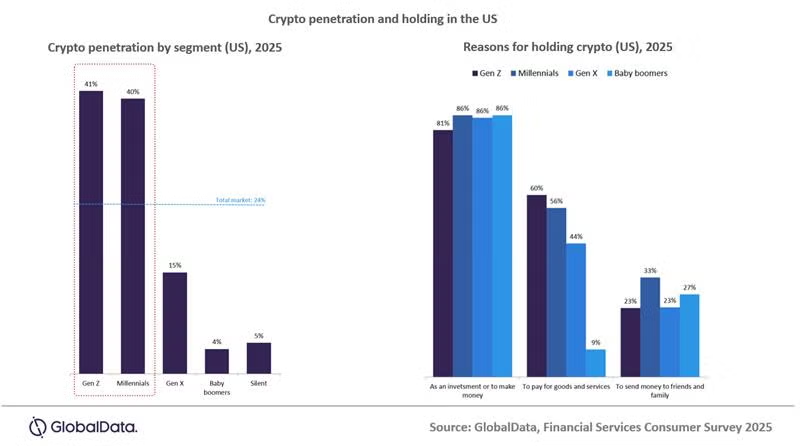

Phoebe Hodgson, Banking Analyst at GlobalData, comments: “The move reflects growing political and market recognition that investor preferences, especially among younger generations, are evolving. Millennials and Gen Z have shown strong appetite for digital assets and diversified investment approaches, often seeking exposure to cryptocurrencies, real estate or private equity alongside conventional equities and bonds. By opening the 401(k) framework to these asset classes, the proposal could appeal to those who feel traditional pension plans are too conservative for long-term growth potential.”

GlobalData’s latest report, “Targeting Pensioners in Financial Services 2025,” highlights that any structural change in the investment rules of the US pension market, the largest in the world, can ripple across global capital flows. Asset managers, custodians and fintech platforms may view the policy as an opportunity to develop crypto-compliant retirement products, while international regulators watch closely to gauge systemic risk.

Hodgson continues: “However, the policy introduces considerable risk. Cryptocurrencies, while offering high return potential, are also prone to extreme volatility, regulatory uncertainty and valuation challenges. For retirement accounts, which rely on stability and compounding over decades, this could expose savers to larger drawdowns, particularly if allocation decisions are made without sufficient financial guidance.„

Using data from GlobalData’s 2024* and new 2025* Financial Consumer Surveys, the report identifies the size, growth and characteristics of the pensioner population globally, as well as on a country level. The report highlights market potential and the unmet needs of retirees, guiding providers on how best to design pension, savings, and wealth products for this growing demographic.

Hodgson concludes: “In the short-term, this decision is likely to spark debate between advocates of investment freedom and defenders of traditional pension safeguards. Crypto expands choice but brings outsized volatility, regulatory uncertainty, and operational risk into long-horizon retirement savings. Wealth managers must set hard guardrails—clear disclosures, suitability checks, and allocation caps—so clients understand the downside as much as the upside. Access is optional; risk discipline is not.”

_________

*2024 Financial Services Consumer Survey, which was conducted online in Q2 2024 among 67,292 consumers across 41 markets globally.

**2025 Financial Services Consumer Survey, which was conducted online in Q2 2025 among 63,441 consumers in 42 markets globally.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: