bunq, Europe’s second-largest neobank marks its 10th anniversary with 20 million users

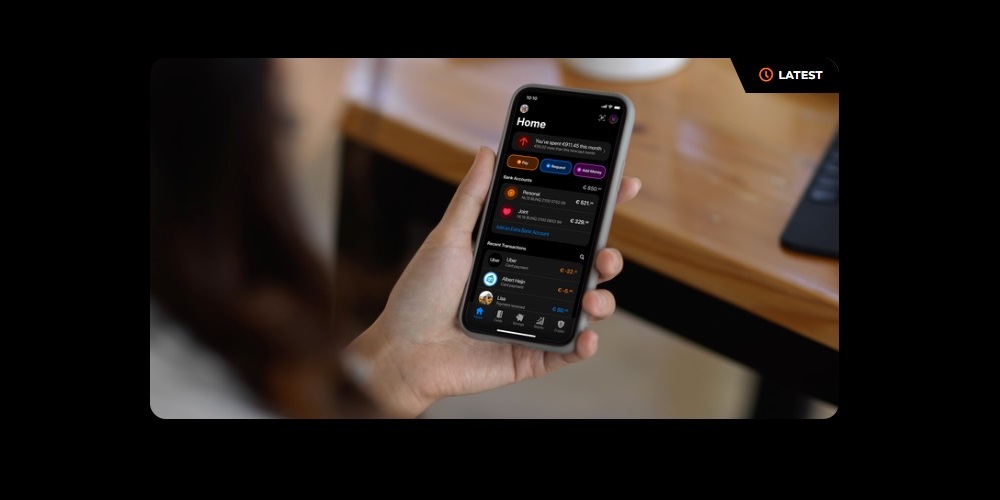

bunq, Europe’s second largest neobank, is celebrating the 10-year anniversary of its first app launch, by surpassing 20 million users across Europe. „To mark the occasion, bunq has introduced a complete app redesign and a suite of new features. The new app and milestone were revealed at the bunq Update 29 event in Amsterdam.” – according to the press release.

„Shaped by extensive user feedback, the new design offers a cleaner interface and more intuitive navigation, making it easier for users to stay in control of their money. They can instantly access bunq’s most popular features in just a tap, including everyday Bank Accounts, Savings Accounts, Cards, Stocks and bunq Crypto.” – the bank said.

“bunq was built to be the first bank people love to use,” says Ali Niknam, founder and CEO of bunq. “Ten years on, it’s truly amazing to see so many already saving, spending, and investing with us. Now, we’re taking this laser focus on our users globally, to make life easy for many more.”

The news follows bunq’s announcement on applying for a broker dealer license, fast-tracking its entry into the US market as part of its global expansion plans.

___________

Founded in 2012 by serial entrepreneur Ali Niknam, bunq was the first bank to get a European banking permit in over 35 years, raised the largest series A round ever secured by a European fintech (€193 million), and was the first EU neobank to achieve structural profitability at the end of 2022. On its mission to build the first global neobank for digital nomads, in April 2025, bunq announced it’s fast-tracking its entry in the US by applying for a broker-dealer license and planning to reapply for the full banking license later the same year.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: