After successfully completing the registration and technical compliance process, BORICA became the only Bulgarian provider listed to date in the public register of the European Payments Council (EPC).

„Starting October 2025, BORICA AD will introduce the Verification of Payee (VoP) service, in a pilot with one Bulgarian bank and three foreign branches of Bulgarian banks, for their euro transfers. The regulation requires that by the end of 2026, all payment service providers in Bulgaria should have integrated VoP into all their channels.” – according to the press release.

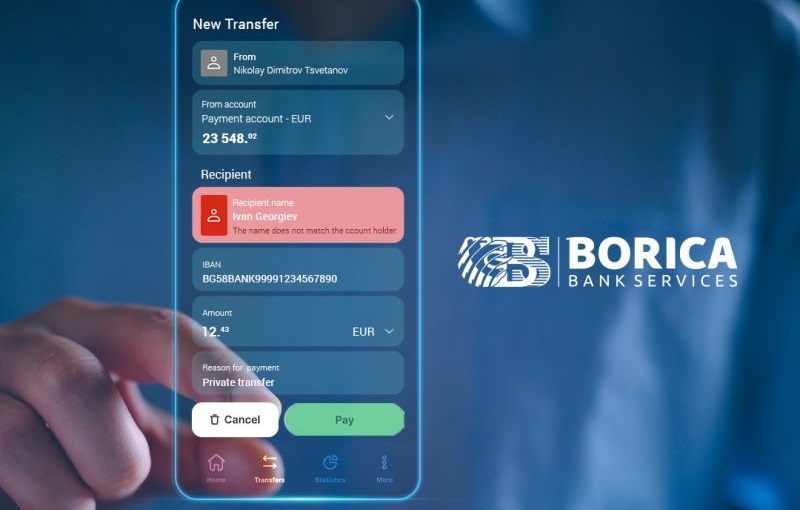

The Verification of Payee (VoP) service allows the payer to check whether the beneficiary’s name matches the actual account holder (IBAN) before making a transfer. The main goal is to prevent misdirected payments and fraud, especially in the context of growing instant payments, where money is transferred within seconds.”

Verification of Payee is part of the new European payment regulations and will be a key tool for ensuring higher security and trust in the payment process. It has proven highly effective in preventing Authorised Push Payment (APP) frauds, where individuals are deceived into authorizing transfers to fraudsters.

„Experience from other European countries shows that proper implementation of the service can reduce fraud cases by more than 70%, which is especially important for protecting vulnerable users”, says Vania Ganeva, Director of „Payment Services” at BORICA AD.

The “Verification of Payee” service will be mandatory for all SEPA payments – both instant and standard – under the new Instant Payment Regulation (IPR). It must be available across all digital channels – online and mobile banking – which requires a high level of technical readiness.

As a certified provider in the role of Routing and Verification Mechanism (RVM), BORICA offers three options for integration with the system, which meet all regulatory requirements and ensure fast and secure payee verification in real time. With its three options, BORICA offers:

. verification of the match between the IBAN and the payee’s name

. 24/7 access to the service with a response time of up to 5 seconds

. secure communication with other payment service providers (PSPs) and RVM providers in Europe

. possibility for batch processing of requests

The solution also includes additional functionalities, such as automatic extraction of BIC from the IBAN and the option to store data in BORICA’s infrastructure. This allows PSPs to save time, resources, and effort for technical integration and regulatory compliance.

„As a technology partner, our mission is not only to ensure a high level of security and regulatory compliance, but also to make the transition to the new requirements as easy and smooth as possible for financial institutions in Bulgaria. We strive to take on the burden of complex technical and regulatory work so that they can focus on their core business and serve their customers with confidence and peace of mind,” adds Vanya Ganeva.

According to data from the European Commission, over €1.5 billion is lost annually due to APP frauds. In 2024 alone, several hundred cases were reported in Bulgaria, with the largest fraud amounting to $10 million.

Bulgaria is joining the European protection framework, with BORICA AD being the first and currently the only certified provider of the service in the country.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: