Conversational AI infrastructure will transform how banks and customers engage with financial data

Personetics, the global leader in AI-driven Cognitive Banking, announced the launch of Personetics MCP Server, „which enables banks to develop and deploy Agentic AI applications leveraging Personetics’ sophisticated financial models and actionable insights” – according to the press release.

„With the MCP (Model Context Protocol) Server, banks gain direct access to Personetics’ capabilities—including financial behavior analysis, predictive analytics, and contextual engagement frameworks—through a secure, scalable server environment. This empowers financial institutions and fintech innovators alike to craft personalized, proactive Agentic AI experiences that guide customers toward smarter financial decisions.” – the company explained.

Highlights of the Personetics MCP Server include:

Native Access to Financial Wellness Models – Banks can call Personetics’ AI-powered insights via MCP to power autonomous conversational agents, predictive nudging, or goal-based coaching experiences.

Flexible Deployment & Messaging Control – Institutions define how insights are surfaced—whether through chatbots, mobile assistants, virtual financial advisors, or embedded platform modules—creating customized, mission-aligned agentic journeys.

Accelerated Time-to-Market – By tapping into Personetics’ existing, market-proven actionable insights, banks dramatically shorten development cycles and reduce reliance on data science investments.

Secure, Scalable Infrastructure – The MCP Server is built for enterprise-grade deployment, with privacy-by-design, auditability, and compliance with global financial regulations.

“Cognitive Banking fundamentally shifts the paradigm from impersonal, one-size-fits-all interactions to intelligent, agentic partnerships between banks and customers,” said Udi Ziv, CEO at Personetics. “With the MCP Server, we’re giving banks a foundational toolkit—one that translates our deep customer financial intelligence into real, autonomous customer engagement mechanisms. This marks a powerful leap forward in enabling banks to act as trusted financial allies.”

Recent studies underscore the growing appetite for AI-assisted financial advice—with 84% of consumers saying they would switch banks to receive cognitive banking capabilities such as real-time, contextual guidance. The MCP Server helps institutions harness this opportunity by turning existing AI models into dynamic, agentic experiences.

___________

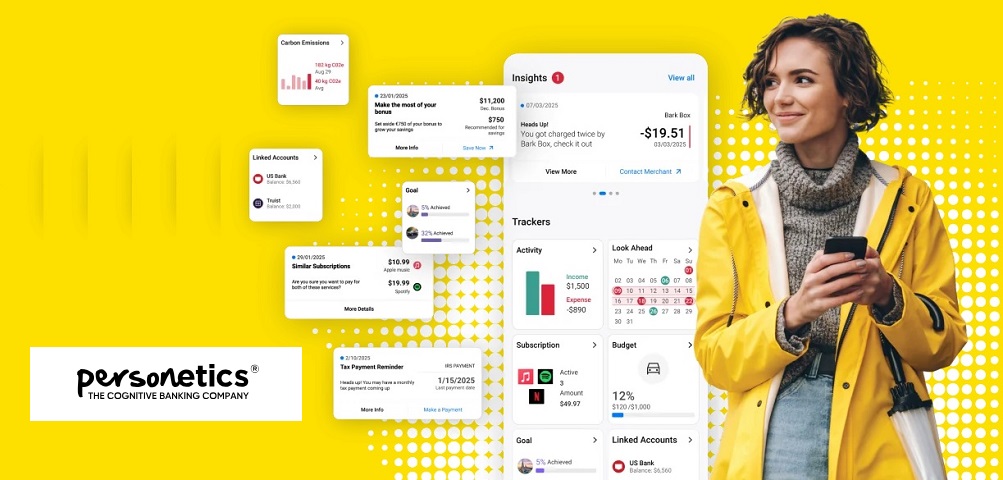

Personetics is the Cognitive Banking Company, transforming how financial institutions build and monetize customer relationships. Its AI-powered platform enables banks to deliver proactive, insightful, and personalized financial guidance—helping customers make smarter decisions and achieve their goals. Serving over 150 million users across 35 global markets, Personetics equips banks with the tools to transition from traditional providers to proactive financial partners.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: