Vista Bank expands the functionalities of the RoPay system developed by TRANSFOND and annonces that „becomes the first bank in Romania to offer instant contactless payments between individuals, from one bank account to another, directly via Mobile Banking”.

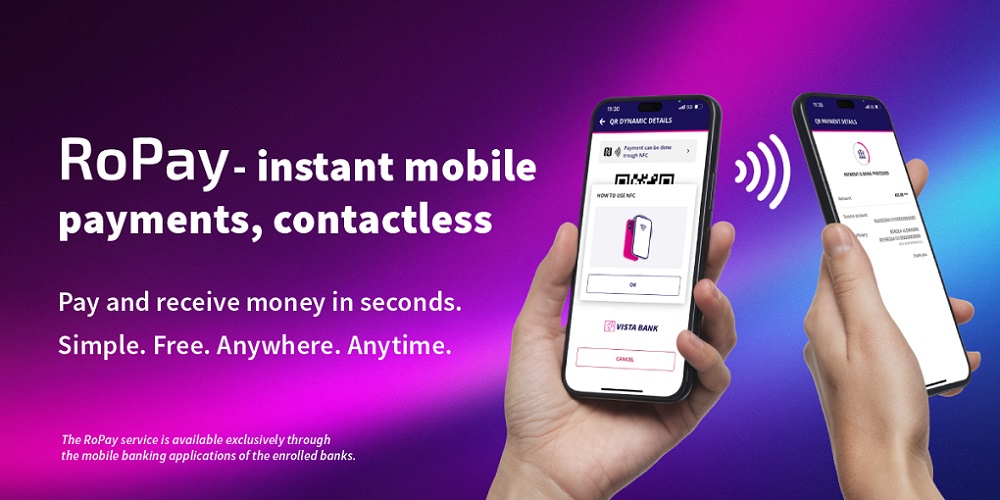

Following the July launch of RoPay via QR code payments, Vista Bank continues its integration with the national mobile instant payment system and introduces a new innovative feature to the market: RoPay Contactless between individuals.

The new service enables instant payments in RON between two individuals in close proximity, directly from Mobile Banking, by simply bringing their mobile phones close together. Bank says that all is simple (contactless transactions, with no need to manually enter payment details), secure (carried out exclusively via banks’ Mobile Banking apps, account to account), free of charge (zero costs for individuals), instant (processing takes just a few seconds) and available anytime, anywhere.

Payments are processed in RON, with a limit of RON 49,999 per transaction, and are available only on mobile phones equipped with Android operating system.

“The launch of RoPay Contactless payments is part of our strategy to simplify the banking experience for our clients through efficient and innovative digital solutions that bring more comfort, security, and speed to their daily financial activities. We are proud to be the first bank in Romania to offer this functionality and we will continue to expand the RoPay ecosystem with new useful options for our clients, such as alias-based transfers, POS or bill payments via QR code, e/m-commerce, and more.” – said Raluca Dobre, Alternative Channels and Transformation Manager, Vista Bank.

“RoPay Contactless represents a natural step in the evolution of instant payments in Romania and confirms the potential of the ecosystem we are building together with banks and technology partners. This capability is not only a national first, but also a demonstration of the local financial industry’s ability to deliver digital solutions at European standards. By expanding RoPay’s functionalities, we aim to accelerate the shift from cash to electronic payments, reduce associated costs, and increase financial inclusion by providing consumers with modern, simple, and secure solutions,” said Răzvan Faer, Head of Development, TRANSFOND.

To implement the new RoPay service, Vista Bank collaborates with Getik, a Romanian technology company specialized in digital solutions for the banking industry.

“We are honored to contribute to the launch of a technological first in Romania. We delivered the RoPay Contactless module in record time thanks to our platformization-based architecture, which natively integrates digital channels with payment ecosystems, as well as due to the excellent collaboration with Vista Bank and TRANSFOND.” – said Ghenadie Dumanov, CEO, Getik.

RoPay was developed by TRANSFOND in collaboration with the Romanian Banking Association and is offered to end consumers through the mobile banking applications of Romanian commercial banks.

__________

With over 25 years of existence on the Romanian market, Vista Bank has a network of 35 branches and 5 business centers and addresses primarily medium and large corporate clients, professional farmers, as well as affluent clients.

TRANSFOND is the administrator and operator of the Automatic Clearing House for retail interbank commercial payments. The company aims to be the main partner of the financial-banking community in Romania in the field of payments (both in local currency and in euro, national and cross-border), of services adjacent or complementary to interbank payments, making the most of the infrastructure and know-how at its disposal.

The main shareholder of TRANSFOND is the National Bank of Romania, and the other part of the shareholding is represented by 18 commercial banks active in the Romanian market. TRANSFOND has developed a series of solutions, for the benefit of the domestic financial sector, but also of companies and end consumers of financial services: RoPay, Instant Payments, Beneficiary Name Display Service (SANB), AliasPay, e-Factur@ and e-Arhiv@.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: