US and UK lead crypto holding growth globally, says GlobalData

The US and UK are recording the fastest growths in crypto penetration in 2025, because of the sector’s increased mainstream promotion and supportive institutional and regulatory sentiment in the West. Although still lagging many emerging economies, the US’s crypto product holding rate increased to 23.5% in 2025, while UK holding nearly doubled to 18% from 10% last year, according to the annual Financial Services Consumer Survey* by GlobalData, a leading data and analytics company.

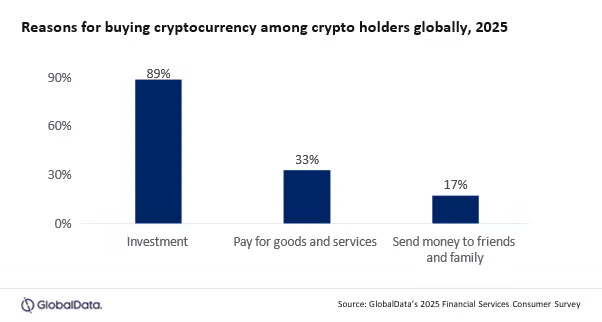

GlobalData’s latest report, “Innovation in Stablecoins 2025”, reveals that while these fixed-value digital assets (stablecoins) will inevitably disrupt the payment space in the future, for now just a third of global crypto holders are paying for goods and services with cryptocurrencies, while only 17% are using them for P2P transfers.

With growing regulation as well as institutional and retail interest, the most pressing challenge for wider adoption today is stablecoins’ interoperability with traditional currencies and payment rails. Retail costs related to on- and off-ramping between fiats and digital currencies are still higher or at par with existing money movement methods, which outweighs stablecoins’ benefits for small-scale transactions, until exiting the DeFi ecosystem (i.e., off-ramping) is required.

Blandina Szalay, Banking & Payments Analyst at GlobalData, comments: “The real utility of stablecoins today is in scale. So-called stablecoin sandwiches bring about numerous benefits for large cross-border institutional transfers. Converting a fiat to stablecoin then back to another fiat currency can circumvent the inflated foreign exchange fees of correspondent banking—a key source of TradFi institutions’ income still.”

The other key benefit on the institutional side lies with the virtually limitless real-time movement of funds facilitated by blockchain. Unlocking this instantaneous liquidity largely improves cash flow management, in contrast to the traditional settlement times of 2–5 business days. There is further potential to profit from funds moving freely overnight and weekends, to leverage the highest-yielding money market opportunities.

Szalay continues: “Beyond these benefits, local liquidity poses challenges too, specifically in emerging markets, where retail demand for stablecoins is also the strongest. Despite all benefits of a stablecoin transfer, off-ramping coins to some local emerging market currencies is challenging, so the tokenization of non-reserve currencies is expected to fold out soon, to mark a next step in the global stablecoin push.”

On the retail front, stablecoins promise democratized access to financial services and the US dollar for anyone around the world. Beyond payments players, large and small banks are now attempting to jump on the stablecoin train too—currently driven by crypto-native first movers—in fears over funds disintermediation.

Szalay concludes: “Stablecoins sit in a very interesting position in between TradFi and DeFi. While the underlying blockchain technology will be able to create unprecedented benefits in the future of financial services, stablecoins have clearly parted with the original founding ideology of cryptocurrencies, as the ever-stronger involvement of state regulators and traditional financial institutions in this space shows.”

___________

*GlobalData’s annual Financial Services Consumer Survey 2025 was carried out across 42 countries. Total respondents were 63,414, out of which 3,004 were from the US and 4,027 were from the UK.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: